Prompt European strength continues but gas-nap remains wide

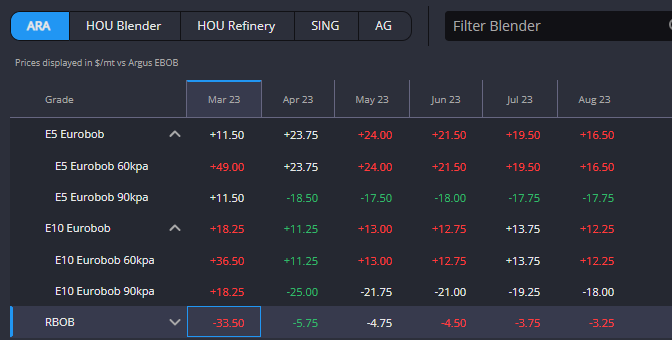

Continuing on from last week’s bullish sentiment in European gasoline markets, a look at the relative blend costs of Summer/winter EBOB in ARA for the month of March are showing that EBOB is effectively still trading in backwardation.

With the blend cost diff at almost $40/mt currently, but the Mar/Apr EBOB spread having flattened further to just $20/mt, current market pricing is certainly pointing to a constructive European fundamentals picture right now.

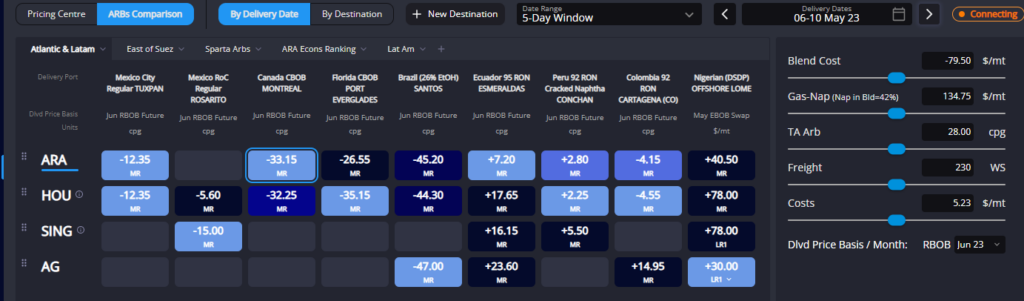

Despite strength in the EBOB market, however, arb routes out of Europe for blended cargoes in ARA are remaining somewhat supported – suggesting that despite the absence of a key feedstock in Russian naphtha barrels and FCC naphtha derived from Russian VGO – ARA remains a go-to hub for sourcing gasoline blends for much of the Atlantic Basin.

Indeed a key route, the TA arb, has moved close to ‘normal’ levels over the last week or so, with the summer months now sitting open for the advantaged players (NWE Refiners), and just about shut for blenders but close enough to open for those able to source the right feedstocks.

Despite the TA arb improving, and the overall strong European picture, ARA appears to still be the source of choice for most of the Atlantic basin – especially in the prompt. This may speak more to current relative tightness in PADD-3, however, with a tighter supply picture there through maintenance holding the door open for ARA-sourced barrels through April.

The overall picture appears somewhat unsustainable, however, and with inventories in PADD-3 already looking well-supplied, we could see some additional pressure on USGC blend values in the prompt.

Indeed, the picture shifts as we move further into Q2, with Houston becoming more attractive again, but still here we are not at ‘normal’ levels – again pointing to either an expected surplus in Europe, some fundamental tightness in the US, or a need to adjust relative pricing.

With Europe already pricing in some relative strength on a tighter supply-side and attractive arb opportunities, and PADD-3 reporting maintenance but with inventories well-supplied, we would tip on the need for some relative repricing in the weeks ahead.

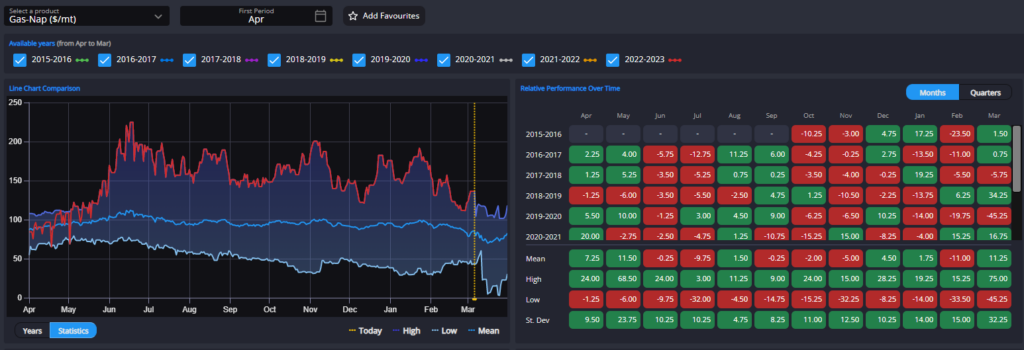

One remaining explanation for EBOB grade strength but attractive blend margins into Atlantic Basin destinations is the still historically high gas-nap spread in Europe, which is helping to make sure that blend opportunities remain to place European-sourced barrels into plenty of export markets.

However, whilst we would normally begin to question the sustainability of such a wide gas-nap spread in an environment where ARA (and Europe more generally) is starved of Russian naphtha barrels, our analysis of the April gas-nap spread over recent years has shown March to be a strong month typically with the spread often widening towards the end of the period.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com