First glimmers of a return to European diesel pull

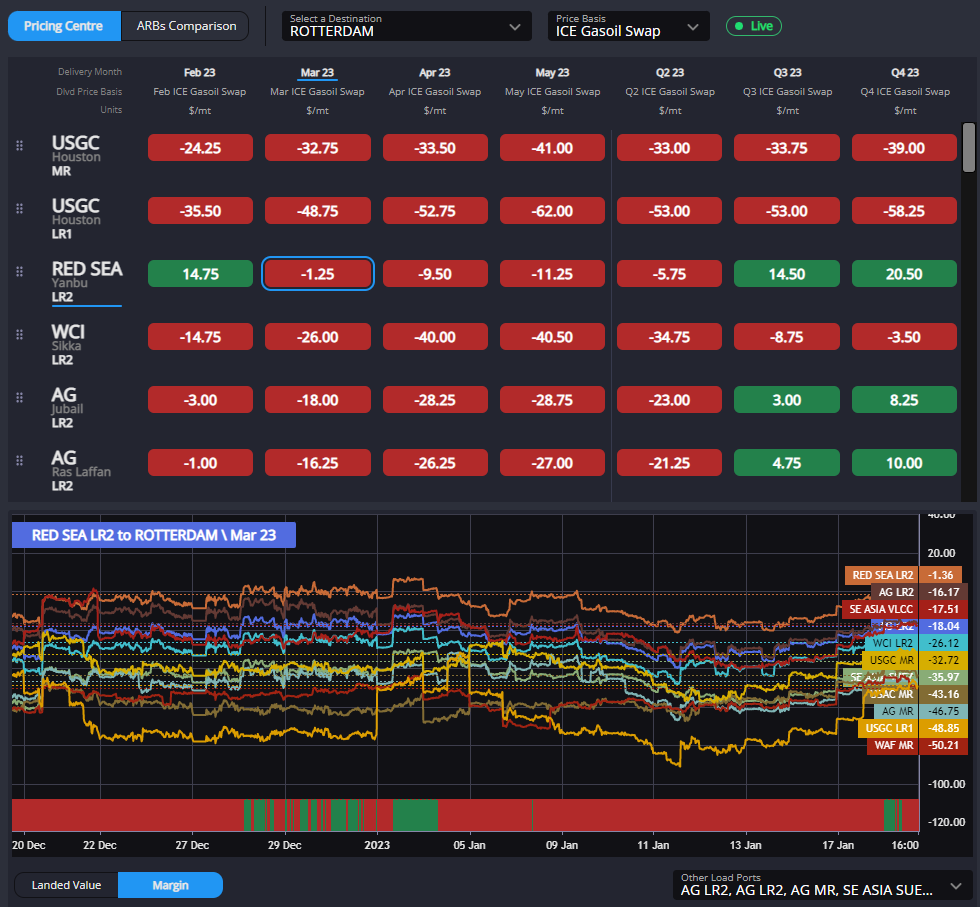

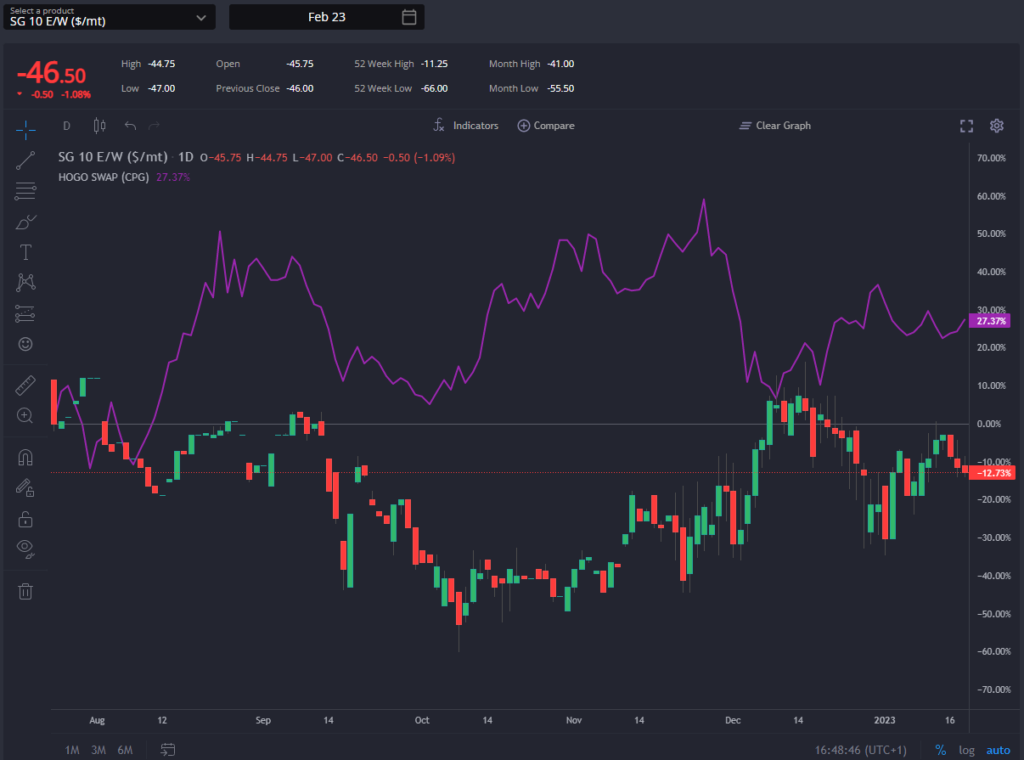

The improvements in the ARA cash diff in recent days have served to reopen the February arrival window from the Red Sea, aided by a narrowing of the MOPAG / SG 10 spread as the Asian market appears to be well supplied. With routes out of the AG almost open as well, the lull in activity to find additional supply for the NWE market is slowly turning around.

That being said, March and April arrivals are not looking particularly attractive yet, and here we may run into supply issues in European markets come Q2 – especially if unexpected supply-side issues (weather or power price related) upset what is likely a fine balance being struck currently.

Furthermore, with inventories below their 5-year average levels in Europe currently and most arbs having been closed for the past six weeks or so, the pricing picture is telling us either one of two things (or potentially a combination of both). Firstly, a combination of healthy European refinery margins keeping refinery utilisation high and term deals struck through 2022 to replace Russian barrels have narrowed the European net-short to levels where only occasional top-ups are required.

Or, secondly, European demand is disappointing and the lack of open arb opportunities into Europe from March onwards until Q3 is an indication that the aforementioned supply-side solutions (higher European refinery utilisation and term deals) have over-compensated for the anticipated Russian supply shortfall.

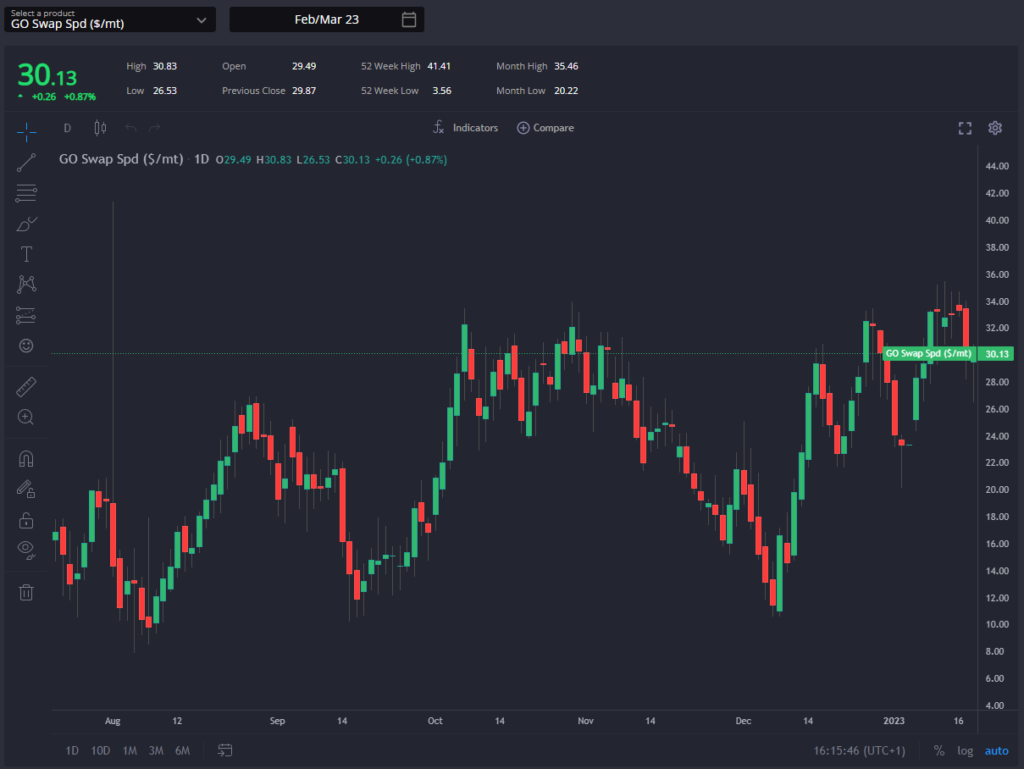

That being said, and this is also to be considered in the context of inventories which (at least according to high frequency readings) remain below 5-year average levels, we have been seeing a slight recovery in timespreads on the European diesel instruments.

Whilst still far off last year’s highs, this is also starting to bring physical cash diffs higher in ARA, helping to incentivise barrels out of storage and also out of the Red Sea (at least for February arrival).

Although the pattern has been clear over the 2H of 2022 that the US had needed to price higher to avoid excess volumes making the transatlantic voyage (as was seen through Nov/Dec-22), the shift to open the arb from the east has been less forthcoming.

Looking ahead, it appears more likely that if Europe’s need for additional barrels grows, it is the E/W that opens further to allow additional barrels rather than the HOGO, with the Americas pricing more strongly in recent months and indicating a need to focus closer to home for now.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com