Softening blendstock premiums keeping Houston exports attractive, compensating for softer US demand

May has kicked off with something of a stabilisation in EBOB cracks and spreads, which remain at historically strong levels even if they have come off in recent weeks.

The spread vs diesel remains just above the $100/mt mark in May, but narrows out to closer to $60/mt through June and July, likely enough to keep yield switching in check for now.

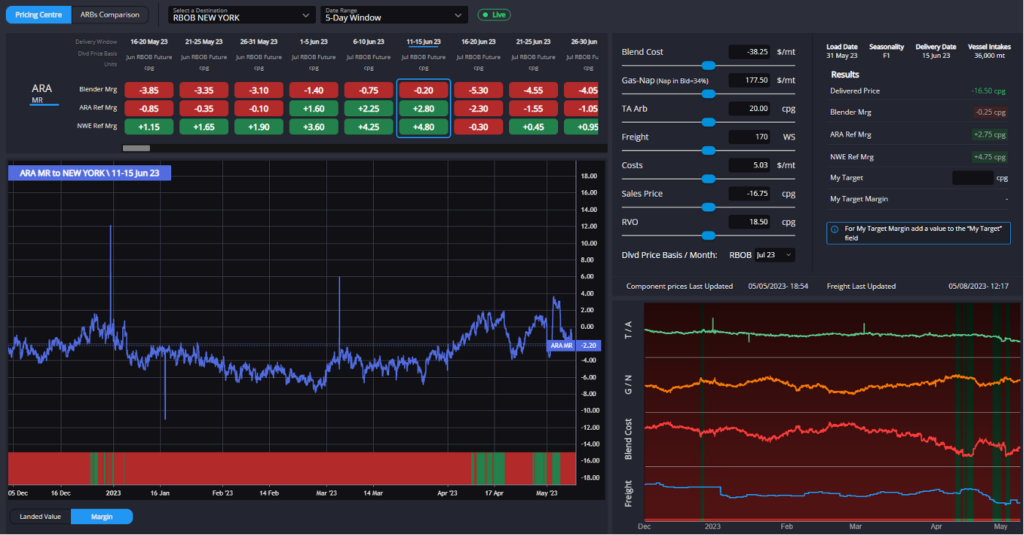

The TA arb slammed shut once more on relative weakness on the US side, pointing European exports back towards the rest of the Atlantic Basin.

However, with inventories in ARA stabilising on the back of a slower export fixture list at the end of April, so have a number of blendstocks’ premiums faltered, with higher octane components in particular narrowing their premiums over the EBOB swap.

Reformate and MTBE in particular have seen their premiums slip on greater availability, As such, with availability good and ARA’s advantage over Houston or AG barrels well established, we should see an uptick in exports out of ARA towards WAF and LatAm in the short-term.

Elsewhere in the mogas complex, gasoline’s premiums over naphtha (gas-nap spreads) also remain at record high levels for this time of year (2022 excluded), pointing to a healthy blending environment with plenty of opportunities in ARA and elsewhere.

More broadly, and related to comparatively weak naphtha valuations, impending recession fears have been lingering since before the pandemic, and whilst thus far the global economy (with generous help from central banks) has managed to shrug off the worst affects whilst maintaining record high employment, the perceived wisdom of a crisis of some kind being just around the corner seems never to be too far away.

That being said, with pump prices remaining solidly below 2022 levels and demand thus far consistently higher y-o-y, there is nothing yet to suggest that gasoline demand is in for a weaker summer.

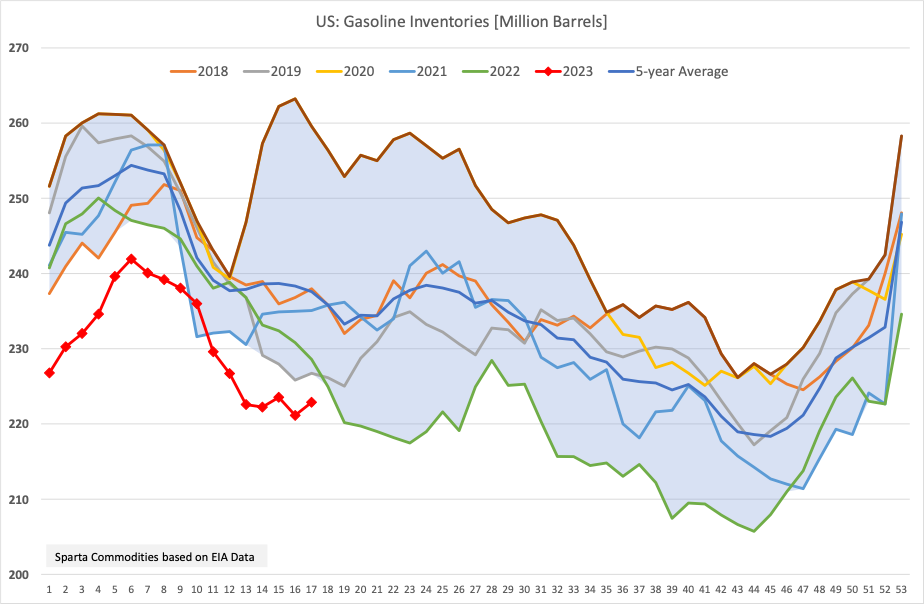

Honing in on the US, last week’s EIA data saw gasoline inventories rising, despite an uptick in exports out of the USGC and lower reported supply. Indeed, at least on a weekly basis, product supplied (a proxy for demand) fell to its lowest end-April level since 2014.

On a 4-week average basis this put nationwide gasoline demand at 8.9m b/d, higher than 2022 and in line with 2021 levels, but still around 500,000 b/d lower than pre-pandemic levels for April.

Here the picture is being slightly skewed by the low inventory situation we entered 2023 with, with weaker domestic demand still being largely offset by lower production and higher exports to keep the nationwide inventory picture supportive.

Focusing on the USGC, MTBE and other high octane blendstocks have been coming off somewhat here due to plentiful supply and stiff competition into higher octane destinations from ARA.

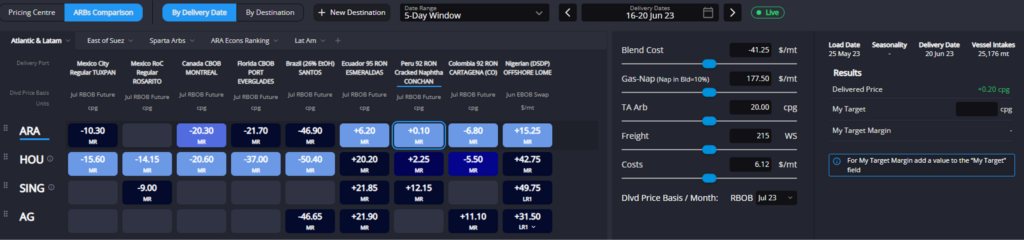

Current levels should be more than sufficient to build upon recent high export levels and keep the pull on gasoline components out of the USGC strong, however, with prompt econs into almost all LatAm destinations pointed firmly to Houston loading.

Furthermore, the recent declines in blend component premiums have even opened up prompt loading opportunities for USGC barrels into Australia in a particularly interesting dynamic which is unlikely to hold for too much longer given some imminent pressure we see potentially emerging on the EoS market.

Indeed, Singapore appears to be pricing just a little too high to maintain export opportunities into markets beyond its close vicinity currently.

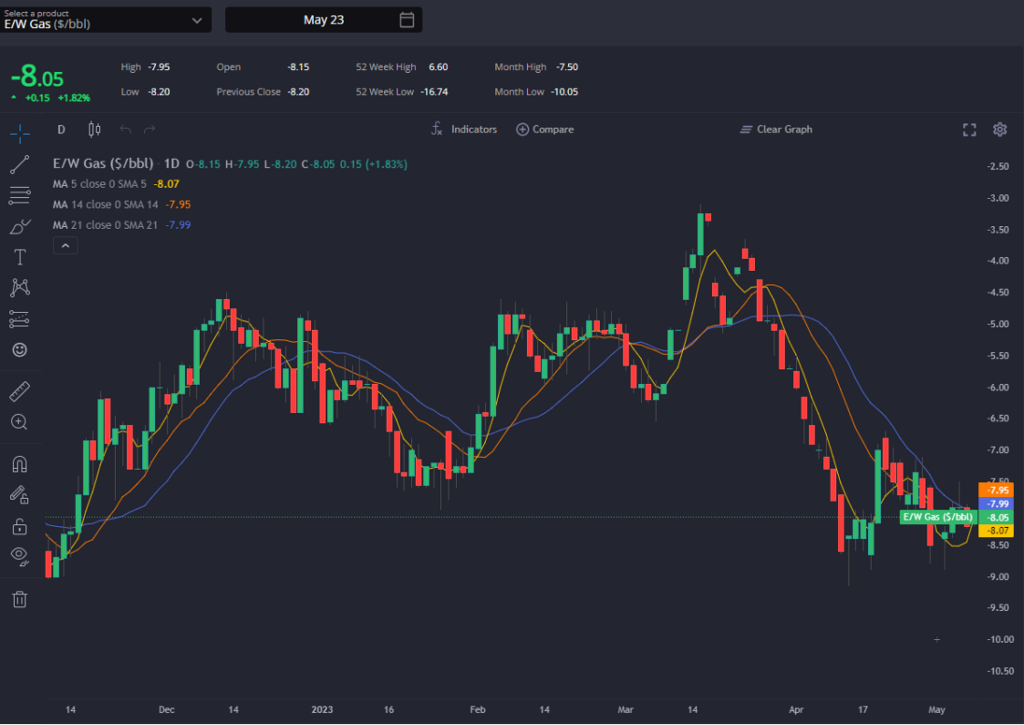

Despite a sharply widening E/W over April, Singapore barrels remain the least competitive option into destinations as diverse as WAF, Australia, Kenya and South Africa. Whether this relative strength being shown in the Singapore gasoline market is sustainable is set to come down to the availability of barrels out of typical key suppliers in India and the Far East over the coming weeks.

In the case of India, for example, April data is showing demand continuing to grow y-o-y, but at a slower rate. If supply has continued to grow, exports are likely to remain at or near their recent record highs, pressuring the EoS gasoline complex.

With South Korean refinery maintenance due to wrap up soon and a number of units coming back online recently across the Far East, we are seeing growing indications that the Singapore complex will need to weaken a little further as the balance lengthens going into summer, despite what may well continue to be healthy regional demand.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com