European physical market moves higher despite sliding cracks, spreads as market signals prompt strength and weaker winter expectations

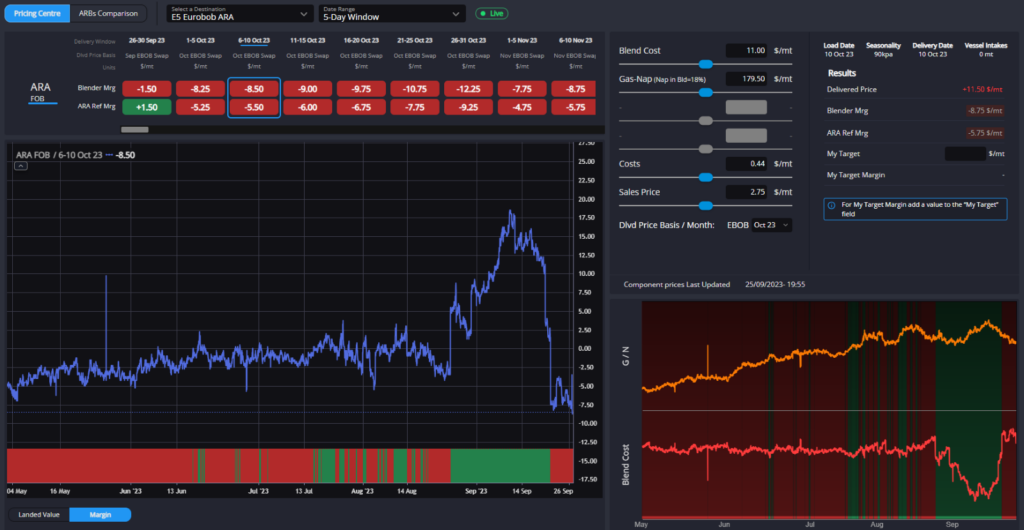

EBOB blend margin slammed shut over the last week. Oct gas-nap narrowed by $40/mt over the last week on a strengthening naphtha market thanks to buyers appearing here after emptying tanks through Q3.

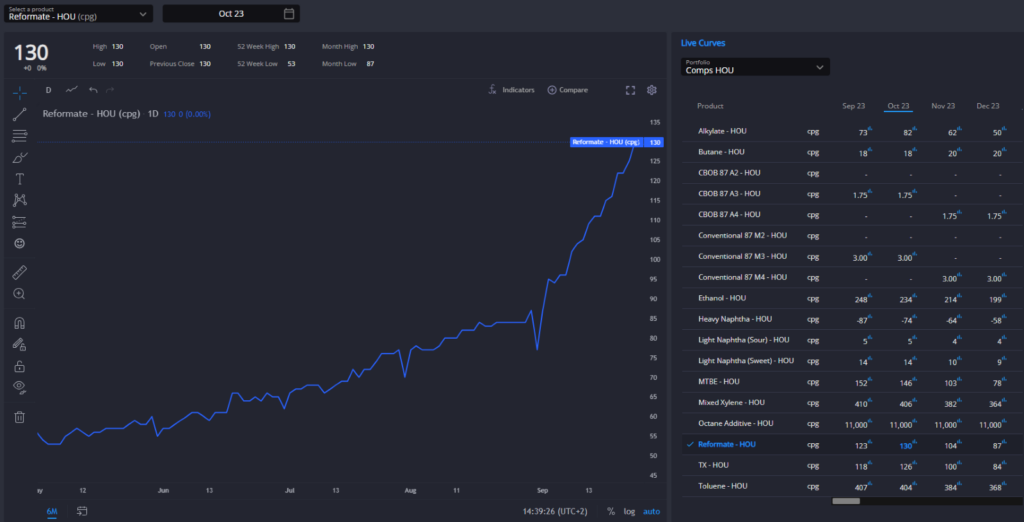

Reformate premiums have rebounded over the same period, having previously dipped through early September. Even isomerate, which now makes up 10% of the optimal E5 blend in October, has seen its physical premiums rise from $15/mt to $50/mt over the last 10 days or so.

The rapid uptick in blend costs for a multitude of grades out of ARA appears to be the result of a combination of tight octane markets in both the US and AG, as well as refinery outages in Europe itself.

As such, with European blendstocks largely tracking their counterparts in the US and the TA arb spread in negative territory for the last week, ARA-origin barrels remain the most cost-effective source of supply to the Atlantic Basin.

Indeed, the cost spread between sourcing barrels out of the USGC vs ARA for these destinations has taken another step wider this past week despite the tightening of the ARA component market, signalling further upside for the European mogas complex in the coming weeks.

Across the pond, we can see in the ongoing octane tightness playing out in physical premiums on higher octane components.

The MTBE supply outage which saw premiums for the high-octane additive move sharply higher in late-August is now history, with MTBE premiums falling (albeit remaining around historically high levels), and instead the strength is being seen now across all higher octane components.

Heavy naphtha barrels have rebounded slightly over the last week to move higher once more, whilst lighter naphtha barrels are seeing their premiums rising vs the underlying C5 quote to highlight a tight market in the USGC at the moment on both a quality and quantity basis.

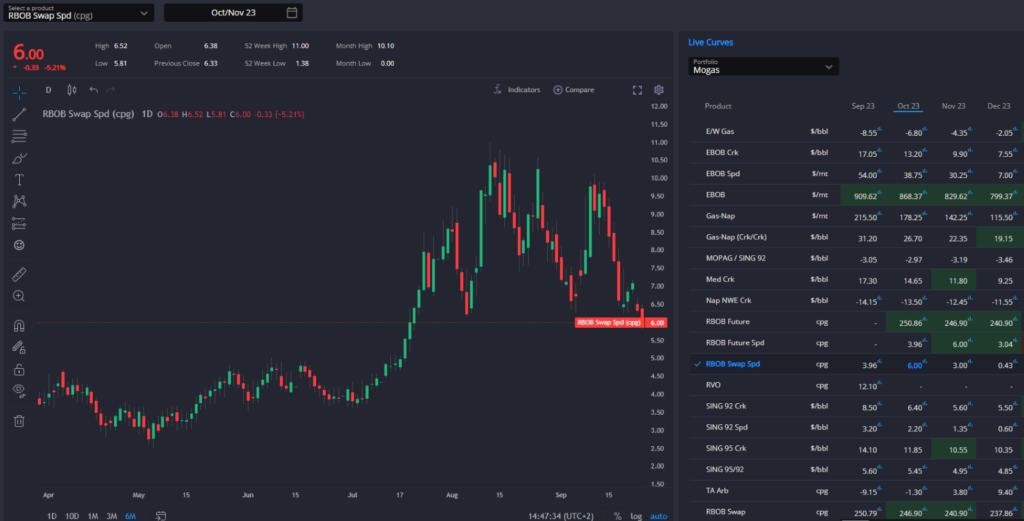

A look ahead into Q4, however, paints a different picture for the US gasoline complex. Forward spreads have been coming off strongly in recent weeks as the market looks towards a significantly longer balance in Q4 and the chance to build stocks once more over the winter months.

Forward M and A-grade blend margins remain extremely closed for both a USGC blender or refinery operator, and although this is no cause for concern on the supply-side with expectations of lengthening overall balances into Q4, it does signal that we should expect physical premiums across the components to begin falling again steadily as we move into October.

The recent temporary export ban on Russian refined products has been felt in the European market, where a relief from competition into North and West African markets has provided some support, but the impact is also being felt in the AG.

AG physical markets had been anyway heading higher in recent weeks as refinery turnarounds and strong export pull tightened the regional balance on higher octane components, but the Russian export bans are likely to provide a further two-pronged support in the short-term.

Lower arrivals of straight-run naphtha out of Russia as a blendstock as well as reduced competition for finished barrels into various African destinations is likely to support higher premiums in the AG for the time being, although the influence on the broader EoS gasoline market appears to be thus far strongly outweighed by developments further east.

Singapore 92R cracks have collapsed in recent days thanks to an influx of Chinese barrels into the market, as well as returning refining capacity across the continent running up against a Singapore market which is still having to compete for outlets as inventories in Singapore rose for the last two weeks.

Singapore blended volumes are currently the cheapest source of supply into both Australia and West Coast Mexico, the latter an arb which has been open for some time now and is showing no sign of closing just yet.

The continued negative E/W spread offers another explanation for why Sing 92 cracks have fallen quite so sharply, with a need to maintain this negative spread in order to not entice Atlantic Basin barrels into a well-supplied EoS market through Q4.

However, the size of the downturn in the Sing market is difficult to justify, and we would expect at least a small rebound in the next few days as these levels are unlikely to keep refining margins sufficiently healthy in the short term.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com