West continues to be under pressure but East firming up

Over the last week, GC component prices continued to fall with Reformate going from +33cpg on Monday 05/12 to +28cpg on Friday 09/12. Blending margins remain positive for both A and M grades in December and actually widening since last week. GC traders can now collect 1 USD/gallon on M grade and up to 2.5 USD/gallon on A grade in December. These blending margins are good indicator of continued supply pressure in the US.

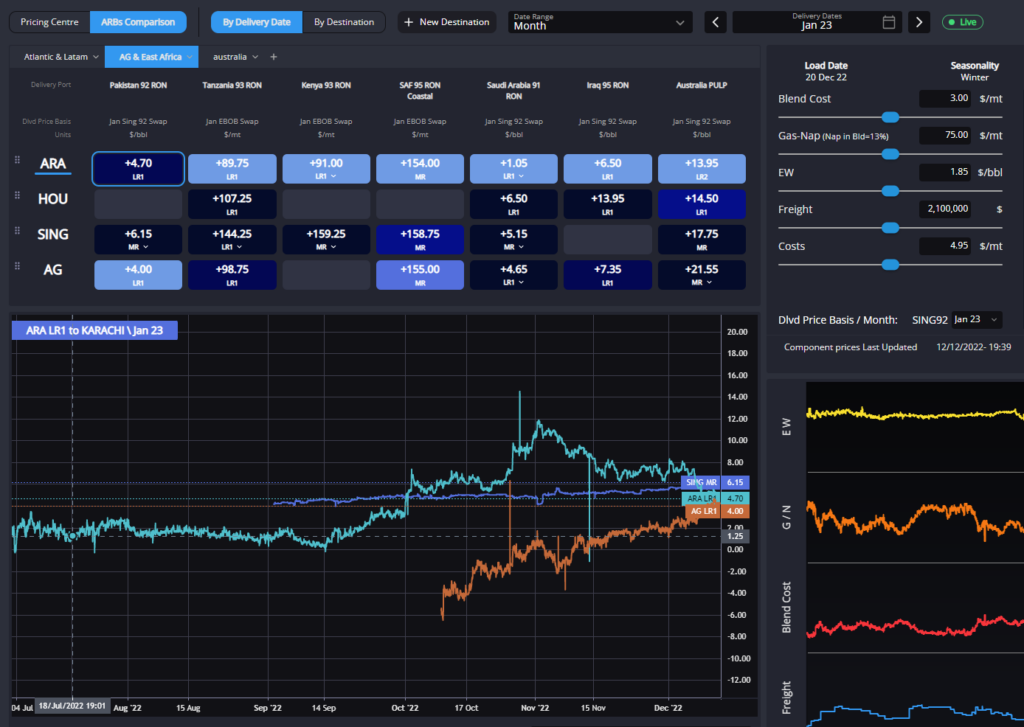

In terms of Arbs, Houston remains the cheapest source of supply in the Atlantic basin and has its bread and butter shorts covered. In terms of more exoctic arbs, although they will probably not materialise, it is pricing itself competitively into WAF and Australia. These arbs will probably never happen, but they are a good indicator of how weak the market is in the US relative to other regions.

In ARA, On Wednesday 07/12 traders decided it was time to move into contango and window was well offered. E5 window went from +25 usd/t over Jan on Monday 05/12 to -2 usd/t on Friday 09/12. With all arbs shut and tanks filling up, the market felt the need to move into contango, in line with the US price action.

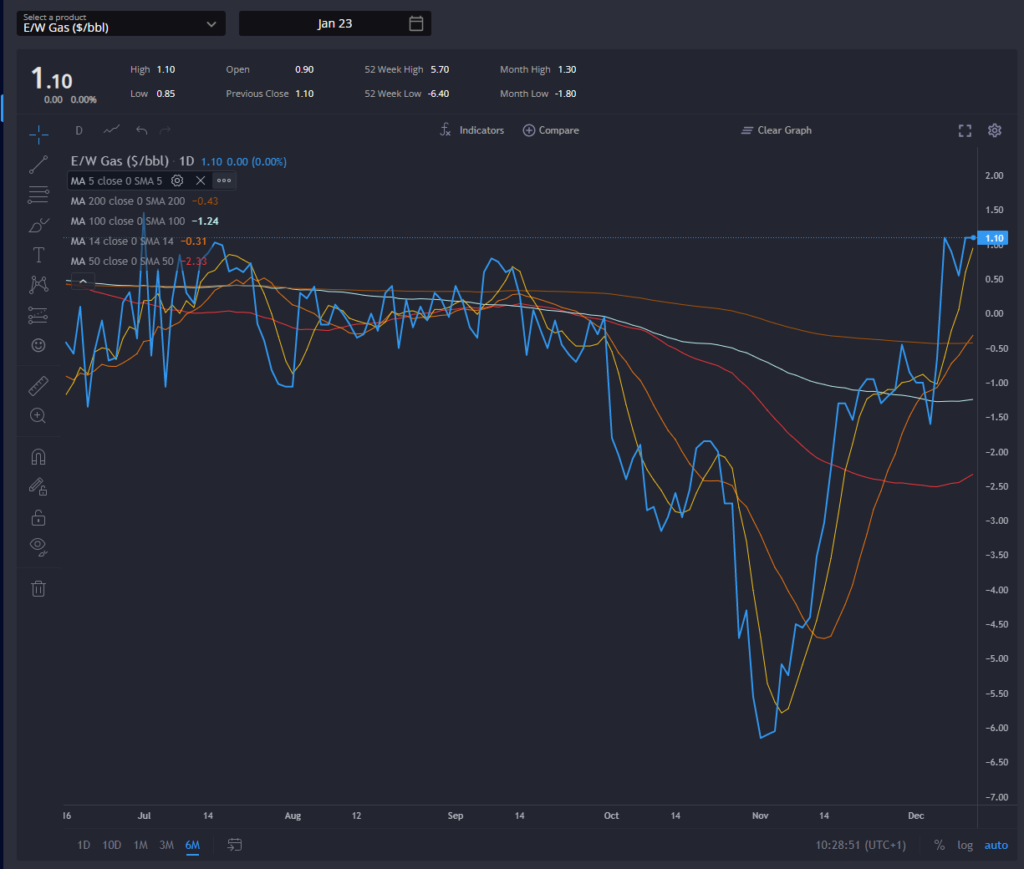

On the back of a higher EW (up 3 usd/bbl in the week), ARA is now the cheapest source of supply into AG and East Africa. This could create a rebound in the market as some of these destinations maximise the use of E5 and E10 in the blends. Indeed, despite weaker structure, component prices in ARA remained stable (Particularly high Octane components).

Coupled with a drop in Gas/Nap, blending margins for finished grades are now even worse than they were last week. This makes E5 and E10 the components of choice when considering potential arb blends. If Arbs to AG were to materialise on the back of a stronger EW or a deeper contango, this could generate demand for finished grade in the window.

If AG demand does not materialise the next support level is carry trade. Buying reformate now and storing for summer 23. So we looked at the econs and, with the current 51 usd/t Jan/April contango, a Jan-23 Heavy Reformate Argus +110 usd/t would be valued in April-23 at Argus +79 usd/t (including 20 usd/t of storage and working capital costs).

At that level, and with the current Q2 Gas/Nap and Q2 Arbs, the RBOB Arb would be marginally open for refiners but shut for blenders. All other things being equal, April reformate would need to trade at Argus +50 to make the arbs fully open.

So there still seems to be room for component cash diffs to come off in Europe. Particularly if Gas Nap keeps falling.

In Singapore the prompt market is still pricing the previously booked cargoes out of the region into WAF and Latam. Forward structure is already in line with Europe and US although firming up as we write this commentary. While Europe might end up cargoes to AG in Q1, arbs to Singapore on an LR2 are still shut by 2 to 4 usd/bbl.

But if European structure continues falling and EW rising this arb could open at some point. Until then, Singapore structure will be entirely reliant on Chinese refinery runs and export quotas. Given the new Covid policies in China and the bullish momentum that followed, Asia will remain the strongest performer over the coming weeks.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com