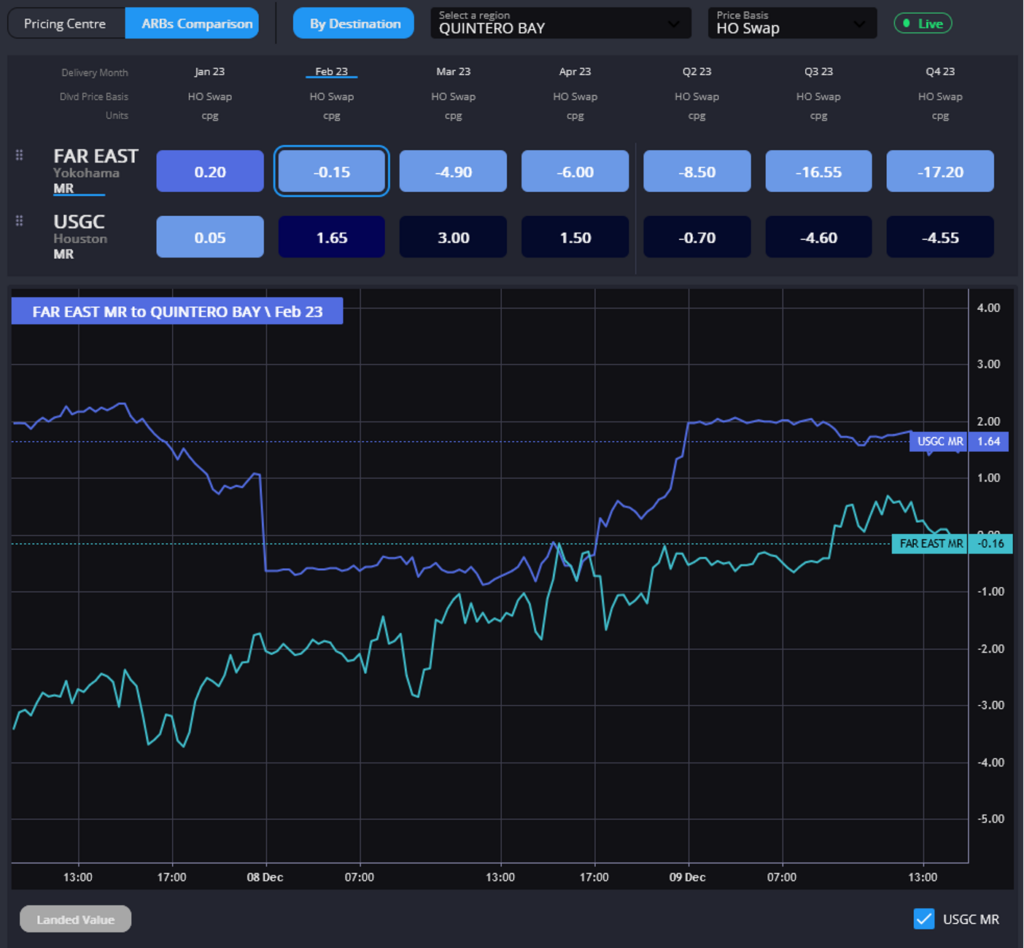

USGC Arbs barely workable transatlantic but applying pressure on EoS pricing

The USGC has emerged as the most competitive supplier of ULSD into NWE in recent days, as sliding cash diffs have closed arb opportunities into Rotterdam from almost all origins.

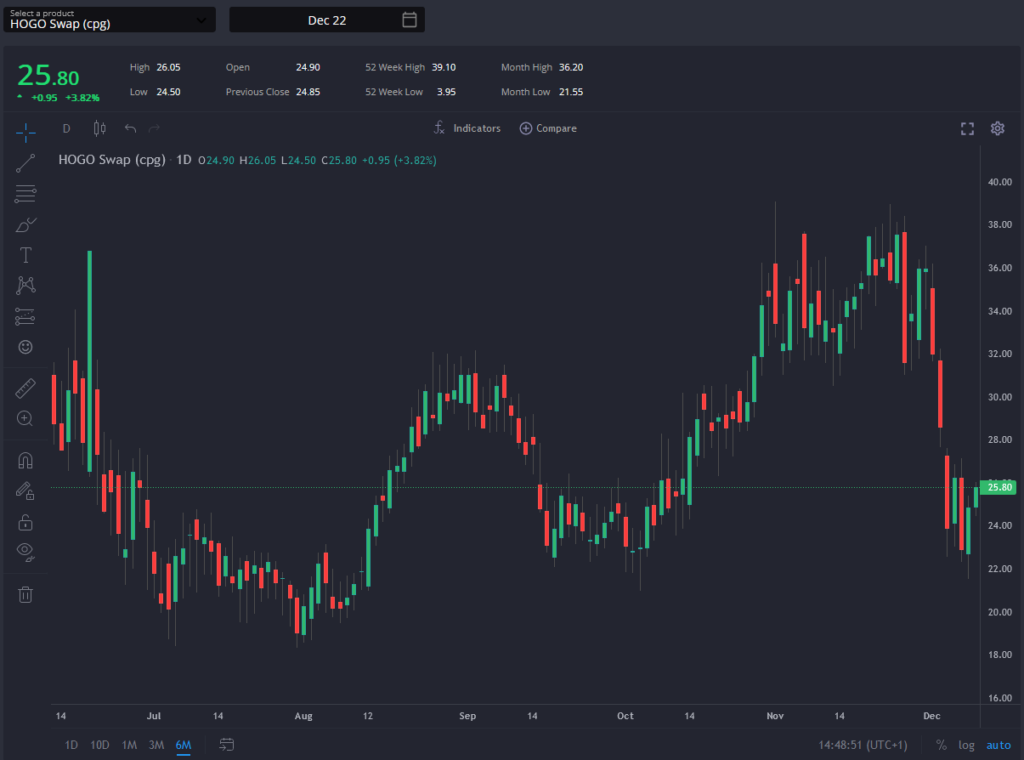

From the US side, a narrowing HOGO spread and widening USGC 10 diff discount vs the HO Swap have served to keep USGC barrels attractive, and an easing of the pull from USGC barrels through the Colonial pipeline has also pressured waterborne cash diffs into more workable territory.

With the Dec HOGO swap now back at mid-October levels following its recent sharp decline, the necessary correction in US pricing to relieve supply-side pressure on the USGC is in place, and further downsides are unlikely in the absence of any additional fundamental pressures ahead.

Elsewhere, we may begin to see opportunities opening back up to move cargoes into WAF for redistribution, with barrels out of Singapore currently looking the most attractive option by some margin with strong economics on chartering a larger vessel to then lighter off the Lome coast.

WAF cash diffs finally followed the rest of the Atlantic Basin in easing this week, having proven sticky in the last few weeks, and we would expect to see more volumes heading into WAF in the absence of a strong pull into NWE at the moment.

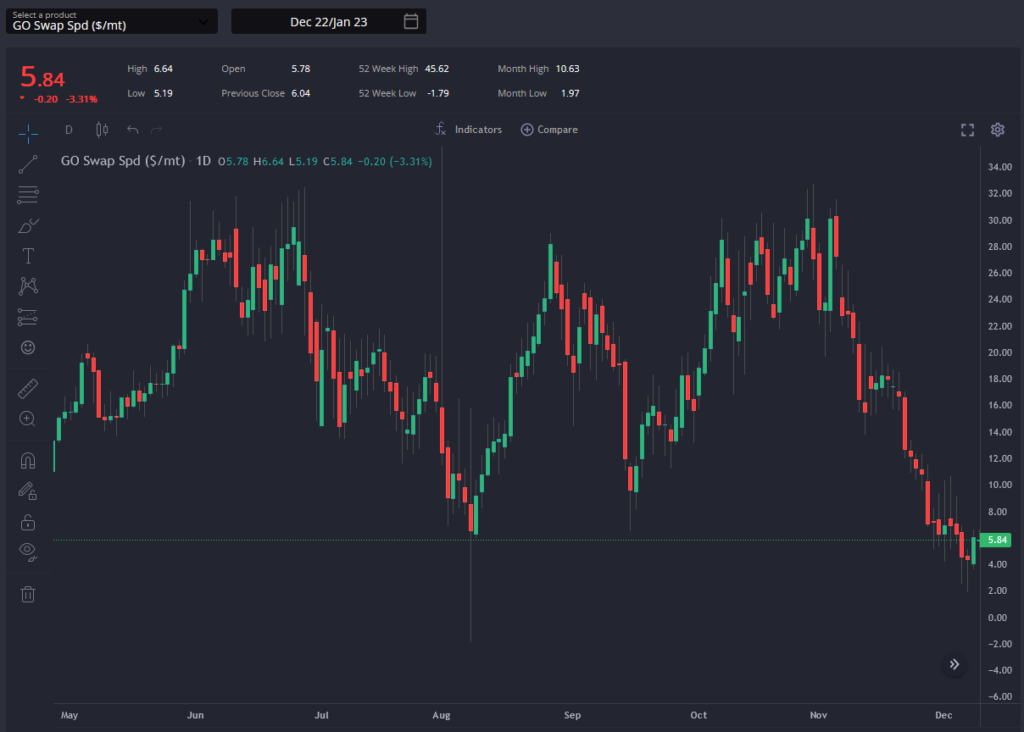

In Asia, timespreads have also been easing amidst mounting pressure from Chinese export barrels. Despite the softening of the USGC market, the Far East is set to retake its place as the most attractive source of barrels into the west coast of Latin America, with barrels out of Northeast Asia finding it difficult to place into Singapore in the current market.

Easing fundamentals globally as refinery maintenance winds up and mogas-diesel spreads move further in diesel’s favour are also likely to weigh further on diesel timespreads and cash diffs, which have been coming in sharply in the last week or two.

Overall, it would appear that the robust end-user demand which has sustained clean products markets through much of this year has begun to ease, with refining margins faltering and no indication currently that either Europe or the USAC are having to bid higher to secure import barrels. It seems that, for now at least, diesel markets are taking a calmer run towards the end of the year with attention turning to the weakening macroeconomic picture.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com