Increasing diesel supply, poor demand and the end of European turnarounds in April leads to a bearish view on both diesel and jet globally

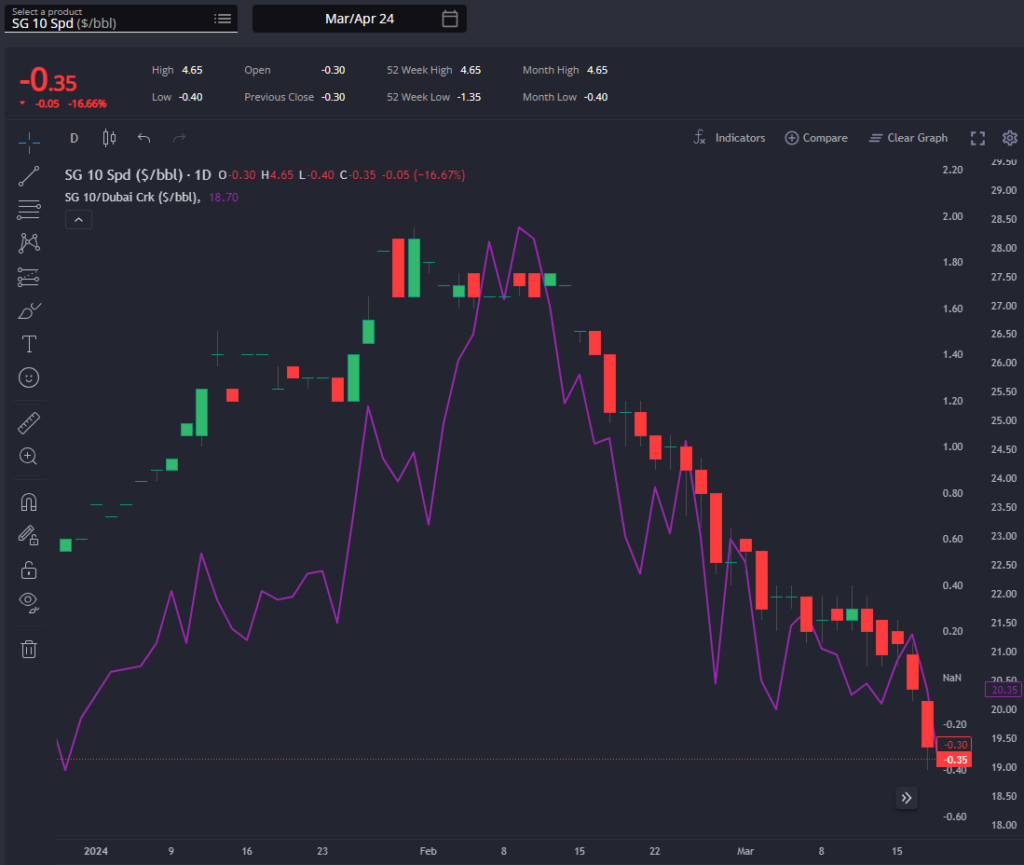

Singapore’s diesel market has remained on a downward trajectory since early February, a trend that persisted throughout this week.

This decline is reflected in both cracks, spreads, and diesel premiums, with spreads nearing contango levels which are, particularly evident in April’s standing at +0.10 /bbl presently.

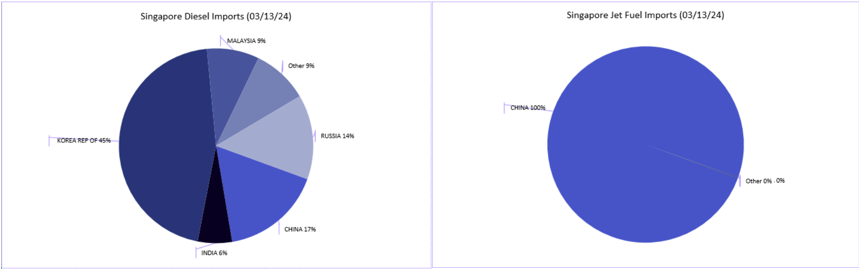

This is largely due to the surge in Singapore’s middle distillate stocks to a 2.5-year high, attributed to substantial imports from South Korea and China, although imports from India have reduced due to factors we will discuss more below.

This influx of diesel has exerted pressure, widening the GO E/W to historically wide levels, with March and April figures at -$52.00 /mt and -$42.75 /mt, respectively.

As observed from our forthcoming “By Origin Dashboard,” cargoes from the WCI and AG regions now distinctly target western destinations due to Singapore’s weakened position.

Our Senior Pricing Analyst Thomas Cho highlights the close to unprecedented South Korean gasoil tender volumes in April, nearly exceeding the record monthly amount of 4.8 million bbls, hinting at prolonged pressure on Singapore’s pricing until the Asian turnaround season gains momentum in late April.

Cho speculates on the possibility of buyers stockpiling for future, even VLCC shipments, to the West.

Consequently, Singapore’s regrade has seen improvement, although European jet pricing weakness persists despite closed arbs to Europe. However, with no alternative outlets, arrivals continue, sustaining the European jet pricing downturn.

Looking ahead, the opening of arbs for AG/WCI/South Korean jet to the US appears imminent in the coming weeks.

European diesel spreads experienced a notable decline this week, whilst diesel cracks stabilised after a period of strength attributed in part to ongoing Ukrainian drone attacks on Russian refineries.

Insights Global reports that ARA diesel stocks have surged to their highest level since August 2023.

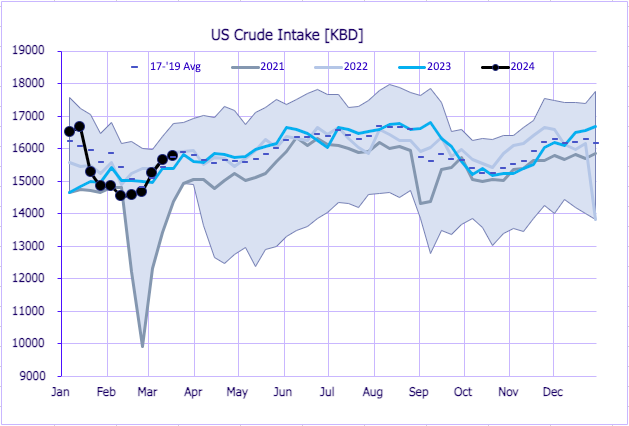

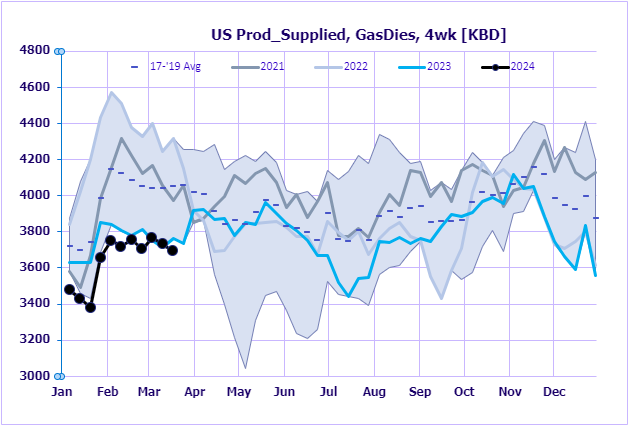

In the US, increasing crude runs contrast with persistently low diesel demand, currently at 5-year lows, prompting the US arb to remain open to Europe in the very prompt.

AG/WCI arbs also firmly indicate delivery to Europe due, in part, to the above discussed Singapore market conditions. Consequently, Europe anticipates a surge in marginal supply, setting a decisively bearish outlook, especially post the ongoing turnaround period concluding at the end of April.

This sentiment is mirrored in European and US paper positions, with combined positions in U.S. diesel and European gas oil declining to 55 million barrels (46th percentile) from 87 million barrels (72nd percentile) over the past five weeks, underscoring the prevailing market sentiment.

It will be important to monitor here the continuing effect of the Russian refinery drone strikes.

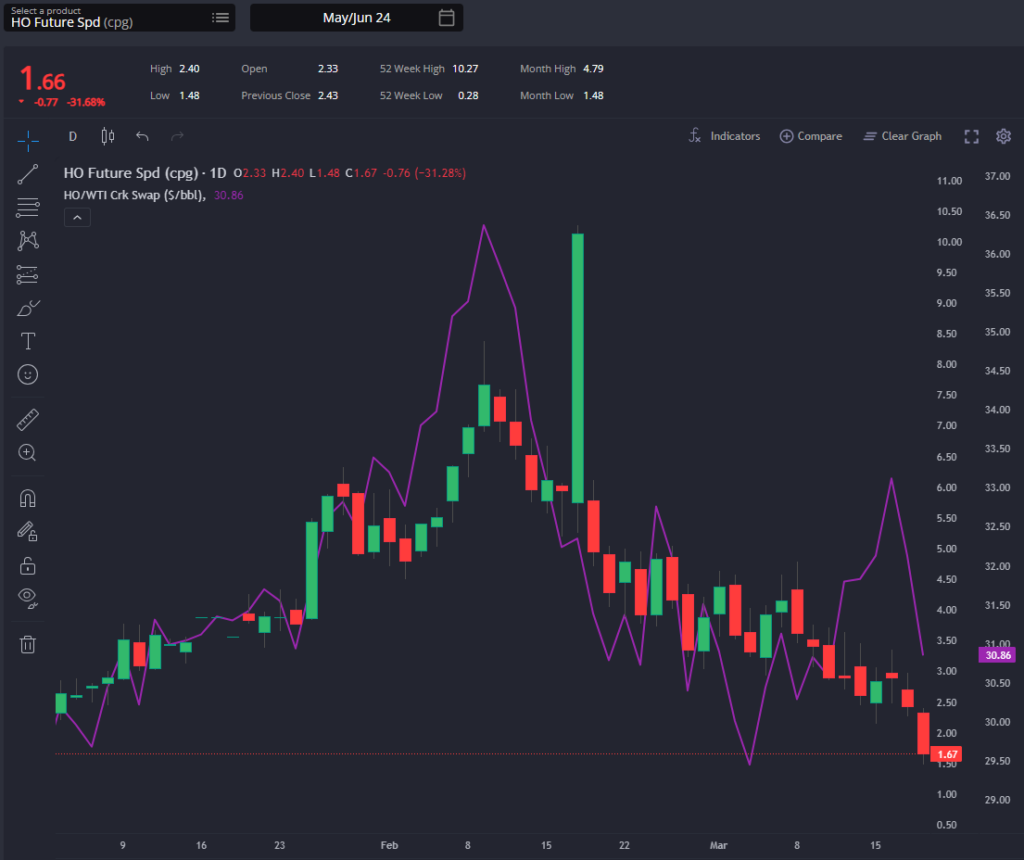

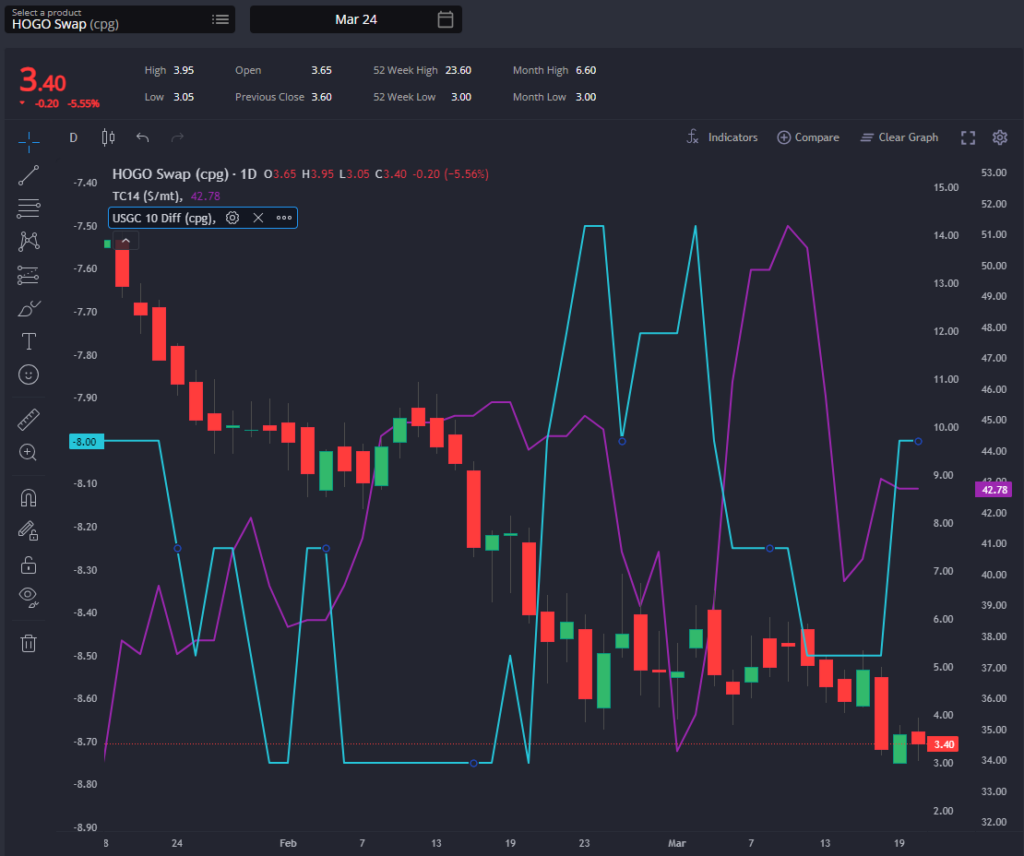

HO cracks and spreads mirrored ICE GO’s behaviour this week, with spreads narrowing while cracks stabilised.

Poor US diesel demand, coupled with increased US crude runs, contributed to the decline in USGC diesel differentials and HOGO over the week.

TC14 freight rates also saw reductions, although commodity owners Michael Ryan and David Thwaite anticipate a stabilisation soon.

Despite this, the arb remains open in the prompt to Europe, suggesting a significant diesel flow in the coming weeks.

The attacks on Russian refineries and reduced exports imply increased diesel flow from the USGC to Latin America, where the USGC currently stands as the primary source with some competition from AG/WCI due to reduced MOPAG pricing, coming from the recent surge in TC5 rates.

While this additional diesel supply from the USGC may provide some relief, the short-to-medium-term outlook for US diesel pricing remains decidedly bearish.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com