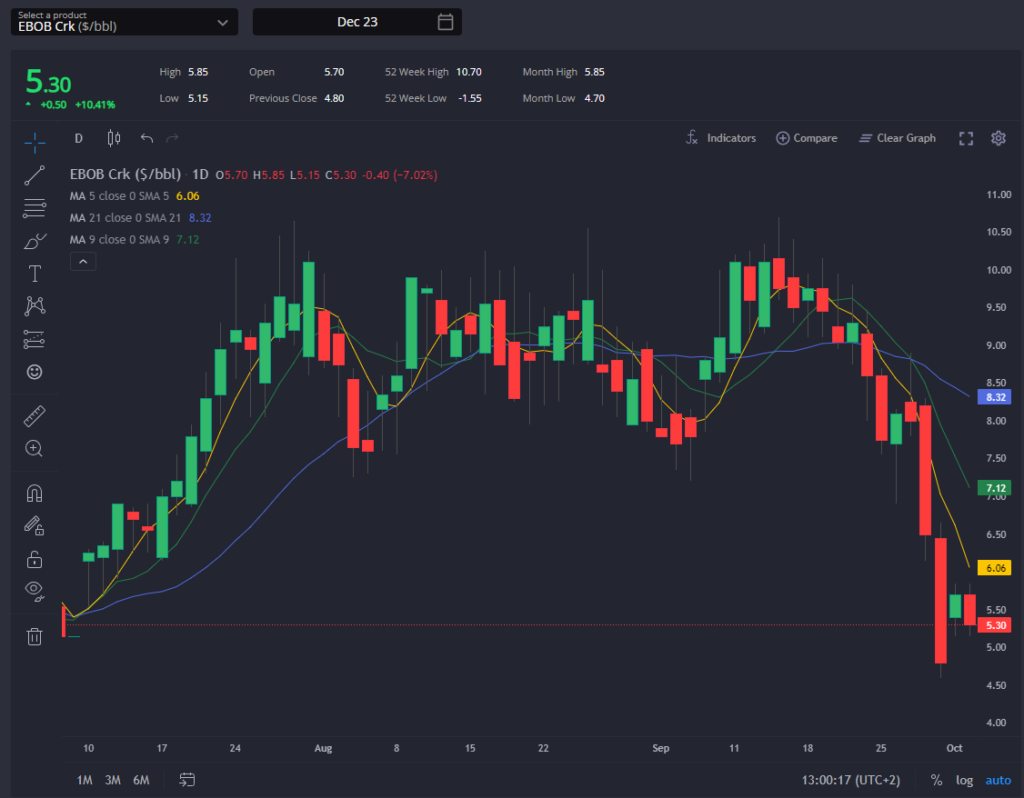

EBOB retreat was overdue, but now looks overdone

The recent collapse in Q4 EBOB cracks has been both foreseeable and surprisingly stark. What began early last week as a consolidation to bring EBOB closer in line with blend values in ARA – a reasonable response to softening prompt demand and recently risen physical diffs – descended late last week and continued early this week into something more resembling a rout.

December-23 cracks, a bellwether for winter gasoline strength, have taken a hit as the broader market has flipped to focusing on distillate for the winter ahead, moving yield signals for refiners squarely away from light ends.

The move has firmly shut blend margins down the curve, as well as opening up the TA spread from its recent historic lows.

This is now pointing Mexican inflows back to Houston for the first time since mid-August, meaning that despite cheaper paper EBOB in ARA it is actually lowering the call on physical barrels out of ARA heading west in the near term.

The difference is relatively marginal for now, however, and ARA remains the cheapest source of supply in WAF and ECSAM. Demand should remain (seasonally adjusted) robust, therefore, and a rebound in the Dec-23 EBOB crack back to towards its 5 or even 9 day moving average is now likely.

In the absence of such a rebound, this would form a significant bearish call on gasoline demand through the winter ahead.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com