ICE GO Spreads remain highly backward as French refinery and port strikes intensify

With the continuing strength of the European complex due to reducing ARA stocks (falling steadily over the past 5 weeks) and the ongoing French refinery and port strikes, currently all Red Sea, AG and WCI fixtures are pointing west.

Further evidencing this, we have observed the unusual move of ADNOC’s VLCC, the Front Tyne. The vessel had been sat Offshore Lome for the past few weeks. The VLCC has faced extra competition from Russian barrels in the WAF region and reduced demand for these barrels to flow to ECSAM since the European sanctions.

The ULSD VLCC, now only partially laden, is on its way to Rotterdam with ETA April 9th (days before April’s expiry).

In previous reports, we had mentioned the short-term resupply of Europe from USAC. However, this has proven to be unsustainable considering the continued declines in PADD 1 inventories and now some of the EoS fixtures referred to above have been seen pointing to the USAC, with Reliance seen to have put the STI Solidarity on subs for early April loading.

The April HOGO swap has increased sharply over the last week, a one third increase to its highest level since the end of January, as it fights to stop these barrels flowing TA.

With freight rates from the USAC and USGC TA, and RVO, all seen at recent lows (lowest levels since July 2022), we were seeing that the best source of short term resupply into the MED had been the USGC and USAC in our last report. With those perhaps unable to get a hold of EoS barrels being forced to look for resupply TA; Exxon were seen to have fixed the Estia LR1 early April loading for this route.

The need for USGC and USAC barrels to flow to Europe may have been exacerbated by competition into Latam from Russian sanctioned barrels, with Mexico seen to have taken its first post-cap ULSD Russian import this week. With the flow of Russian barrels into Latam likely to continue, the impact on the US diesel complex should see USGC outflows pointed increasingly back into Europe, putting a hard cap on the HOGO spread going forward to allow these flows at least sporadically through Q2 at least.

However, with a widening E/W once more and a slightly weakening freight market, the AG has become the best source of supply for the MED and North Africa. Unipec were seen to have fixed the Haifeng LR2 for early April loading into Morocco.

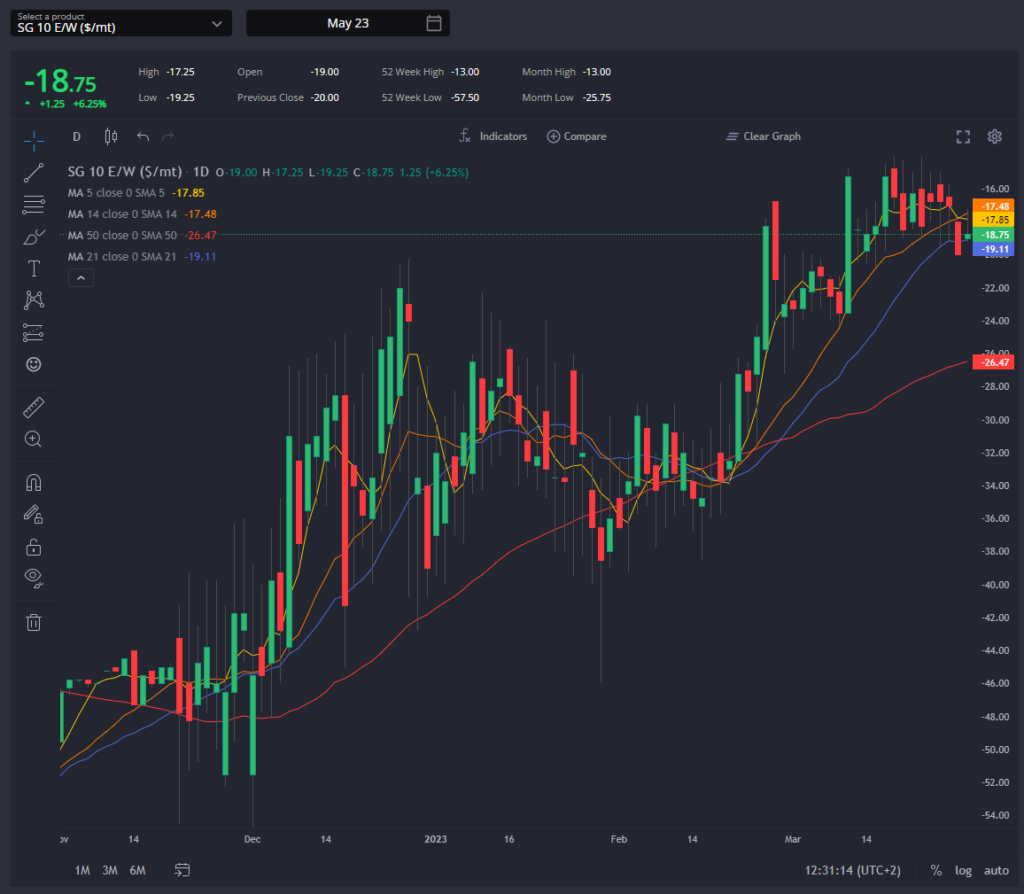

The April SG 10 E/W has begun to widen again in the last week or so as Europe returned to lift barrels out of the EoS, moving away from the 5-year average levels at which it has been sitting through much of March.

As observed in our last report, the best short-term arbs into Singapore remain South Korean and Taiwan ULSD exports. However, falling FOB prices and falling AG/SG 10 spreads appear to be improving the picture for WCI exports into Singapore for May arrivals.

With the West about to receive a lot of supply from EoS combined with expected reduced South Korean, Chinese and Indian exports in April/May, we should see positive moves in Sing 10ppm spreads over the next few weeks with the resulting narrowing of the Sing 10ppm E/W. The one caveat here being that Singapore gasoil and jet stocks appear to be at an 18 month high.

Even though these stock levels appear to have been driven mostly by jet imports, not ULSD, with the resultant ten-fold decrease in the April Sing jet regrade since early Feb. There might be a play here to be made on Sing Jet Regrade as refiners react by putting more jet into the ULSD pool.

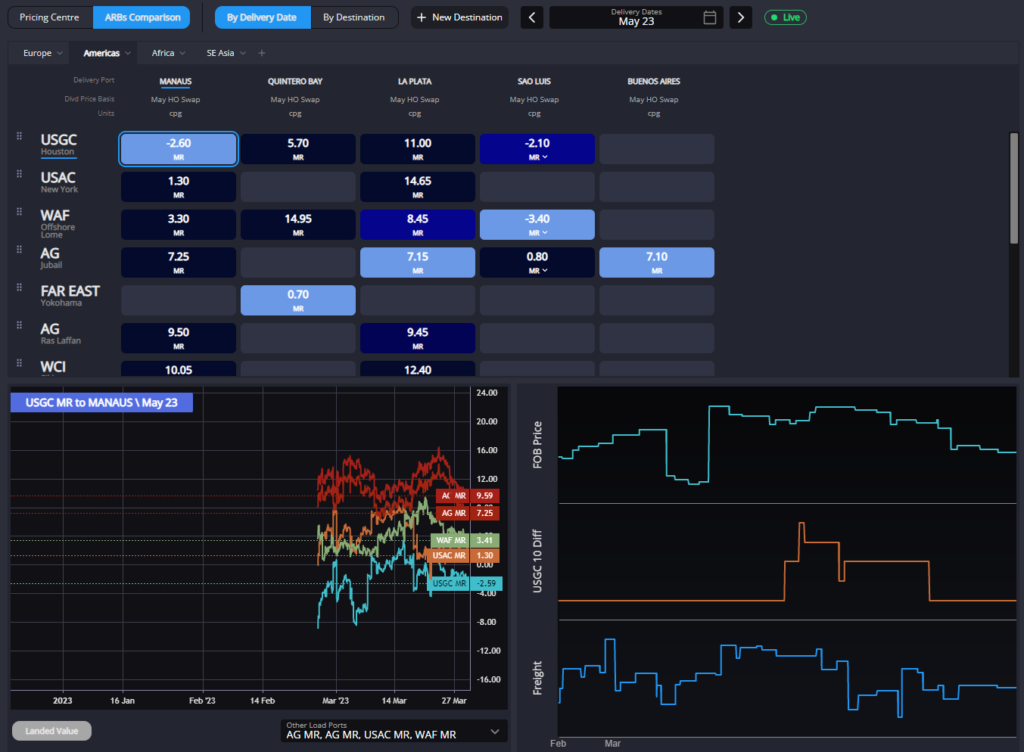

Moving onto the Latam picture, our calculations show barrels out of AG have a clear advantage over US Gulf barrels into Argentina for May arrivals. Vitol having fixed the Dee4 Ilex on this route.

The story becomes more complicated for Brazil, our tool indicates that US Gulf remains the best source of supply for ULSD. However, the matching fixtures have yet to be observed possibly due to Brazil receiving Baltic/Russian supply instead at discounted levels.

We observe fixtures from USG flowing to WCSAM despite our calculations showing that the Far Eastern barrels land better here. Multiple fixtures have been observed to evidence that these Far Eastern barrels are currently finding superior homes in Australia, Indonesia and Philippines.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com