Widening gas-nap spreads opening up blend opportunities in Houston

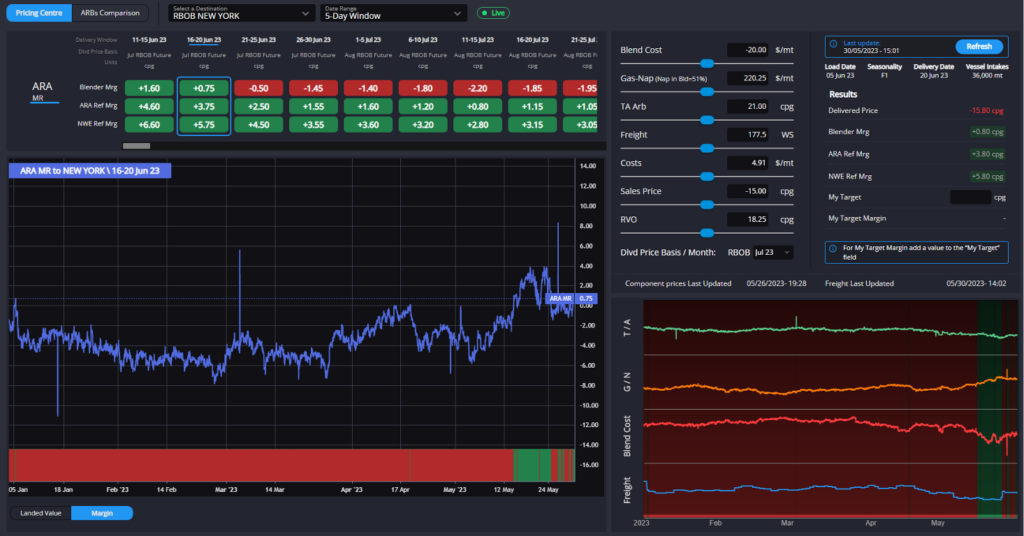

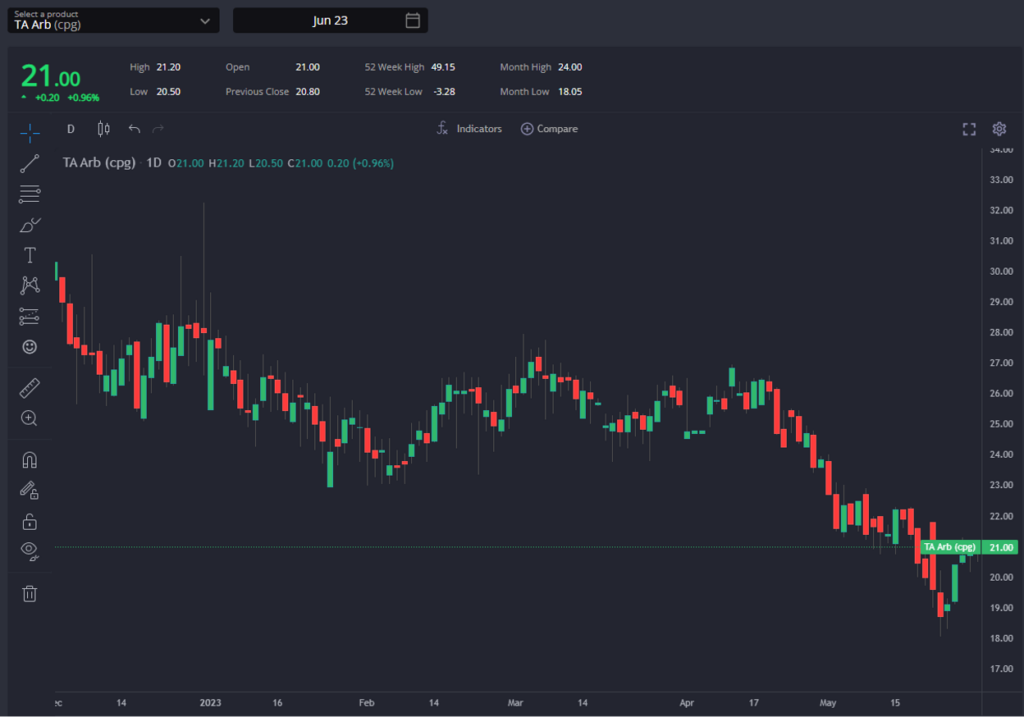

TA arb has shut for blenders from mid-June onwards, despite continued low inventories in PADD-1. The prompt arb window has now been open for some time (on and off since mid-April and consistently since 11 May), and this has almost certainly been enough to generate significant transatlantic flows from both refiners and blender activity in ARA.

The June TA arb spread is somewhat bottoming out now however, and we wouldn’t be surprised to see some blender opportunities to make the arb work also in the final windows of June if the current gas-nap spread widens further in the next few days.

The June gas-nap spread is currently around the $220/mt mark, still around $15/mt short of where the May spread looks set to close.

For context, if the June gas-nap widens out to current May levels, the blender margin for the currently-closed 10th June loading window opens to +1.65cpg – highlighting how close we are to an open TA arb also well into June.

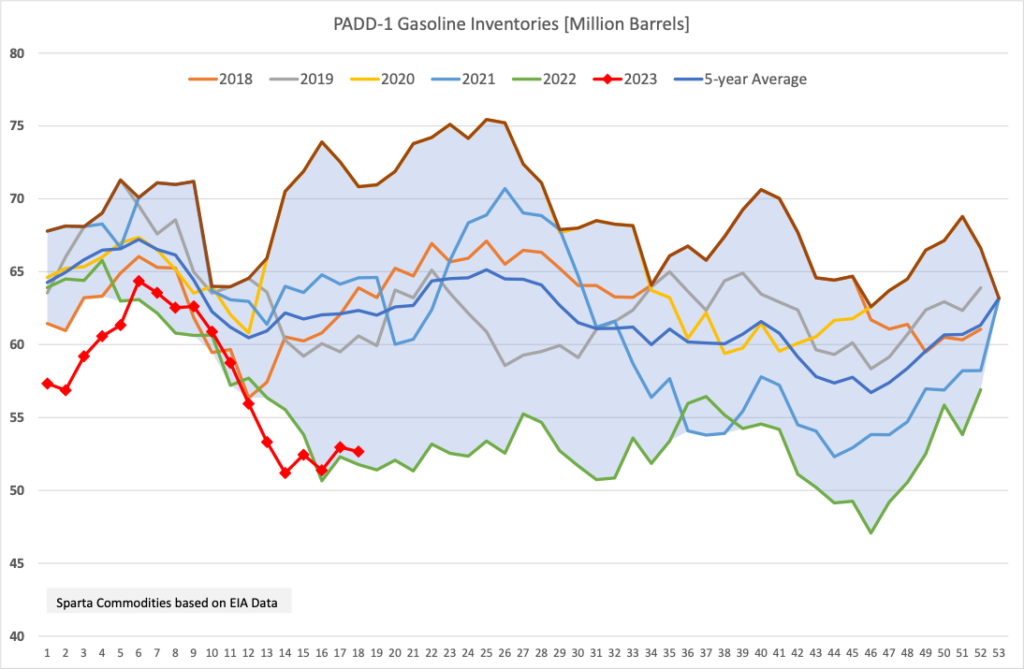

US, and PADD-1 specifically, fundamentals continue to appear supportive of keeping this TA arb open also for blender barrels for the time being.

US demand figures aren’t quite hitting the highs of past years in the latest weekly data, but PADD-1 inventories remain essentially in line with last year’s historically low levels with the US domestic system apparently struggling to stabilise the inventory situation without consistent waterborne arrivals.

M-grade blender margin is almost open. Driven by a widening gas-nap in the US, with finished gasoline proving strong on its fundamentals currently.

This is also pushing alkylate premiums higher, which is in turn pushing the alkylate share of the cheap M-grade blend down to just 5.5% in May.

In June, which is clearly the more relevant month now, we are still looking at a ~19% alkylate blend, but this is likely to change in the coming days as the prompt gas-nap spread rolls into June and the strength in finished gasoline barrels vs a soft naphtha market pulls more straight-run naphtha and reformate into the mix.

Whilst physical naphtha premiums have begun to strengthen, the widening swaps curves are proving more than enough to make naphtha look extremely attractive to the gasoline complex currently.

The fall-off in naphtha pricing in the Americas vs finished grades has opened up Houston arb opportunities into all of its typical Latin American homes – especially the lower octane destinations of Peru, Guatemala, etc.

Combined with almost-open M-grade blend arbs in Houston we are looking at an uptick in naphtha demand on the cards as a straight-run blendstock for gasoline as well as an uptick in the volumetric call on finished gasoline barrels out of Houston.

This should in-turn see gas-nap spreads in the US stabilising. The June MB2/RBOB spread has just reached the -240cpg mark, it’s lowest level since mid-April, but further downside is likely to be limited by increased straight-run blending in the coming days and weeks.

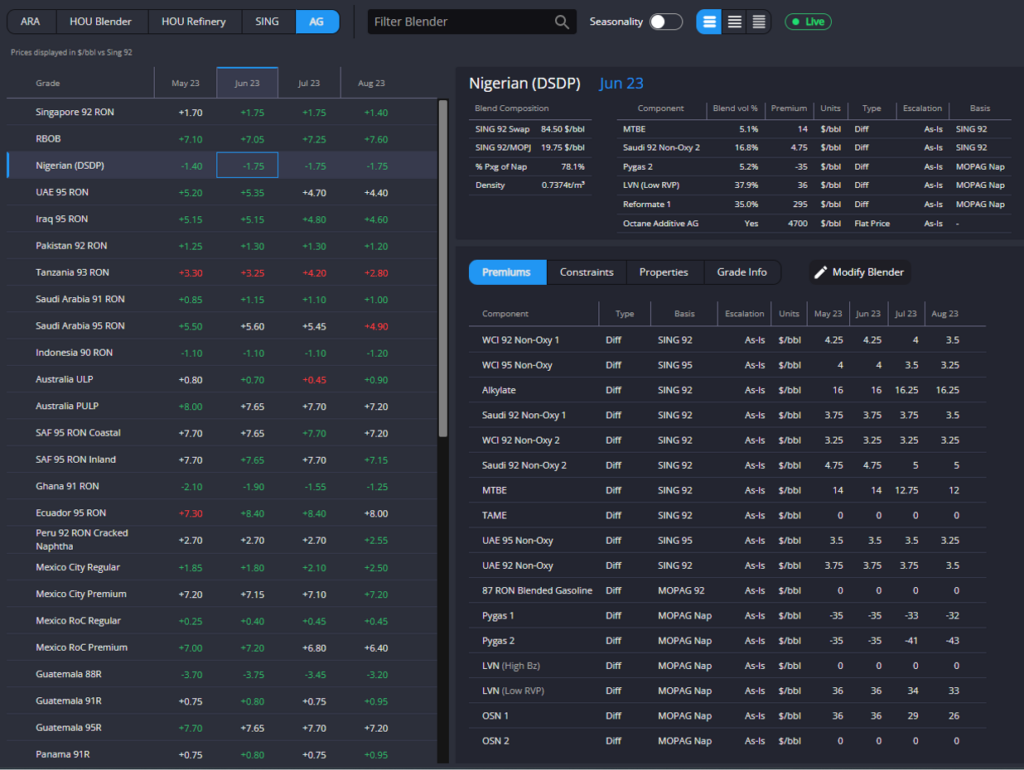

Finally, the AG has firmly reclaimed its title of cheapest source of supply into all EoS destinations as well as staking strong claims for placing barrels into both WAF and Brazil at current levels.

This has been driven largely by the increasing tightness of the Atlantic Basin market, with both ARA and Houston blend hubs continuing to see component premiums strengthening.

Component premiums in the AG are also largely at their highest levels this year, but so far the run higher has been slower, and nothing in the relative pricing (June E/W currently at almost $12/bbl, Sing 92 cracks around 5-year average levels) is yet to suggest fundamentals in the EoS will need to keep these barrels from moving west in the near future.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com