Medium-sour vs light-sweet divergence to continue, for now

ICE Brent rocketed past $90/bbl last week with time-spreads ballooning out in similar fashion. Geopolitical tension continues to flare while the market expects stronger refinery buying for summer runs and OPEC+ has rolled over cuts and referenced a tightening of compliance.

Light sweets in Atlantic Basin looking for outlets with Far East econs mostly weak

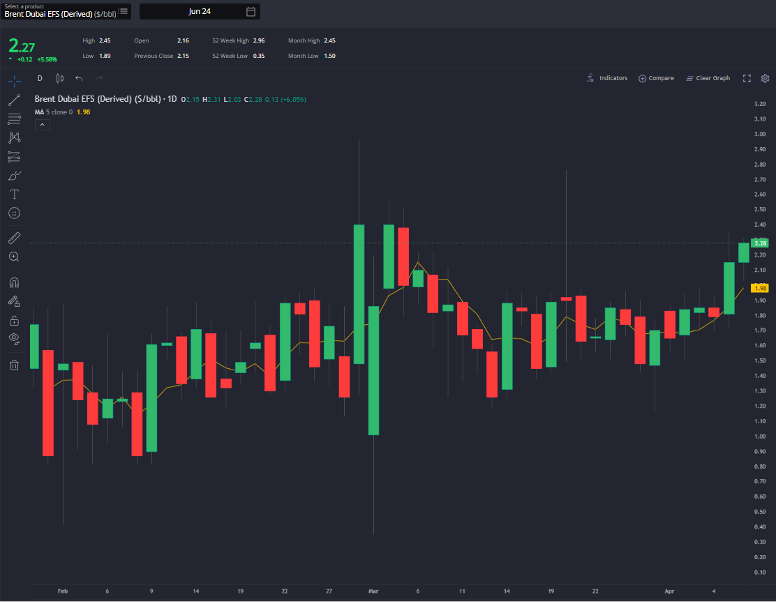

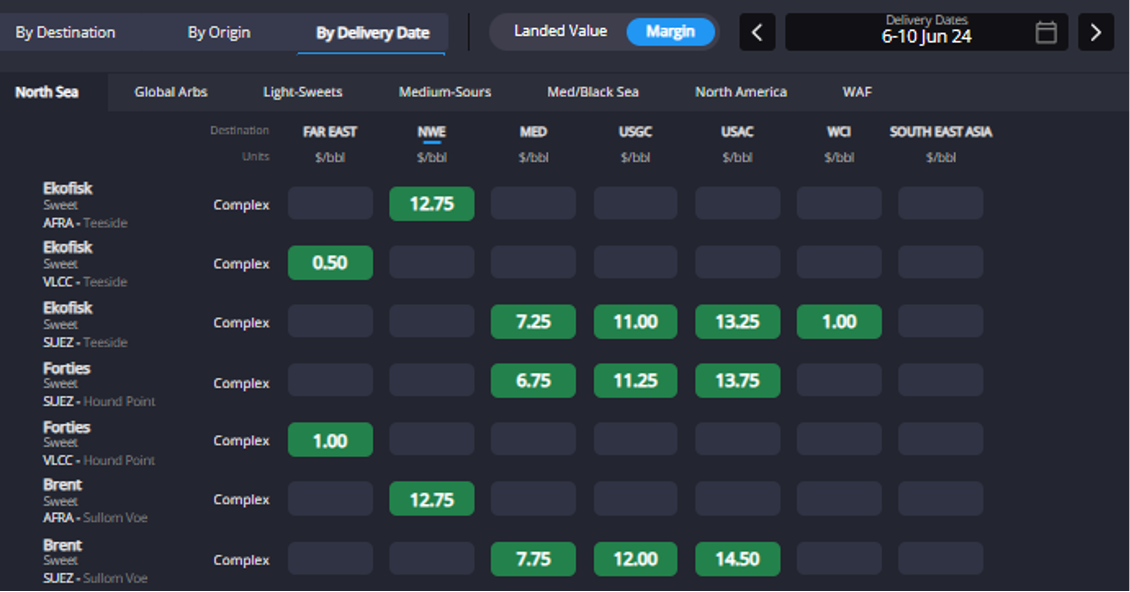

The runup in flat price has coincided with TI/Brent substantially narrower than earlier this year while the Brent/Dubai EFS tacked on some $0.50 cents vs late March. A key point here is that most North Sea and WAF econs to arb East are as a result currently very poor. In fact, some complex margins for WAF in the Far East are negative on an outright basis (partly also due to a relatively weak Asian gasoil market).

These barrels are – at face value – pointing to alternative destinations like the USGC and USAC, which are now the highest margin destinations. That mirrors a similar pattern seen in late February for Black Sea crudes.

In the North Sea, where FOBs remain down m-o-m and y-o-y, that may help put a floor under the market for now. North Sea physical diffs (and CFDs) were in fact bid up a little through last week, though it is unclear yet whether this heralds generally higher demand in the Atlantic Basin, or whether the run up in flat price/structure that is the driver.

Meanwhile, there are other pressures emerging, namely WAF. It’s poor competitiveness in Asia finally saw a drop-off in FOB diffs late last week. For all the anticipation of Dangote’s ramp-up, WAF crude avails appear ample in May while April has been struggling to clear. WAF barrels are essentially the least economic grades into Far East currently and margins also lag North Sea crudes into the Americas.

That all suggests diffs may need to cool further, putting pressure on NWE, prior to substantially stronger refinery buying post-peak-maintenance. We may also ultimately need to see some pressure on the EFS emerge.

In the same context, we should note that several spot grades out of the Middle East are pricing best into Western destinations. Spot Basrah margins round the Cape to a Med complex refinery are some $2/bbl higher than their equivalent Far East margin.

Spot Basrah to NWE on a VLCC is by some distance the best global location for the grade on a margin basis. As such the tightening in global medium-sour supply currently being played out in light/heavy crude spreads might see some refiners choosing MEG crudes at the margin.

WTI picture slightly rosier

As for WTI; waterborne USGC FOBs are steady. Strong USGC runs and seemingly healthy exports are at play (and keeping PADD-3 crude stocks on their broadly flat trajectory).

WTI is actually one of only a small number of Atlantic Basin light sweets that currently return a firmly positive complex refinery margin in the Far East. CPC may still be workable (via both Suez and Cape), but North Sea and WAF are approaching negative outright margins. As such, some preference for WTI from Asia, as well as a more artificial draw from India (as refiners there potentially shun Russian grades at the margin on tightened shipping scrutiny) may see WTI clear well. PADD-3 crude stocks have the potential to begin drawing soon.

Heavier crude bull case builds (further)

Recent weeks have brought a seemingly endless stream of supportive news not just for flat price, but for heavier crude grades in particular. Last week saw a spectacular jump in Mars diffs at the USGC, which have since partly retreated.

Most sourer, heavier crude assessments in the US are up strongly m-o-m. Meanwhile, Aramco has pushed up heavier OSPs and markers of medium-sour grades in NWE (e.g. Johan Sverdrup & Grane) are strong relative light sweet counterparts.

The list of supports of heavy crude is growing long and includes:

- TMX expansion startup in May, which should tighten USGC avails as more Canadian crude moves to PADD-5 and Asia (this should displace heavier crudes from said markets but increase overall tonne miles/costs to bring resid-heavy grades to the US Gulf)

- A rollover of OPEC+ cuts and more focus on compliance, as well as MEG seasonal crude burn ahead.

- Russia needing to adhere to is export cut pledges and therefore struggling to market excess bbls created by refinery attacks by the Ukraine.

- The Dos Bocas startup and Pemex’s plans to gradually reduce Maya exports (March exports were reportedly already low)

- Dangote’s ramp-up (at the moment Dangote may be running at only half capacity and on a relatively light slate that will need to get heavier once cracking begins)

- Increasingly higher Upper Zakum feed into Ruwais over Q1 (displacing Murban)

- A possible tightening of US sanctions on Iran and VZ this year

- A likely bump in bunkering demand due to oil trade flow rewirings these last months.

What can we make of this already in our tool?

This is a global issue, but would appear to be more critical in the West of Suez. We can expect a gradually declining margin in NWE & the USGC for preference crudes such as Johan Sverdrup vs competitors in the Middle East (something already beginning to tell against e.g. spot Basrah Medium into NWE). Fuel oil E/W arbs may also need to shut.

More broadly, the margin for light sweets needs to improve against medium sours; given continued tightness in middle distillates vs light ends, that leaves only light/heavy crude spreads to do the work, and therefore (even) higher relative FOBs for medium sours.

Another likelihood is that the marginal bbl of medium-sour runs in NWE, the USGC, and (OECD) Asia are simply at risk of being replaced by incoming new capacity rather than by more light-sweet runs.

OPEC+ will surely be wary of high prices and their impact on inflation and demand, though outside of Europe the macro signals continue to brighten.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com