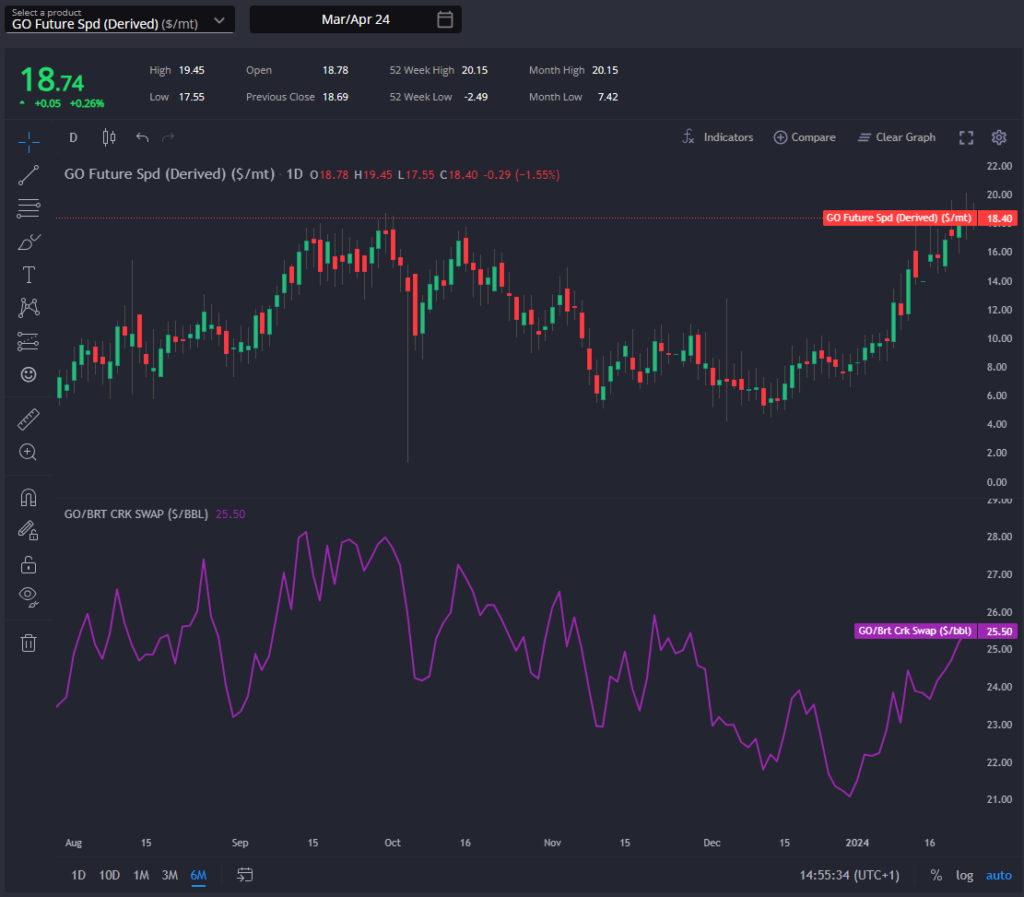

GO E/W and HOGO move to resupply Europe, no reason to believe that this will end in the short term

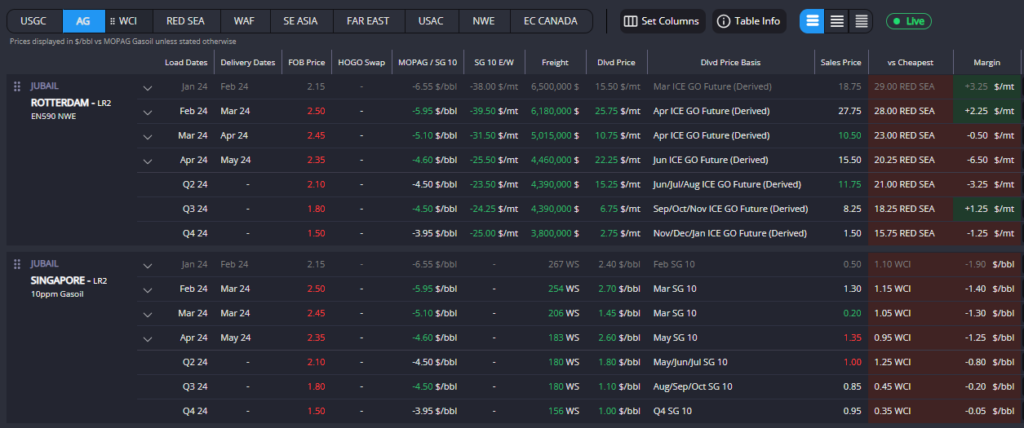

WCI and AG arbitrage routes maintain their dominance into Singapore, proving to be the most cost-effective choices amid a currently dynamic market.

Notably, both regions have witnessed a decline in their premia, a strategic move by sellers attempting to counterbalance surging shipping costs in the current landscape.

Whilst Singapore’s diesel premia continue their ascent, cracks and spreads, as discussed in last week’s analysis, have found a ceiling, experiencing a reduction over the past week.

This is expected to persist, especially as Chinese diesel exports surge and rumoured to again reach nearly 1 million mt in February. The resilience of South Korean diesel exports adds to this expectation.

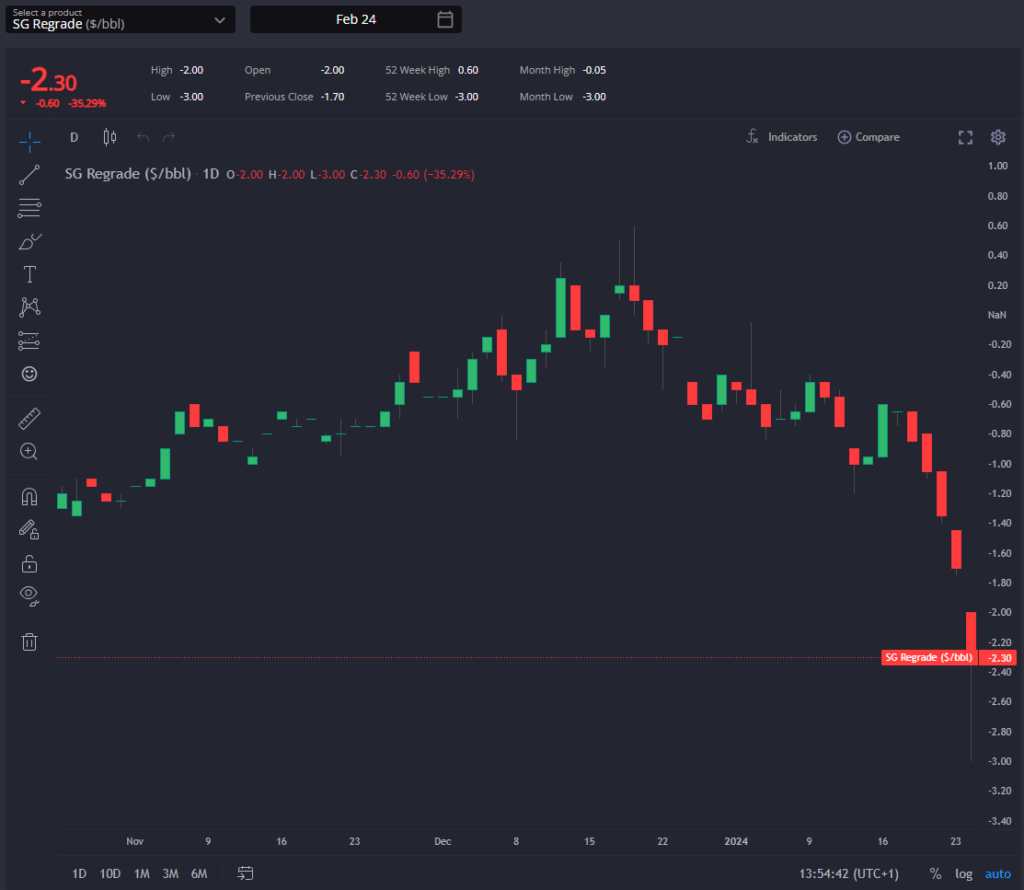

Singapore regrade has widened rapidly, from -$0.75 to -$2.30/bbl over the last week. This should intensify any yield switching away from jet to gasoil, exacerbating the strain on Singapore’s diesel cracks and spreads.

As the jet regrade widens, the economics of arbing jet fuel from Asia Pacific to Europe via the Cape route become more favourable.

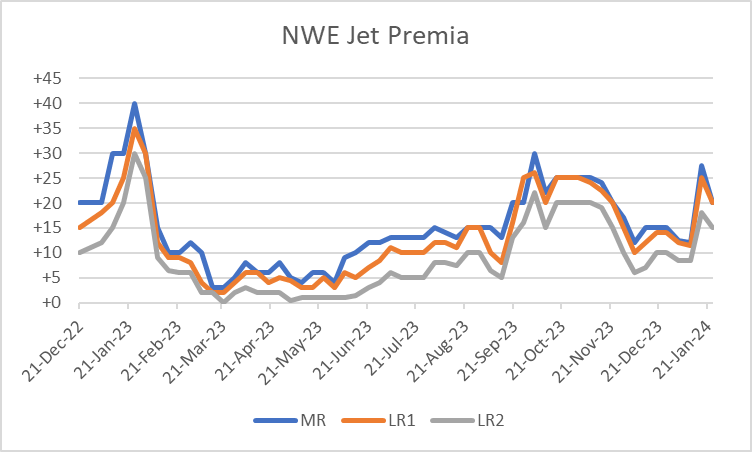

This should add to the decrease in European jet premia witnessed over the past week. However, the protracted journey time via the Cape remains a logistical challenge.

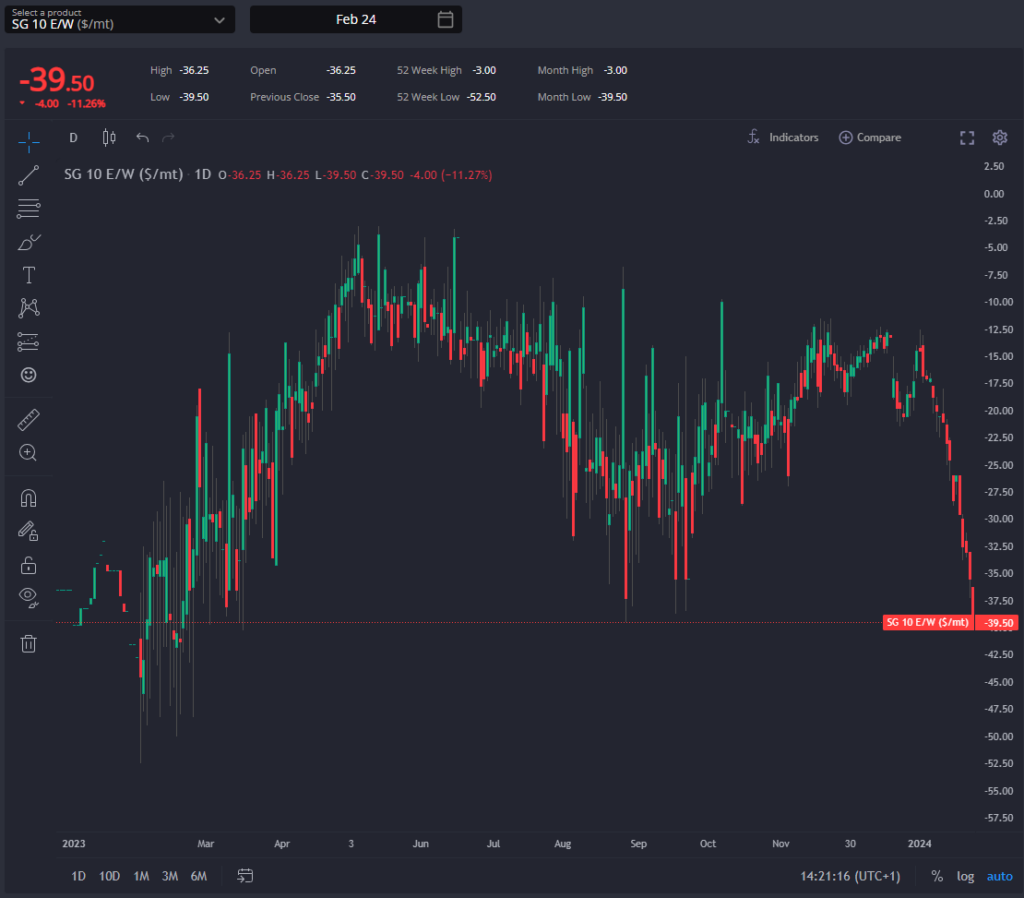

February’s GO E/W widened to its greatest level since February 2023 this week at –$39.5 /mt, predating the Russian diesel sanctions.

Even amid the escalating challenges posed by the ongoing geopolitical tensions in Yemen, Israel, and the Red Sea, along with the circumnavigation requirement around the Cape, AG/WCI diesel arbs firmly point westward.

The rapid ascent of TC5, a component of the MOPAG 10ppm values, has emerged as an important factor here also.

Mirroring the robust performance of European cracks and spreads, February’s HOGO swap continues its narrowing trajectory.

This trend should gain momentum as Europe seeks alternative sources, compensating for the absence of Asian-origin barrels traversing the Suez Canal.

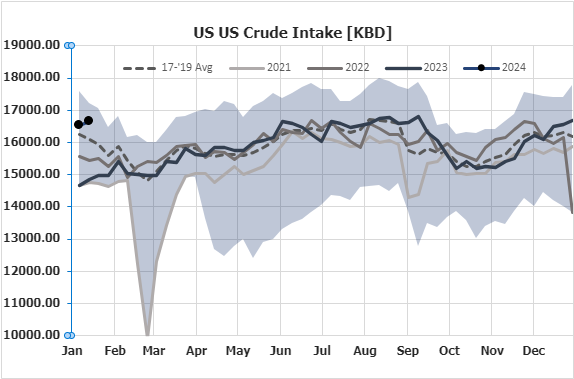

In the United States, sustained high crude runs maintain diesel production levels, even as domestic demand lags expectations.

The trend of a narrowing of HOGO is poised to persist, particularly as additional supplies become available post the recent thaw in the US Gulf.

European jet premia experienced a downturn in the past week, driven by elevated jet cracks prompting European refineries to pivot towards jet production.

This strategic shift provides added impetus to European diesel cracks and spreads, aligning with the imminent increase in European diesel demand that is characteristic of an approaching February each year.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com