Europe softens as US remains supported and naphtha begins to show potential for recovery

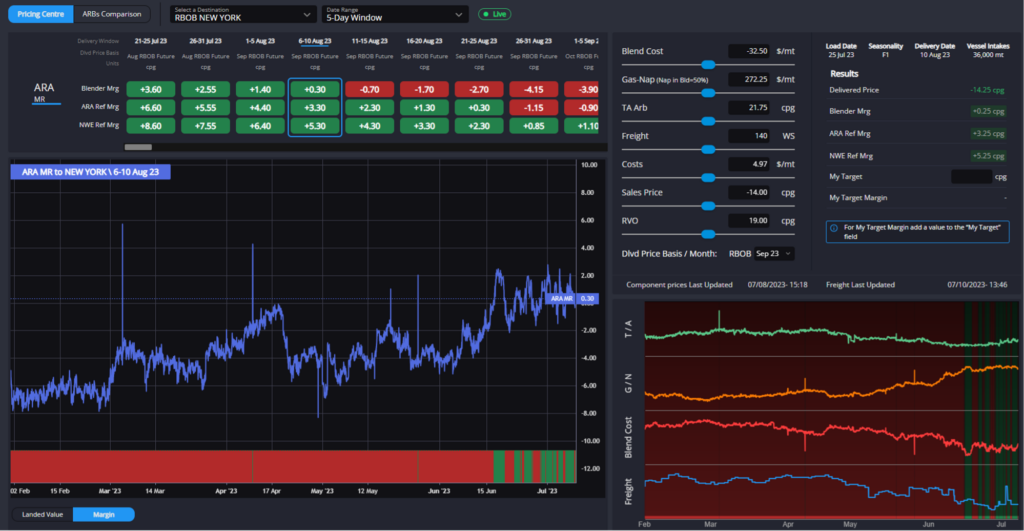

The RBOB arb remains open for the rest of the month, but this remains highly reliant on the current wide gas-nap spread.

If the July gas-nap levels leak into August ($270/mt vs a current ~$245/mt), the prompt TA arb will open up. There is likely to be a limit on how far the August gas-nap spread will go, however.

Even during last year’s peak gasoline tightness in the summer, the August gas-nap spread (see graphic) was already retreating by early-July as the market starts to turn its focus towards the latter stages of peak demand season.

Couple this with some initial indications that naphtha markets have reached a bottom, with petchem margins becoming workable at current levels and some reported return to buying from the large naphtha purchasers in the EoS, and the necessary extension of the gas-nap spread out by another $30/mt or so may not be as foreseeable as the rollover was last month.

Add to this an almost 3cpg narrowing of the TA arb in August vs July, and the reopening of the prompt TA arb for blenders in August would require a strong signal from the US side to make it happen.

In the European market, very prompt E5 Eurobob blending in ARA is currently also just about in the money thanks to the gas-nap spread.

This will fall off a cliff as we move into August, however, signalling that current levels of blend activity may well fade towards the end of the month.

A further signal that some pressure may be beginning to be felt on the prompt European market can be seen in an increasing competitiveness for ARA-origin barrels into Atlantic Basin destinations.

We have seen the USGC hold a significant discount vs ARA barrels into these destinations in recent weeks, but a steady softening of the European complex and step higher for USGC blend costs last week has seen this gap narrow to insignificance for prompt loading to destinations such as Canada, Guatemala, and Brazil.

The improvement of the relative competitiveness of ARA barrels can also be traced back to a tightening of the USGC market.

Last week’s EIA report saw nationwide gasoline inventories fall (led by PADD-3), whilst PADD-1 inventories rose slightly, alleviating some of the support for the TA arb and helping support upticks in physical premiums for some (light naphtha, reformate) blend components in Houston amid tighter availability.

Finally, in the EoS, the abundance of cheap naphtha has been slowly drying up in recent weeks, with Russian flows reportedly subsiding slightly. This has seen August naphtha in Singapore trading above July, as well as the July E/W naphtha spread ballooning out to $11/mt after having started the month at less than half of this level.

The arb to Asia opening up has helped to alleviate some of the pressure on the European complex and appears to be justified as petchem margins bottom out in Asia and South Korea’s announcement on the removal of tariffs on naphtha imports is likely to see this arb able to move at a lower baseline than before.

That being said, the August E/W has narrowed sharply throughout the day today, perhaps suggesting that the EoS may not yet be ready to sustainably receive the kind of substantial volumes that are likely to be fixed at July spread levels.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com