European strength continues to dominate, offering winter strength to Asian markets

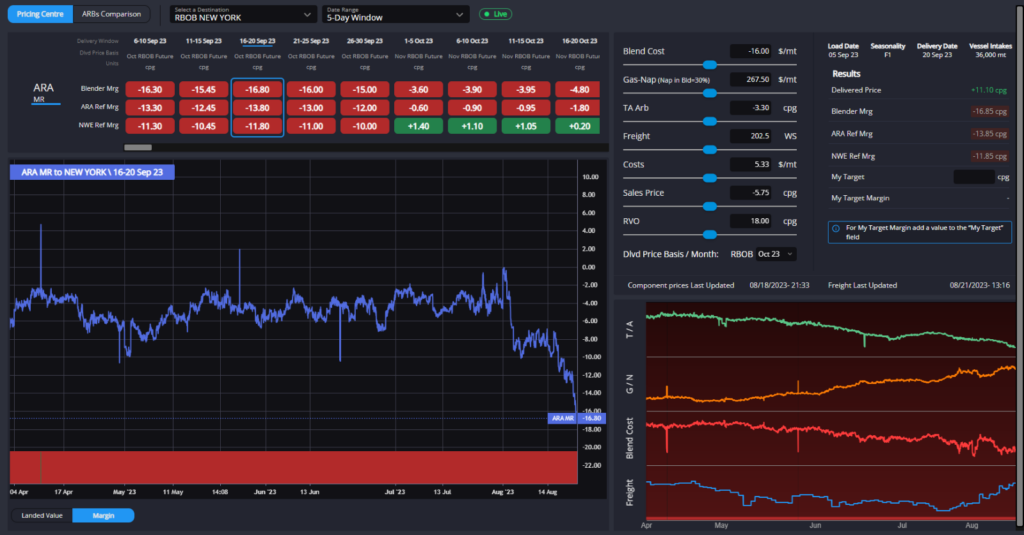

The physical TA arb remains slammed shut in the prompt, with paper TA having narrowed sharply and freight costs continuing to rise whilst blend costs have bottomed out.

Whilst PADD-1 inventories are not exactly high, the European side continues to price higher to force typical export barrels to stay closer to home in the short-term at least.

Ongoing refinery issues – including unexpected outages – continue to prop up a European gasoline market which would typically be winding down from its summer highs at this time of year.

An offline FCC at Total’s Antwerp refinery has blown life into the ARA barge market, helped by an outage at an Alkylation unit at BP’s Rotterdam refinery, seeing backwardation running at levels to draw further volumes from tanks to cover the physical short in the prompt.

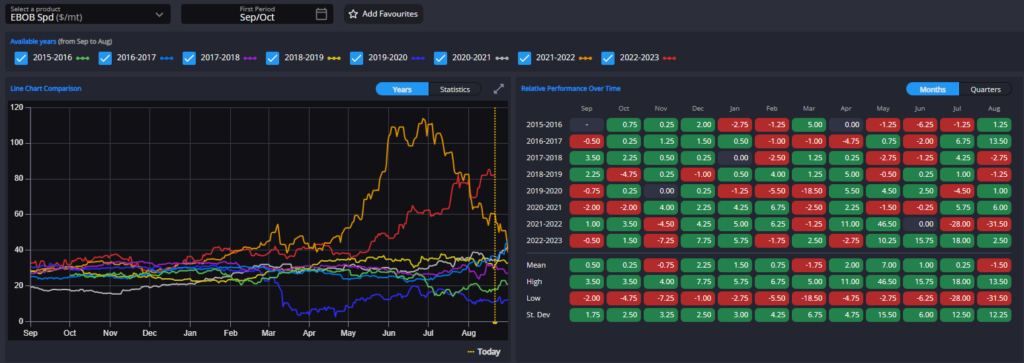

Furthermore, prompt European strength has travelled down the curve well into Q4, with December EBOB cracks currently trading at their highest seasonal levels in recent memory.

Whilst these levels would not be considered unusual come the settlement of December swaps, to already be trading so high points gasoline traders already sending strong signals to the continent’s refiners ahead of a first winter without direct inflows of Russian oil product.

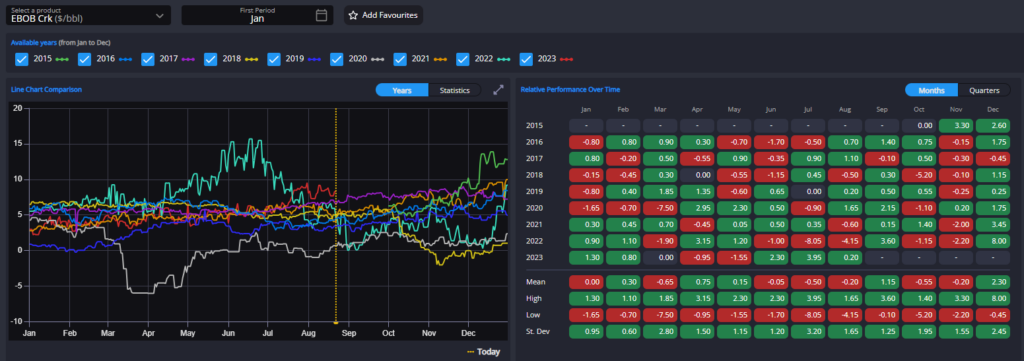

Although much of the focus in this regard has been on the diesel market, a lack of heavier molecules from both the crude and residue streams will continue to impact Europe’s ability to run gasoline-producing secondary units at capacity through the winter months.

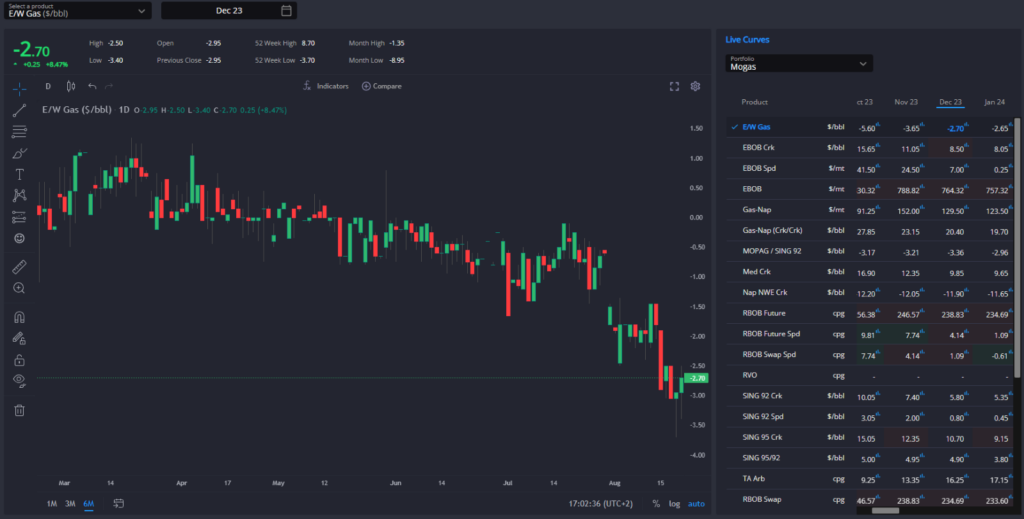

This forward strength in the European market is also serving to reverse the typical winter dynamic of a positive E/W spread and the pursuit of destinations to place excess European barrels.

With the Dec E/W spread currently trading around -$2.70/bbl and averaging also around these levels into Q1-24, EoS destinations are all pointing firmly to either the AG or Singapore for their winter resupply.

This is set to relieve pressure from ARA, but simultaneously gifts additional market share to EoS suppliers and Singapore blenders.

Whilst this would typically present an opportunity for Far East exporters to command higher premia, Russian volumes are not absent entirely, and we expect a continuing role for AG blending activity to supply East of Suez shorts.

In the Atlantic Basin, despite the ARA strength down the curve that we have explored in depth, Houston is pricing itself out of many of its typical export destinations, signalling that despite a narrow TA arb, there are still opportunities for specific grades to move out of ARA.

The size of the uptick in relative Houston pricing recently has been driven largely by strength in individual components, signalling that here as well there are octane concerns.

We would expect these to subside more quickly than those in ARA, however, and suspect that by the time we move into Q4, Houston should once again be the source of choice for the majority of the Americas.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com