TA arb dynamics pointing to potential blend opportunities in ARA

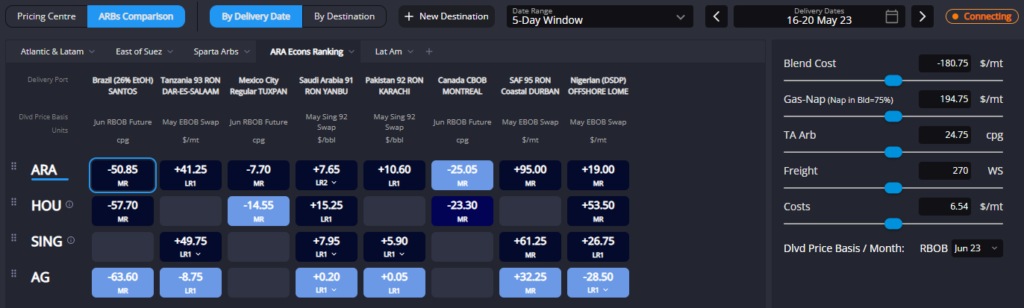

The main story this week is the continued feasibility of the TA arb. A sharply widening G/N spread and a softening of the Atlantic Basin MR freight market have opened up this route over the past week or so without the T/A spread having moved significantly (as can be seen in the bottom-right of the chart).

The fact that it has managed to remain open now for close to two weeks – and that it applies to every window between now and 2H-June – is pointing to a level of fundamental support for the TA mogas arb that we haven’t seen since last year.

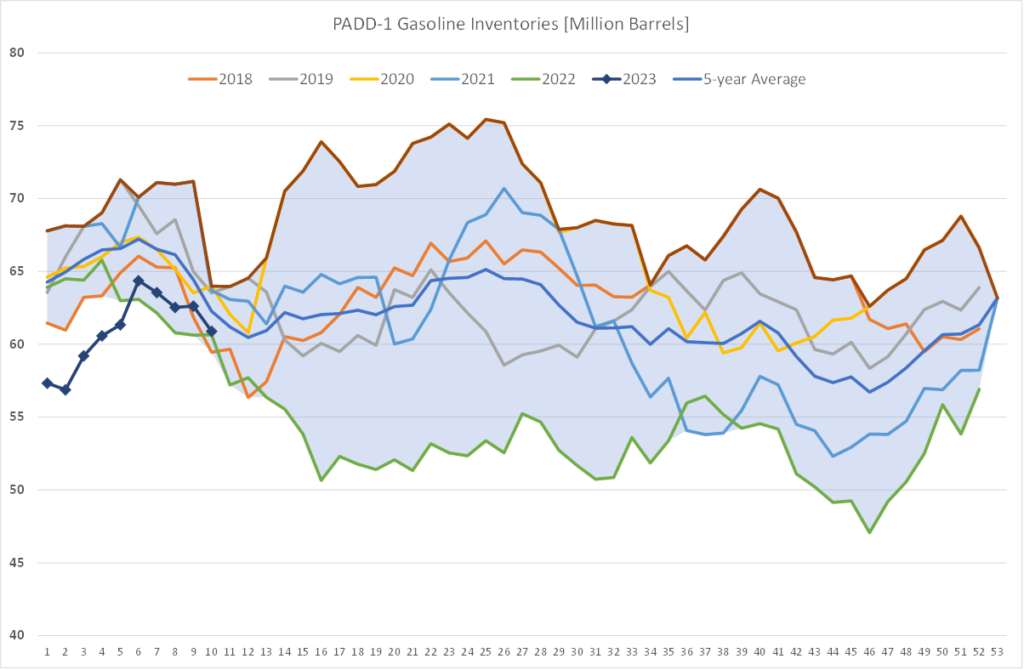

Indeed, a glimpse at the fundamental situation on each side of the Atlantic confirms that this arb is justified. PADD-1 inventories have been making their seasonal draws since early-Feb and are now trending towards the bottom end of the 5-year range.

Whilst an open TA arb isn’t unexpected from mid-Q2 onwards, and is being supported currently by a healthy stock environment in ARA, for now it seems as though the strength that is being lent to the European mogas complex remains justified despite the aforementioned European inventories.

Although the AG’s inherent price advantage continues to see barrels out of the AG pricing more competitively into most major destinations, barrels out of ARA remain importantly more attractive than those out of Houston for all Atlantic Basin destinations outside of Mexico, and competitive vs barrels out of Singapore even as far afield as Tanzania.

Given likely available volumes out of the AG, this should allow for European barrels to continue finding homes in Nigeria, Canada, and Brazil for the time being.

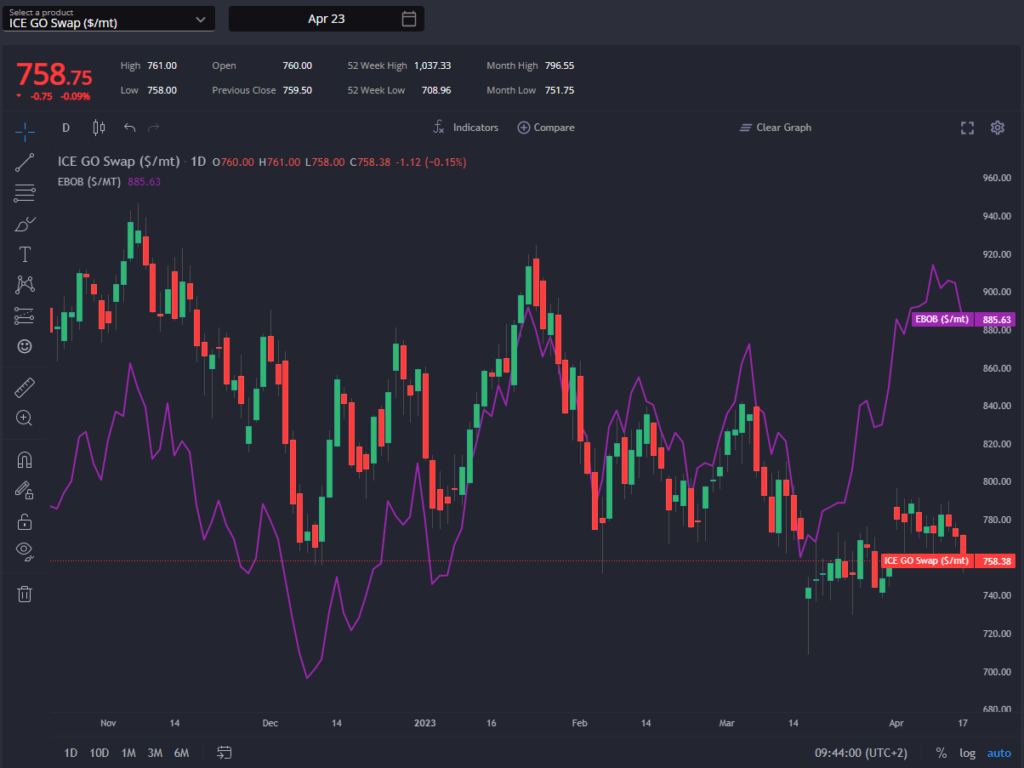

This goes to justify to some extent the current strong $/tonne premium over diesel for refiners not only in Europe, as the demand outlook for gasoline appears distinctly rosier than that for distillates for now.

The size of the shift does raise some alarm-bells, however. With the yield incentive for refiners changing dramatically in both the WoS and the EoS, some attention should be diverted to the likely supply impact coming out of China and Asia more broadly.

As previously mentioned, barrels out of ARA are currently pricing competitively vs barrels out of Singapore into destinations as far afield as East Africa.

This comes despite the collapse in the mogas E/W spread over the last couple of weeks, with the Singapore side of the balance weakening strongly alongside a sharp reduction in backwardation there.

Although this has opened up some opportunities into the west coast of North America, ARA remains the more attractive source of supply further down the Pacific coast in Ecuador, and the outlets currently available appear incapable of relieving the supply-side pressure currently being exerted on the Singapore market.

Although this pressure has begun to make itself felt on the Singapore gasoline crack, the market remains firmly above 5-year average levels here.

This is a level which we would not be surprised to see challenged in the coming weeks, however, with AG and European barrels pressuring Singapore’s traditional outlets and incessant supply-side pressure coming from both Chinese export barrels and the yield-shifting incentive towards gasoline at current levels.

Something is likely to have to give on the supply-side globally, and Singapore cracks appear the most likely culprits at the moment.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com