Diesel market continues to come off its highs as strong European pull potentially unsustainable

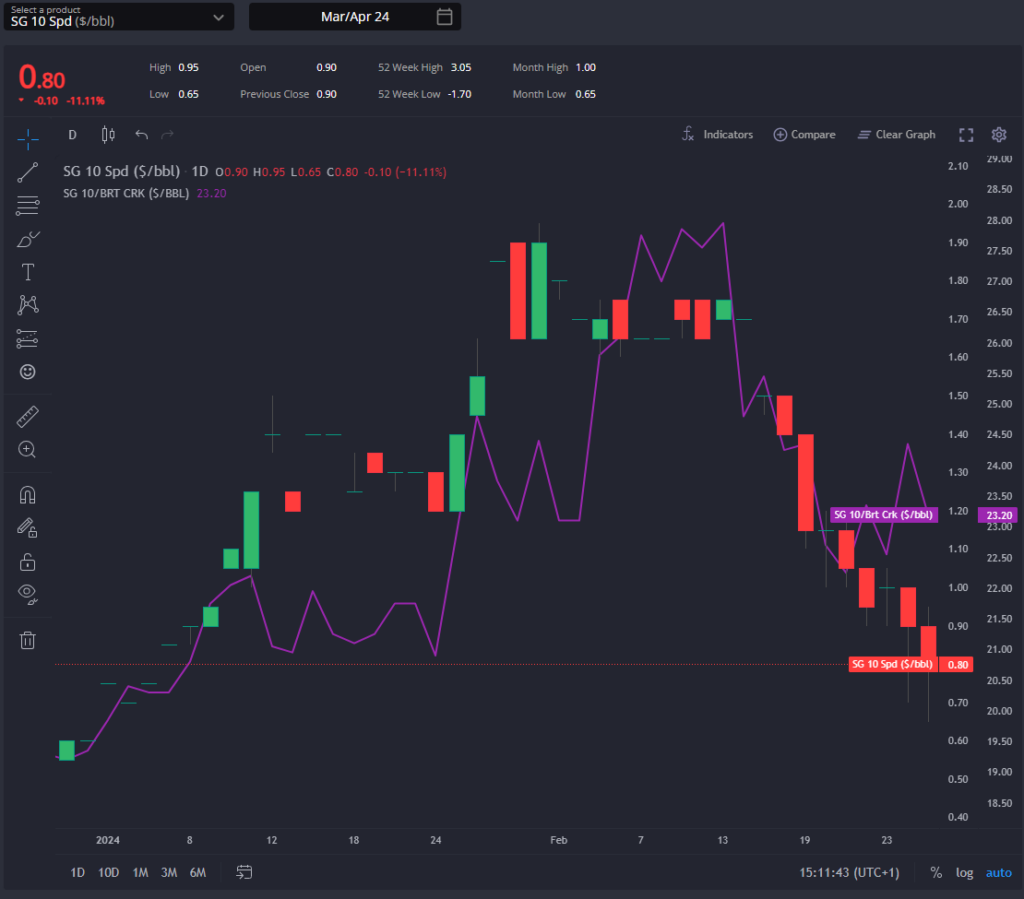

Singapore’s diesel spreads continued on a downward trajectory that has been steady now since early February.

However, there are signs of stabilisation in Singapore diesel cracks, with March’s figures showing a modest improvement from +$22.20 to +$23.20 /bbl presently.

Towards the end of March, Singapore should experience a reduction in diesel flows from the AG/WCI, as these shipments are increasingly directed toward Europe. This shift is underscored by the narrowing of the MOPAG/SG 10 spread, propelled largely by rising TC5 rates.

Despite these shifts, WCI (and AG) arbs continue to land better than those of South Korea into Singapore, primarily due to escalating LR freight costs from North Asia to Singapore, which have been steadily climbing since the year’s onset.

Considering these dynamics, alongside sustained high levels of Chinese distillate exports, we should expect to see spreads follow cracks in finding a floor in the coming weeks in the Singapore diesel market.

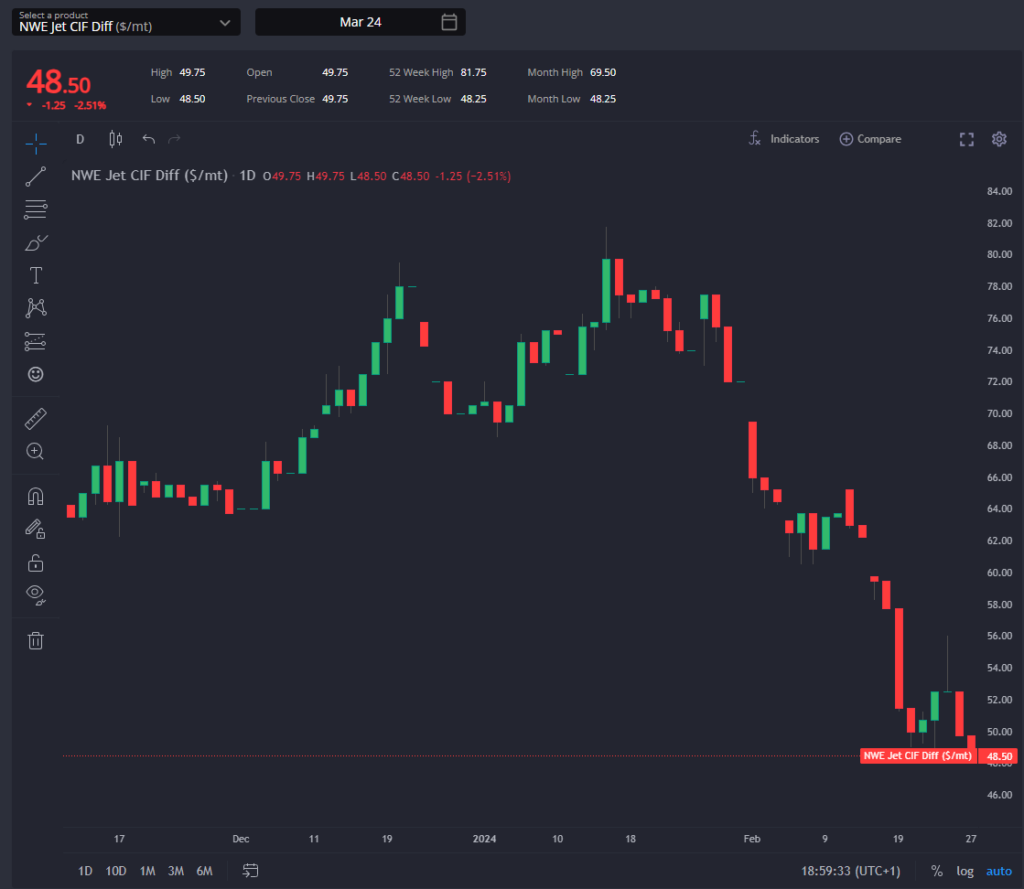

The trajectory of European cracks and spreads have followed those of Asia over the last week, with cracks showing signs of stabilising while spreads narrowed further.

Our arbitrage calculations reveal that almost all major diesel arbitrage routes into Europe—namely from the the AG, WCI, and USAC—are currently open, with only the USGC remaining just on the cusp of open.

Given the open arbitrage routes and an anticipated increase in marginal supply, it becomes challenging to maintain anything but a neutral to bearish outlook on European cracks and spreads in the short to medium term with no significant maintenance/outages or seasonal demand uptick on the horizon to help tighten the European balance internally

In the US, despite a slight uptick recently, US crude runs remain low. Looking ahead, however, there is talk of delay of some US turnarounds due to high cracks currently (e.g. Exxon Baytown CDU 3), which should help to see runs rebound strongly through March and into April.

With a still narrowing HOGO emphasizing Europe’s diesel resupply need, and USGC diesel arbs seeing increased demand from Latin America amid low Russian crude runs, there appears to be an outlet for PADD-3 diesel supplies even if and when crude intake ramps up and available volumes for export grow.

As such, coupled with the more bearish outlook on Europe ahead, we would expect the HOGO to widen towards the end of the quarter and into the next (above-and-beyond any rebound in RVO pricing).

Additionally, the closure of almost all Asian origin jet arbitrage routes to Europe has contributed to a widening Singapore regrade.

This has since been exacerbated by falling Korean jet diffs, pointing to continued kerosene oversupply as winter winds down in Northeast Asia.

In Europe, whilst the prompt jet market remains oversupplied, a hint of strength is returning to the market when looking towards the end of the month and into Q2, with premiums discussed for the end of the month finally taking a turn higher today.

Insight from broker contacts suggests a shift towards a more bullish sentiment in the European jet market post-March 2024, attributed to reduced jet production resulting from maximum diesel runs and modest improvements in demand.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com