Summer gasoline bullish momentum doesn’t want to pause

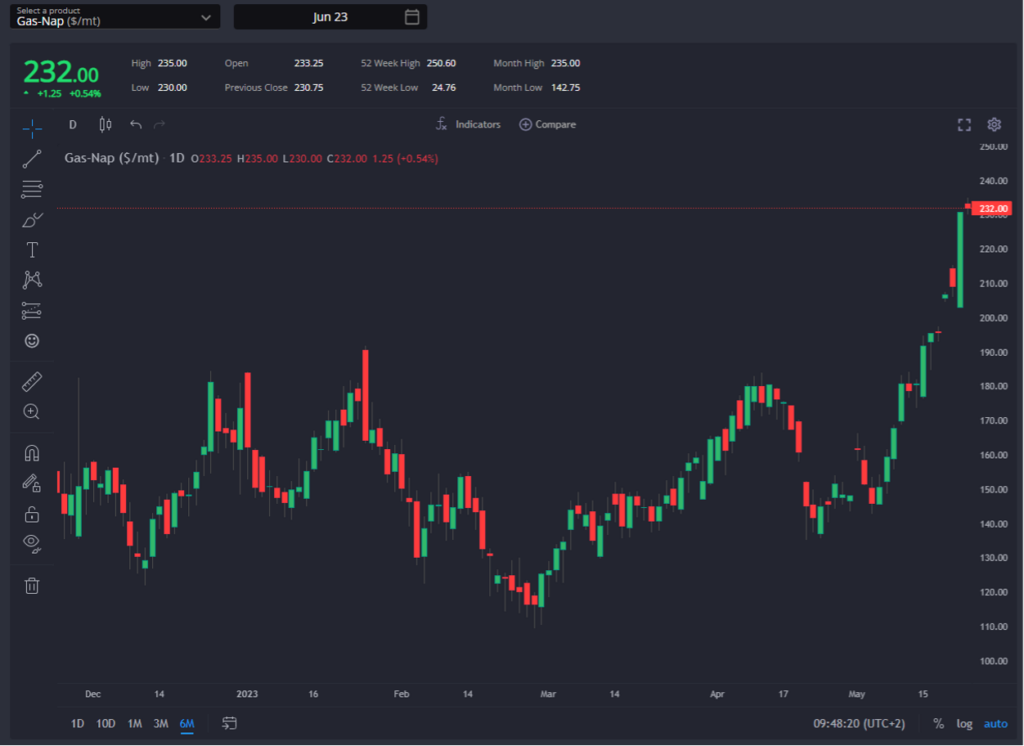

The market has been on an almost relentless bull trend since the beginning of the year with only a weak moment 2H April.

Despite the initial lack of arb demand, particularly from NY, component prices were too expensive to produce any kind of competitive blending margins.

Despite ample supplies in Q1, with negative blend margins, buyers preferred to buy finished grades, driving spreads higher.

As we entered the summer period, US stocks kept continuously drawing as is standard at this time of the year. The main difference this year is that US buyers have had almost no term deals on the books for Q2 and Q3 from Europe. They are currently very exposed to GC supply.

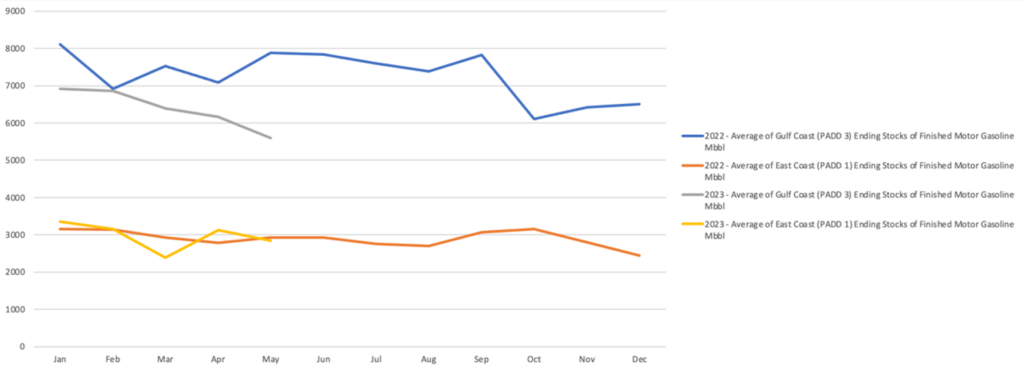

As you can see in the chart below, PADD 3 stocks are already at much lower levels than last year. We have only just recently started seeing some Arb buying from ARA. Are we seeing the first signs of a demand driven bull run?

Indeed, the price action over the last 3-4 days is very telling: gasoline strength drove Gas-Nap to high enough levels to generate positive blend margins for both E5 and RBOB grades.

At the end of last week, we started seeing the signs of an exhausted bull market asking for a breather. Blenders were able to offer E5 in the window at a margin, putting what looked like a cap on the spread run.

On Monday component cash diffs rallied to catch up with a higher gas naphtha and those blend margins were gone and arbs to NY for blenders closed as well. Again, a sign of a potentially exhausted market.

But as mentioned before US gasoline stocks keep drawing, particularly in PADD 3 and buyers are realising how exposed they are to spot market opportunities.

Arbs opened up again after only 1 day, and market rallied again with June/July spreads now trading at $33/MT (up from $20/MT just one week ago).

This could create a constant pull and a rolling backwardation until supply catches up. On top of that, its is worth noting that naphtha components now represent 53% of an RBOB blend in ARA. Arbs open or closed will be dramatically impacted by the Gas/Nap price action.

On the Naphtha front, the OSN and Petchem market has been very weak since the beginning of April, last week MOPJ flipped into contango.

On the other hand, the picture for heavy naphtha is totally different with huge premiums (+80 for pure HVN in Asia and +90 in Europe). This difference in cash diffs (OSN close to 0 or negative and HVN at +90) is close to the highest quality spreads ever recorded.

In term of arbs, West to East arb is totally closed with negative E/W so no real opportunities to spot deals from Europe to Asia, just some Skikda A-grade last month. US is sending sour-light cargoes to Europe, adding to the bearish pressure on the CIF NWE quote.

As the market maintains its “buy the dip” mode, one must keep an eye on the supply side economics.

Since early April, refiners have been incentivised to run at max gasoline yields after a very long period of max diesel output.

Its too early to feel the pressure on the supply side, but its worth keeping an eye on gasoline production, especially in Q3 as we will start feeling the yield switch across the Atlantic and Med basin.

Keep an eye out for any unexpected additional Euro grade offered by the Med or NWE refiner.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com