US diesel tightness further contributes to E/W widening as 3rd Chinese export quotas announced

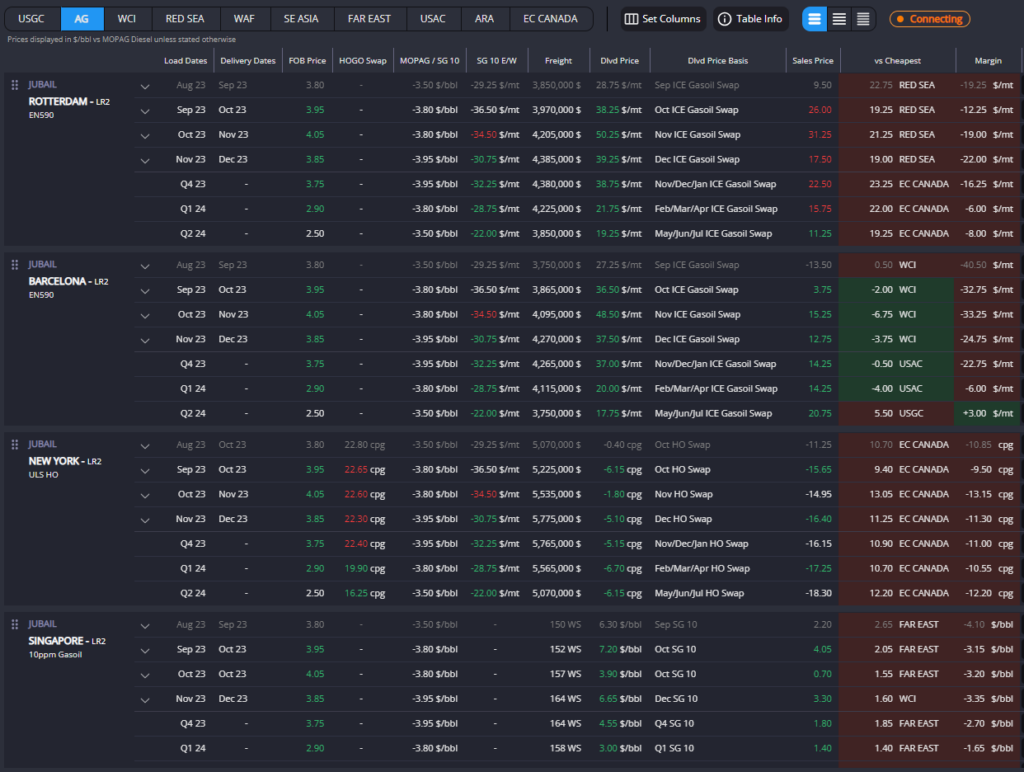

The Red Sea, along with AG and WCI, maintains its position as the most economical arbitrage route into Europe, while transatlantic (TA) arbs remain firmly closed.

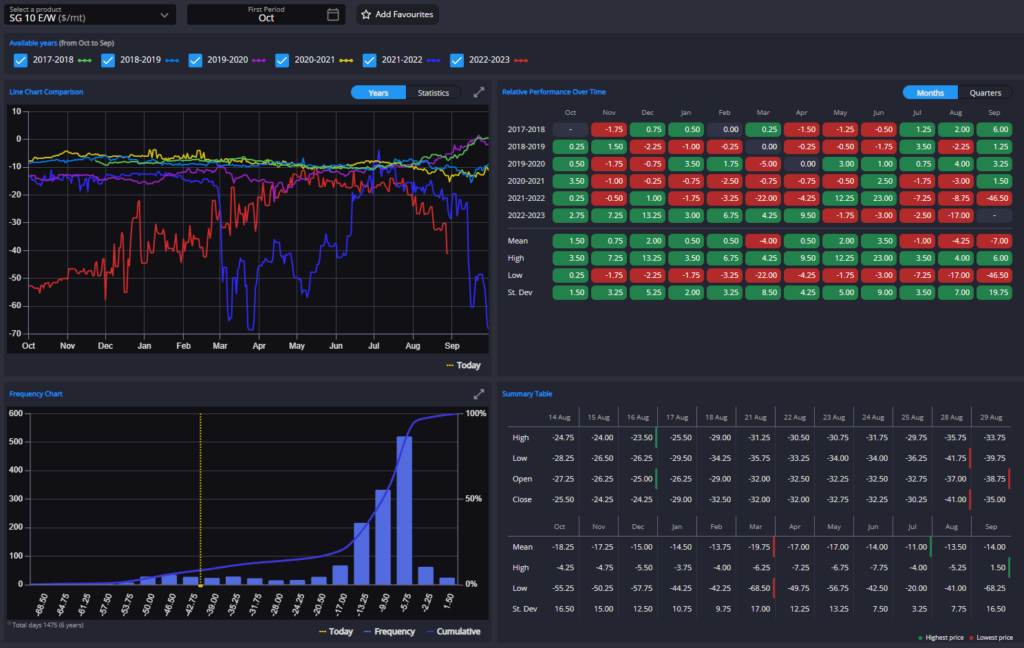

The East-West (E/W) spread has tracked the recent changes in ICE GO spreads and cracks, with September’s E/W spread remaining stable at –31$ /mt.

Despite a reduction in European sales prices due to the increased availability of some earlier East of Suez (EoS) cargoes, ME arbs continue to favour the West.

ICE GO spreads and cracks have remained largely unchanged at their currently elevated levels, reflecting reduced ARA stocks, whilst relatively unchanged net ICE GO positions also hint at a potential ceiling for Q4 cracks and spreads.

Margins for ME loaders have this week favoured New York over the Mediterranean. This week saw reverse TA arb fixtures to Latam and USAC from Europe, indicating the scarcity of diesel in North America, and exemplified by surging US West Coast diesel prices, as well as vessel availability concerns amid hurricane fears in the US Gulf.

With Singapore’s stocks reaching a 19-week high and the release of new Chinese gasoil quotas, it appears that the E/W spread will need to maintain its currently wide position, as the Atlantic Basin requires these cargoes more than East Asia.

The US Gulf Coast (USGC) continues to face challenges into all parts of Latin America, both West and East Coast, with competition from AG, WCI, and Far Eastern barrels. This is attributed to product shortages in the US and reduced vessel availability due to hurricane concerns.

Despite increasing South Korean FOB prices due to East Asia starting a second maintenance period of 2023, and rising WCI FOB prices due to upcoming maintenance at MRPL, HPCL, and IOC refineries, USGC barrels remain in a challenging position vis-a-vis Latam.

September and October HOGOs are at their highest levels since January 2023, alongside surging New York sales prices. The colonial arb to PADD 1 is likely to open, aided by the USGC differential’s wide position and the difference in stocks levels between PADD 3 and PADD 1.

Our platform indicates that AG barrels currently land more cost effectively into New York than those from USGC. We have noted the diversion of vessels and Ship to Ship (STS) of EoS cargoes to the US Atlantic Coast this week. As winter nears, maintaining the currently wide HOGO spread is crucial, as the US grapples with internal low stocks challenges.

South Korean barrels are facing a cost-effectiveness challenge from WCI barrels into Singapore, although WCI barrels, as noted earlier in this piece, are currently directing their focus toward the Western market.

Notably, the recent release of the 3rd batch of Chinese export quotas was announced this week. Heightened SG10 cracks which have bolstered Chinese gasoil export margins have combined with limited Chinese economic stimulus measures to double predicted Chinese gasoil exports in September to 1120 KT, compared to August’s 620 KT.

This should be enough to counteract East Asia and India entering an elevated maintenance period during September and October, resulting in expected downward pressure on SG 10 cracks.

Q4 SG10 cracks and spreads have remained relatively unchanged over the past week, despite volatility in the market. However, the September Singapore regrade has narrowed from -$2.30 to -$1.40 /bbl, reflective of increased gasoil availability and driven by earlier Indian arrivals, newly announced Chinese export quotas, and the continued blending of jet fuel into the gasoil pool for transpacific voyages to the US West Coast and West Coast Latam.

Furthermore, indications suggest Chinese jet demand is on the path to recovery, inching closer to pre-pandemic levels. The trend of a narrowing in SG regrade is therefore expected to persist, with the overarching trend indicating the E/W spread is likely to widen as the US and Europe exhibit greater diesel demand compared to East Asia.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com