Lowest ARA gasoil stocks this year, E/W to reverse recent narrowing as WCI barrels, on paper, point to Singapore

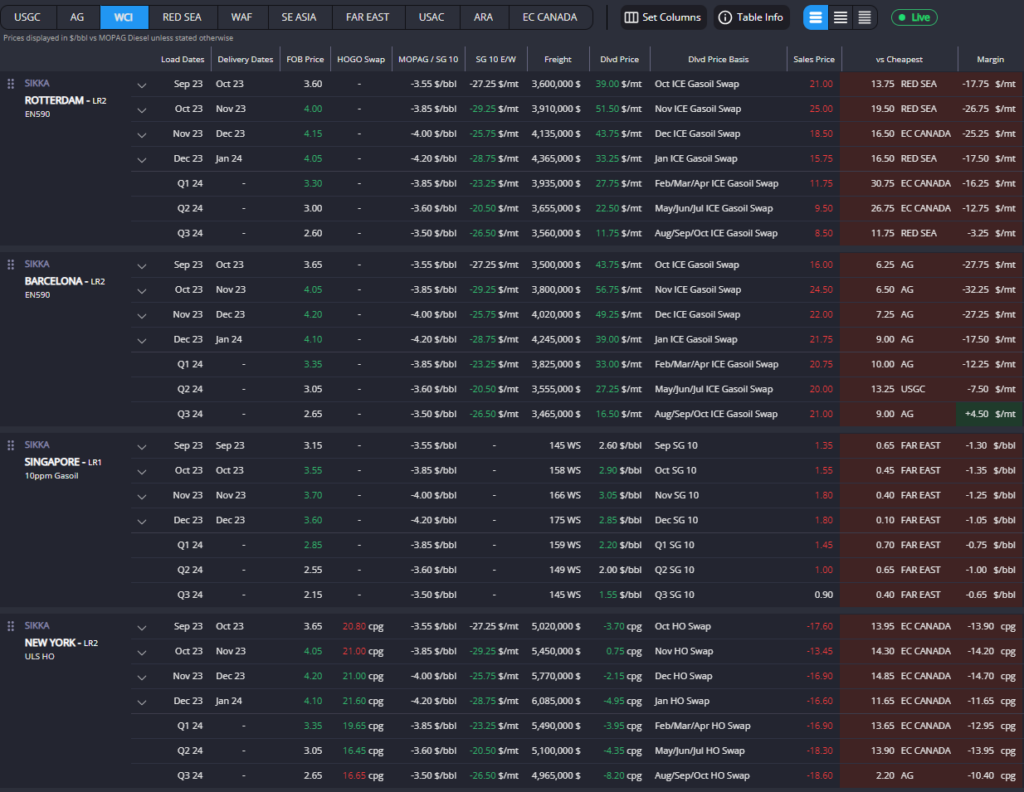

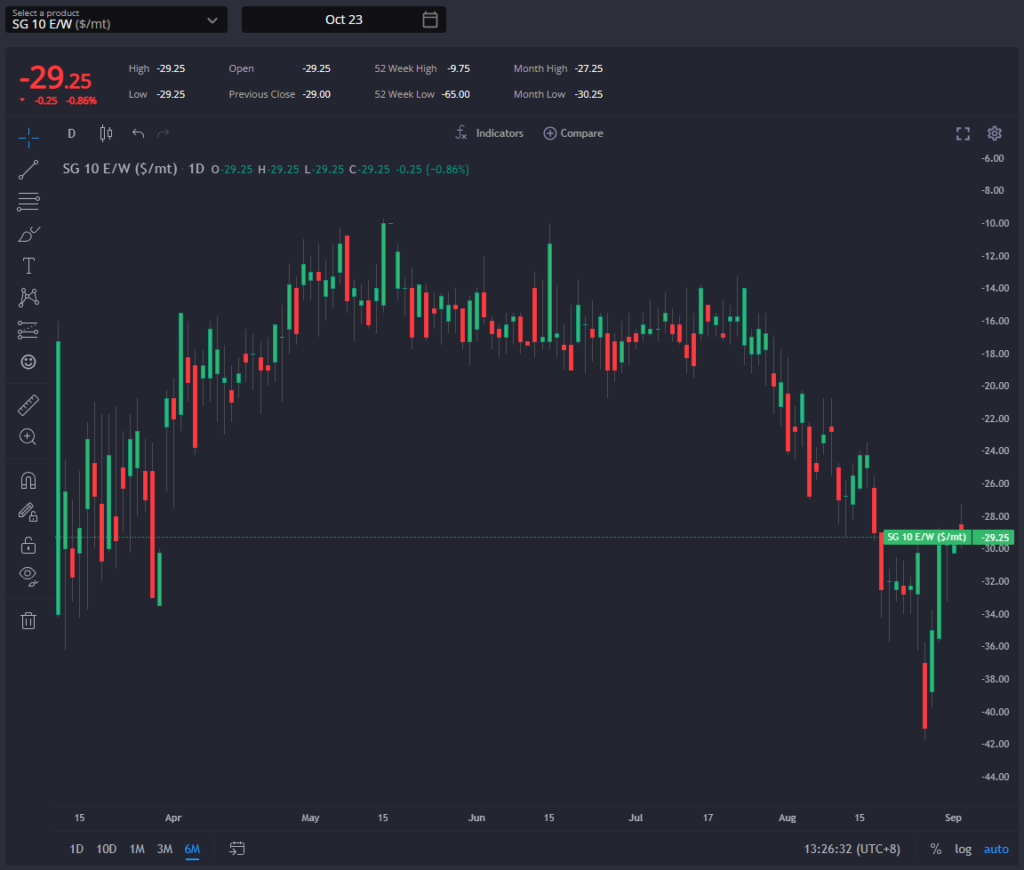

Red Sea arbs remain the most cost-effective option into Europe, but all arbs into Europe are currently closed until Q2 2024. Arabian Gulf (AG) arbs still favour Europe, although a recent narrowing of October’s E/W spread from -$41 to -$29 /mt has led West Coast India (WCI) arbs to point toward Singapore.

However, matching fixtures have yet to materialise; mid-September WCI such as LRs Sea Star, Navig8 Pride and Seriana all being fixed UKC for orders. Reliance barrels are particularly important for European winter/cold property requirements.

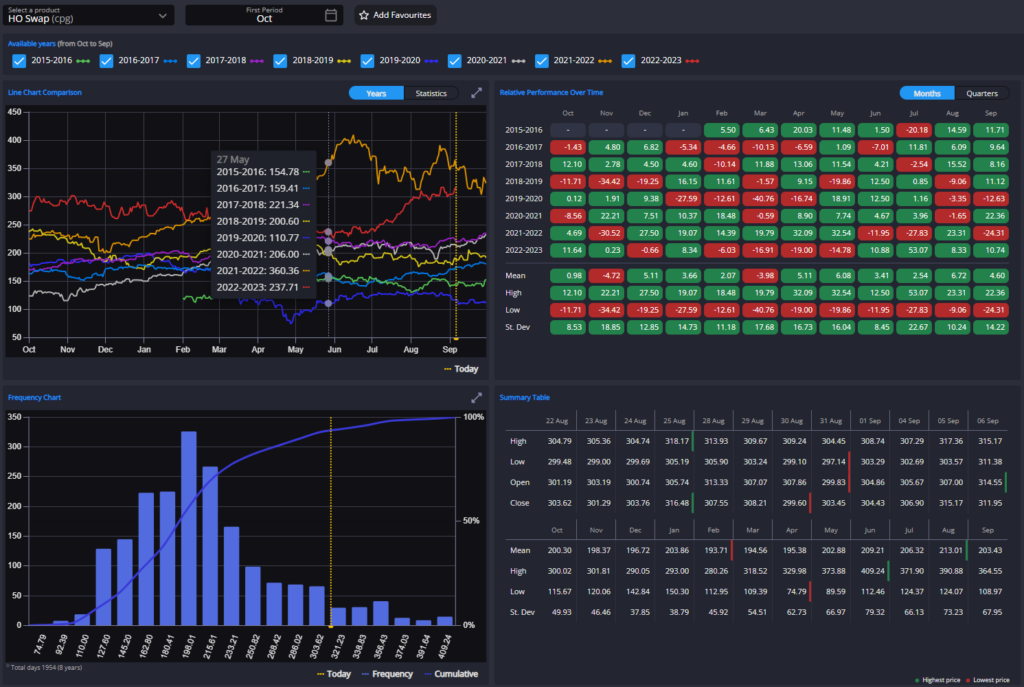

October’s HOGO narrowed from 23 to 20.8 cpg over the past week, but this, combined with HO strength and a narrowing US Gulf Coast (USGC) differential, hasn’t been enough to open the Transatlantic arb.

ARA stocks, indicative of European stocks, decreased to their lowest levels since December 2022, raising concerns as Europe approaches its first winter without Russian diesel.

Consequently, we will need to see either HOGOs or E/W spreads move to levels that allow for external resupply to Europe.

Given low US stock levels and the recent announcement of new Chinese export quotas, a reversal of the recent E/W narrowing is highly probable, followed by continued upward movement in ICE GO Q4 spreads and cracks, as partially seen already with October’s GO crack rebounding from +$31 to +$34.25 over the last week.

The USGC has reclaimed its position as the most cost-effective arbitrage route into Northern Brazil, benefitting from increasing premia in the WCI and the AG due to ongoing Indian refinery turnarounds and robust demand from Europe.

However, its own rising FOB premia, basis, and differentials, coupled with elevated USG MR freight rates amid ongoing Panama Canal disruptions, have hindered its competitiveness in the wider Latin American market.

AG and WCI barrels are preferred in ECSAM, while South Korean barrels dominate the West Coast. This week also witnessed the unusual fixtures of the STS at Gibraltar operations of the MRs Torm Atlantic and Sovereign to supply diesel to Brazil.

The Transpacific arbitrage to both the WCSAM and the United States has seen significant activity recently, driven by a shortage of diesel in the US West Coast (USWC), leading to USWC differentials increasing from +20 to +55 cpg over HO since the middle of August.

This has also been partially responsible for the narrowing of October’s Singapore regrade, from -$1.85 to -$1.15 since the beginning of August, as jet barrels have been increasingly blended into the diesel pool for Transpacific arbs.

The low stock levels situation is exacerbated by low stock levels in the US, particularly in PADDs 1 and 4, which is further compounded by the shutdown at the Garyville refinery. With an increasing number of both diesel and jet, reverse Transalantic flows, to the US Atlantic Coast and East Coast Latam.

Given the strong domestic demand for these barrels in the US, especially with the approach of winter, the USGC is not compelled to prioritise exports.

Consequently, the HOGO spread is expected to remain wide, with matching upward pressure on HO cracks in the medium term.

South Korean barrels have once again become the most cost-effective option for Singapore due to their decreasing FOB premia. This has been helped by WCI barrels grappling with rising FOB premia as they contend with their own refinery turnaround issues and increased demand from the Atlantic Basin.

In Singapore, middle distillate stocks have hit a five-year seasonal low, prompting a rally in diesel cracks, which jumped from +$25 to +$29.50 per barrel this week.

However, a potential surge in Chinese gasoil exports, predicted to be almost double that of August, combined with ongoing concerns about China’s economic performance, could create a different dynamic.

In light of these factors, it appears that the Asia-Pacific region currently has less demand for gasoil compared to Europe and the Atlantic Basin.

This situation is likely to widen the East-West (E/W) spread in the medium term, reversing the recent narrowing, with the corresponding shifts expected in Singapore spreads and cracks.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com