Negative blend margins causing continued backwardation… but for how long?

Over the last weeks the European market put itself in defence mode on the back of the French refinery strikes, as it anticipated a potential spike in demand from France just before the summer season.

As a consequence, during that uncertain period, all arbs from Europe were completely shut down with the exception of minor volumes flowing from NWE and Med refiners. We now see that the anticipated French demand has not yet materialised.

The defensive attitude ended up being unnecessary (for now) and in the meantime, most ARA and NEW refiners ended up building stocks at a time when the market was mostly trading in backwardation.

The combination of lack of TA arb demand coupled with the absence of the much anticipated domestic demand and a slim WAF program has killed all market activity in the prompt.

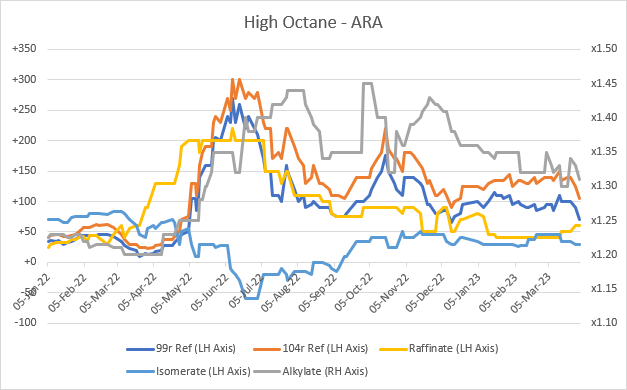

We start seeing the immediate consequences as high octane component prices, that were holding very firm since the start of the year, start losing ground just as we enter summer.

Ironically, during the whole winter most traders were bullish as they anticipated a lack of high octane material in summer, and now that we finally reach summer, we see those components such as reformate and alkylate start collapsing due to lack of demand.

Reformate (99 Ron) is now trading at April Barges +70 $/MT. Given the sustained strong backwardation in the market, and unless we start seeing arb demand picking up, those component prices should continue to fall.

In the meantime, we still don’t see any demand coming from the US or Caribs, whether we are talking of finished grades or high octane components. The market was anticipating a repeat of last year’s trend where Europe exported its high octanes to both PADD 1 and 3 for it to be blended with cheaper US domestic naphtha.

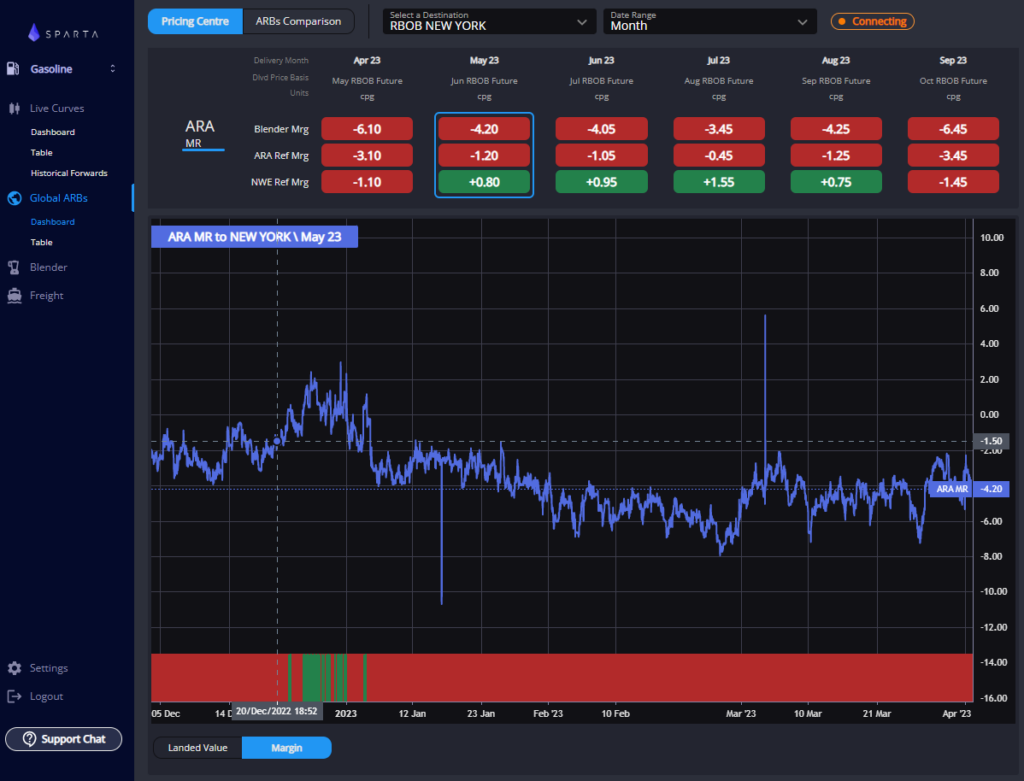

We have yet to see that trend occur again this year, probably on the back of a comparatively much stronger Naphtha market in the US vs Europe (Particularly in NYH). Arbs to NY have now been shut for more than 3 months in a row.

Despite the lack of imports and, consequently, the declining stock levels in NY (PADD 1 stocks are now lower vs. end March 2022) the market’s price action seem to indicate a lack of urgency to attract European barrels. Prompt arb margins have recently been choppy but have now gone back to a 5 months low (negative 7.35 cpg for ARA Traders loading in April).

Meanwhile, forward arbs have now bounced back from the lows and we start seeing an arb margin for NWE refiners. This again indicates a potential for demand going forward, but clearly not on the prompt.

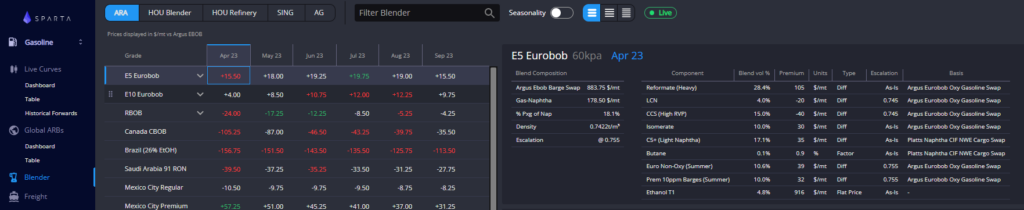

Given this market configuration, one might wonder: why is the ARA market so strong? On the first trading day of summer spec, E5 traded at May swap +$33/MT on average. Why are we seeing such a steep backwardation?

The fact of the matter is that despite the falling component prices, they remain very high and are killing any blending margin. As mentioned several times over the past months, even though arbs are closed, E5 and E10 remain the components of choice in today’s market.

With current component prices, blending E5 would imply a negative $13.25/MT blend margin for ARA refiners. Not surprisingly, that is exactly where the market traded yesterday (April +$13.25/MT = May +$33/MT with April/May at $19.75/MT).

Any end users with a natural E5 short is still incentivised to buy at May +$33/MT rather than blending himself. On the other side, with the current component levels, sellers have no incentive to offer aggressively in the window.

But is this sustainable? It will depend on the US demand over the coming weeks. If US price action does not trigger additional demand from Europe, component prices will continue to fall until we start seeing a positive E5 and E10 margin and only then we can see a weaker market in the prompt.

On the other side, if TA demand spikes, we could see an increased demand for E10 as it remains the cheapest option.

Given today’s April/June TA arb margin spread, there is currently a higher probability for the market to correct. In terms of E10/E5 spread, we continue to see E5 trading at a premium to E10, purely based on blending economics.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com