EBOB rally still has legs in the short term

EBOB cracks pushed higher this week with substantial CDU capacity temporary offline in the US following another cold spell and amid escalating geopolitical risks.

EBOB spreads are not yet as bullish as cracks, nor are physical premiums in ARA; that may well be due to a lull in export demand itself as suspected in this commentary last week.

However, ahead of seasonal turnarounds, rising demand, and the risk of further geopolitical escalation, that situation may quickly change and provide a further leg up for paper.

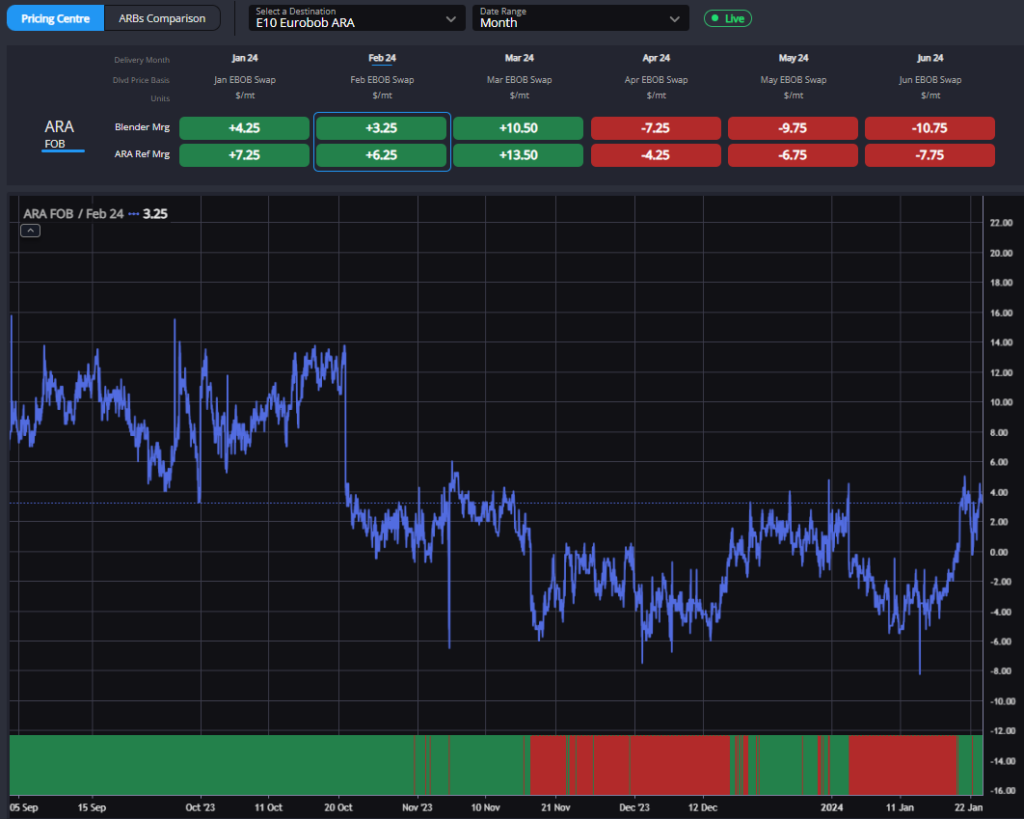

On the Atlantic Basin front, E10 blending margins remain firmly positive with a spike in gas-naphtha spreads lending a hand to blending econs.

That is at first glance a pressure point for EBOB itself, but ARA is also increasingly pricing itself into variety of global arb locations that may see physical premiums begin to move higher in line with paper.

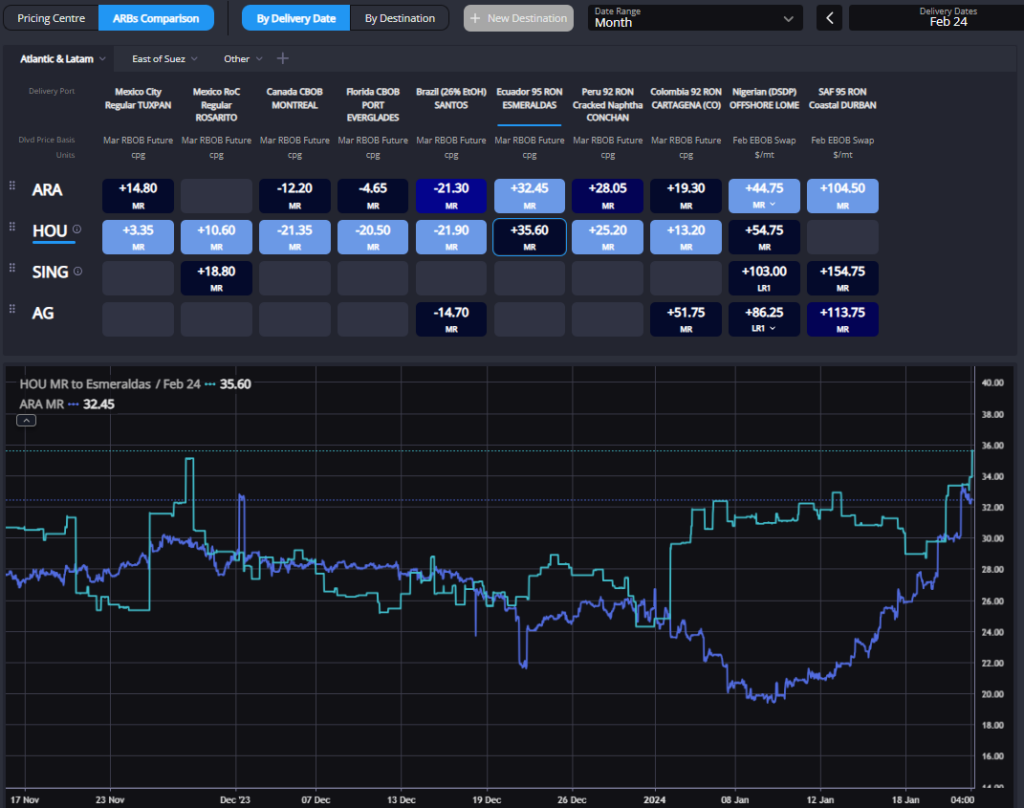

Opportunities are available in Latin American markets (Brazil, Ecuador); that has been made possible via substantial price-impact on the Houston gasoline market from recent weather-related disruptions.

A heavy US turnaround season ahead should further curtail supply there and make a dent in the US stocks that were last seen up some 18 million bbls y-o-y (EIA).

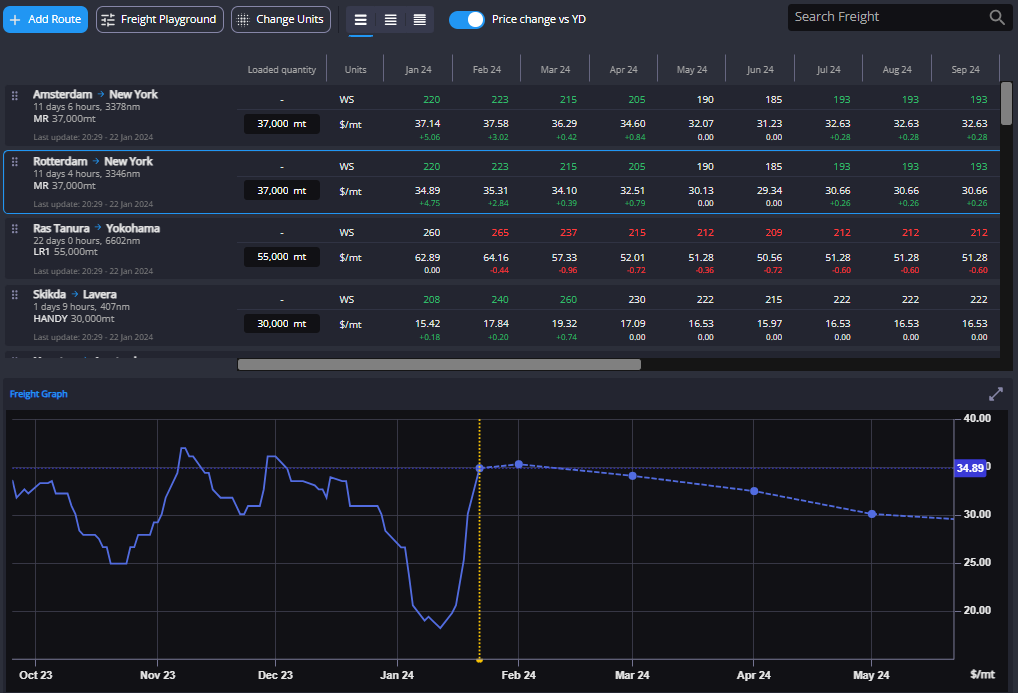

On the TA route, spiking TC2 rates have helped to maintain very shut econs out of ARA into NYH, alongside a TA arb that remains in the doldrums.

The off-season for demand, however, is almost over and sturdier imports into the USAC should be around the corner.

What is more, a hefty rally in TC2 over the last week or two likely has room to mean revert with TC14 likely able to resupply NWE going forward.

For arbs into East of Suez locations, ARA remains the cheapest source of supply to a number of marginal importers.

The advantage relative to Middle Eastern grades has narrowed markedly over the past couple of days, but evidently European components have room to strengthen further before being priced out here, while turnarounds in the Middle East are ongoing.

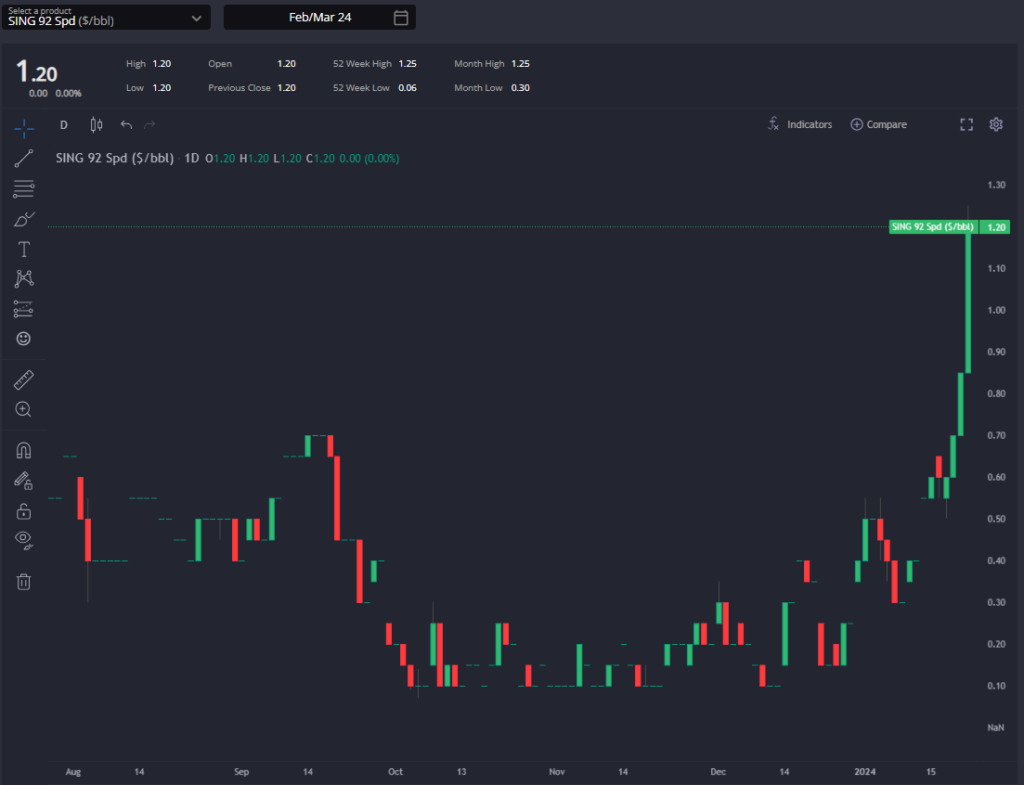

What remains also remains a boon to ARA is the strength of the Singapore market, which continued to rally this week.

Singapore strength has now priced its barrels out of most export markets amid a very strong E/W and on freight costs.

ARA is now the cheapest source of supply to South East Asia as well as East and South African destinations for March delivery.

Just on that basis alone, Singapore strength may have peaked already (and rising export econs and new quotas may also spur some marginal Chinese exports), but a correction is first needed before it starts to put pressure back onto the Atlantic Basin.

What is more, there has also been an element of peaking supply/geopolitical risk premiums this week, given interruptions at Ust-Luga (given the larger role that Russian now plays in supplying products to Eastern markets) as well as ongoing tensions in the Red Sea. The risk of escalation appears to be rising for the time being.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com