Ceiling reached as weak naphtha provides anchor to gasoline complex

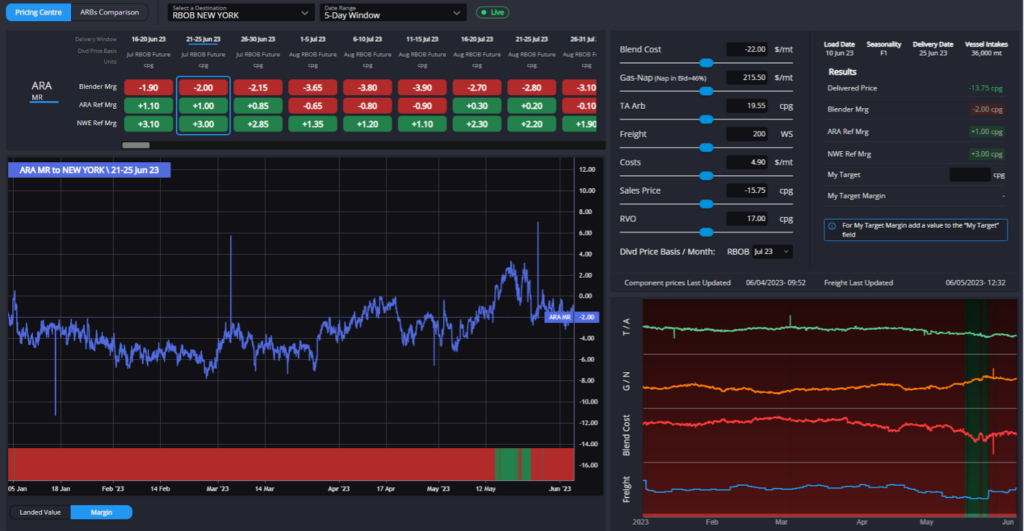

Starting, as ever, with the TA arb, the last week or so has seen the freight market out of ARA strengthening, helping to curtail the attractiveness of ARA-origin barrels into the Atlantic Basin as a whole and cutting off the TA arb for blenders.

Whilst the US fundamentals position – especially in PADD-1 – still looks like it requires substantial outside help, the open arb for much of the last two months has likely done enough for now in terms of fixing sufficient volumes.

Indeed, with the arb still open for the price-advantaged refinery-linked players, there appears little need for the TA arb to widen from currently levels to ensure PADD-1 remains well supplied in the weeks ahead.

With not much changing week-on-week in relative blending values between ARA and Houston, it has been left to the freight market to widen the relative gap between the two origins into a selection of Atlantic Basin destinations.

Luckily, Houston appears to still be well-equipped to supply barrels into much of its ‘home’ markets, with the gas-nap spread remaining very wide as both US and European refiners struggle to place naphtha barrels into Asia and instead are pushing more volume into the gasoline market.

In the case of PADD-3, this is likely drying up the typical naphtha flows out towards Asia, and we may see these volumes turning up in finished gasoline flows into LatAm instead soon enough.

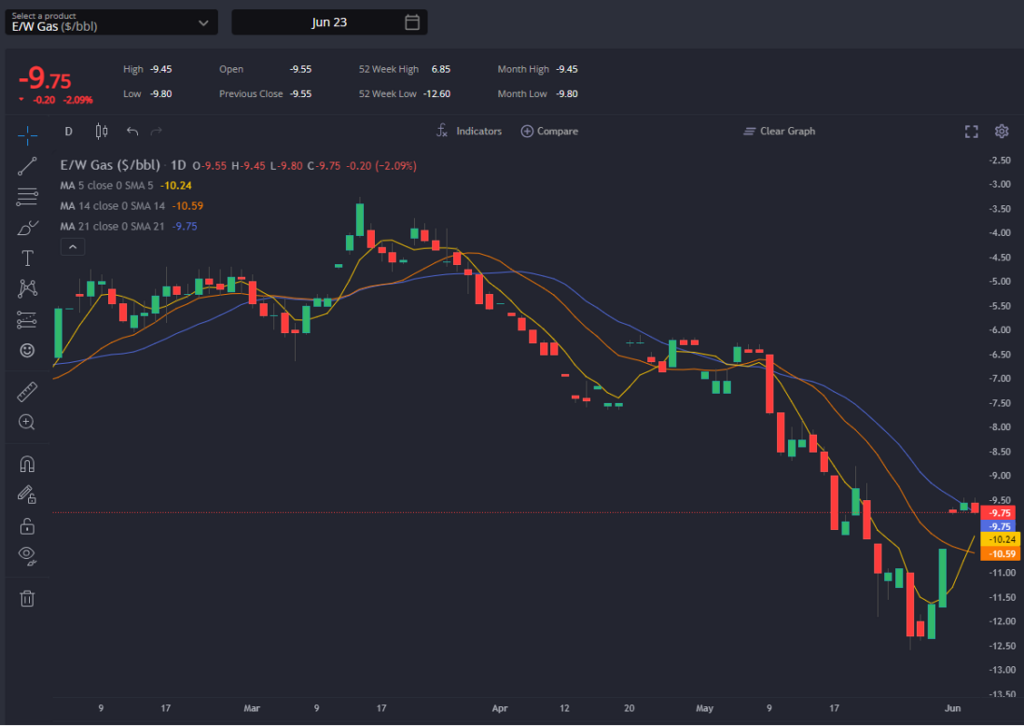

With ARA barrels no longer in such great demand from the rest of the Atlantic Basin, the need to pull components out of the Middle East (or at least look to the east to compliment supply) is also waning, and this is reflected in the E/W having rebounded off its bottom recently.

Whilst this spread has narrowed slightly, it still means that the Nigerian/WAF short is pointed squarely at barrels coming out of the AG currently. With Dangote refinery reportedly ramping up, and the AG currently significantly cheaper than the ARA into WAF, we may have already be entering a market where this reliable outlet for European gasoline barrels is proving less reliable and certainly smaller volumetrically in H2 this year.

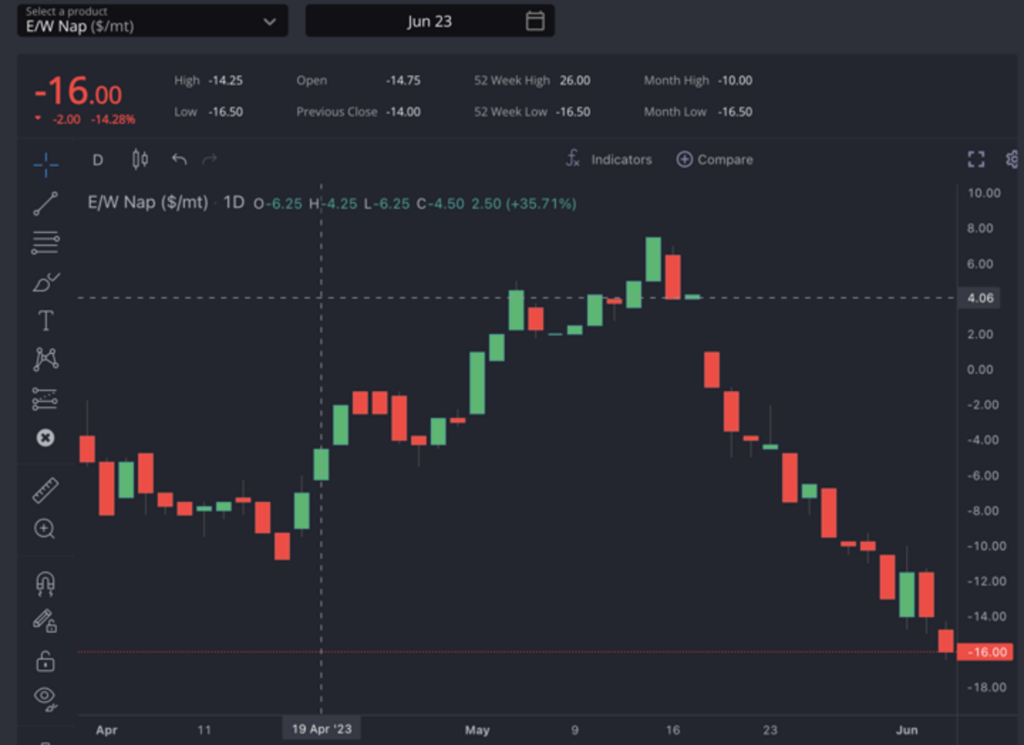

Our naphtha commodity owner, Jorge Molinero, has added a little insight to the current naphtha market. “The east continue to suffer from very weak fundamentals for petchem demand, which is especially harming osn-paraffinic grades. This in turn means that volumes from the West to the East will likely show their lowest levels for the year in June. With the AG and India are exporting more to the East, Europe and US is not finding much opportunity with this E/W. MOPJ flipped to contango in paper and physical premiums for OSN in negative values for Japan and Korea too.”

Furthermore, some light FRN qualities that used to go to petchem pool are now going direct to blending in Europe. Sellers are trying to find sub-octane quotes from blenders rather than petchem ones from chemicals.

Petchem producers are maximizing LPG and just producing ethylene for internal consumption and contract obligations. So clearly there are two different markets right now, weak petchem and big premiums for heavy/frn naphthas.

Going forward we are likely to see a continuation of recent trends: weak Asian market, Europe recovering some strength, and blending premiums plateauing now that support from the gasoline side appears to have been tapped out.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com