Positive blend margins and soft pull on European export barrels put ceiling on gasoline complex

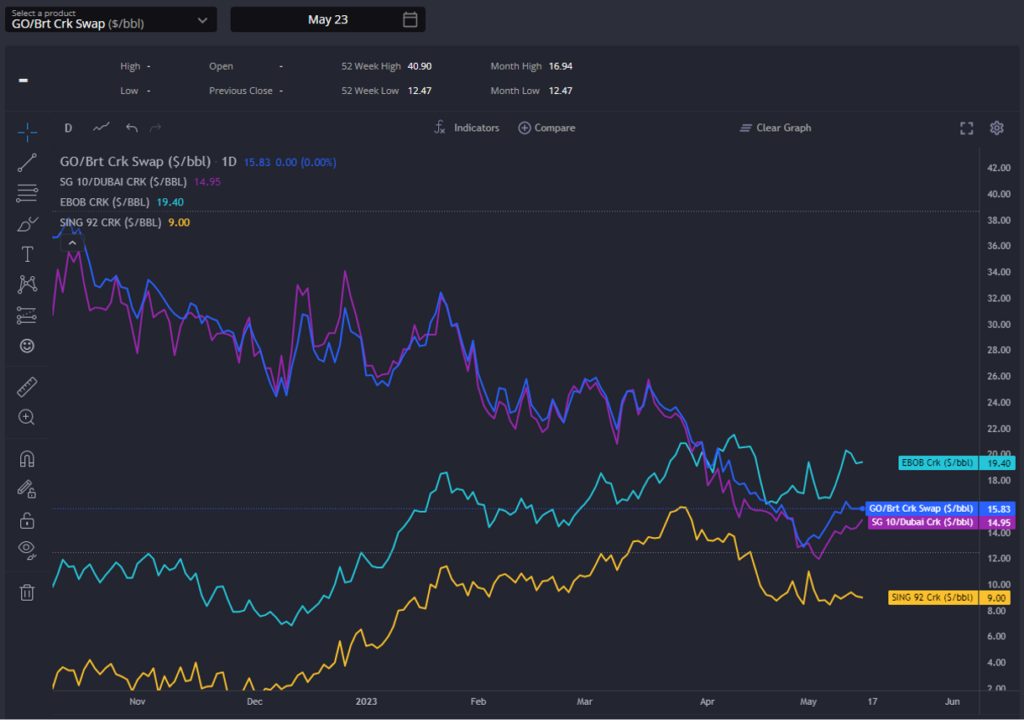

With the E5 blend margin moving positive in May on a sharply widening prompt gas-nap spread, and already close to being positive in June, one could be forgiven for identifying some fundamental strength in market for finished gasoline barrels.

Indeed, if the June gas-nap continues its recent meteoric rise to breach the $200/mt mark as the May swap has already done, the blend margin could open up through June as well very soon. However, this and a number of other factors should be sounding some alarm bells and at the very least will be putting a limit on any further rally in the coming weeks.

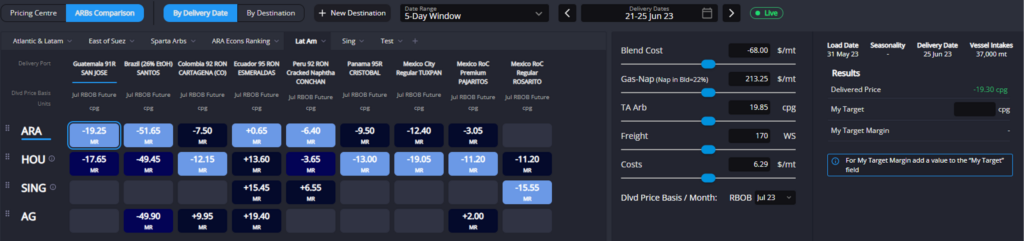

To cover off the bullish side of the European market first, the TA arb remains fully open in May and the first half of June for blenders and requires only another $10/mt widening of the June gas-nap spread (to around $195/mt) to open through the rest of June as well.

A wide open prompt TA arb and the likelihood of opportunities opening up for the remainder of Q2 are certainly bullish signals for the European gasoline market, and at the very least are likely to help keep the floor high on European cracks and spreads for the time being.

With PADD-1 gasoline inventories remaining essentially flat to last year’s seasonal low levels, the pull on this route looks set to remain at least through the rest of the quarter, although the sales price on the NYH side remains in the 0.5-1cpg range.

The supply side of the equation is where we can begin to see some encroaching bearish signs, however. Gas-nap spreads are breaking out of their (2022 excl.) 5-year range despite blend margins already being positive, pointing to weakness in the naphtha pool, where cracks have indeed come off further since the turn of the month on the back of macroeconomic headwinds and plentiful supply.

With blend margins positive, the available pool of barrels for the gasoline pool is expanding, and we would expect this draw on additional volumes into the finished gasoline pool to weigh on ARA gasoline cracks and spreads through in the near term.

Furthermore, with cracks having heavily favoured gasoline production in Europe since mid-March, it is unsurprising that ARA gasoline inventories are seen at around 2-year highs currently.

This will be at minimum placing a firm cap on the upside for gasoline market for now, and contributes to the overall narrative of a turnaround in the recent upsides on the horizon.

This may manifest itself also in a softening barge market soon.

Current very high levels, with barges trading around the +33/+38/mt mark have been supported by very thin liquidity in the E5 market, are a boon for those currently long spreads, but may not be representative of underlying fundamentals anymore.

The E10 market is seeing more trades, but here is exactly where the supply pressure is set to be felt sooner rather than later.

As hinted at above, the situation across the Atlantic is looking to have greater fundamental support, with recent product supplied figures showing robust demand and nationwide inventories remaining around 5 million barrels (2%) below the previous 5-year range.

PADD-3 is seeing something of a stabilisation on premiums for typical blending components (although MTBE remains one weak spot), but is still facing stiff competition into export destinations in the Atlantic Basin, with Canada, Brazil, and Guatemala all pointing to ARA as their cheapest source of supply.

Similarly, anything west coast of South America is currently pointing to either Asia or ARA for supply.

Despite a potential lack of additional export outlets at current levels (stable destinations such as Mexico, Florida, and Colombia all very much still pointing to Houston for resupply), PADD-3 supply appears to still be very much required domestically, and this should help to keep the US gasoline complex well supported.

Finally, in Asia Sing spreads have traded flat over the last week or so, despite reports that a ‘lower’ second batch of Chinese export quotas could be bullish for the Asian gasoline market.

Whilst lower vs the initial batch of export quotas, the second batch has traditionally always been smaller, and a total 28 million tonnes of clean product quotas in the first two batches is significantly higher than the 17.5 million tonnes in the equivalent period last year.

Confirmed Chinese gasoline exports through Q1 were flat y-o-y at 285,000 b/d, and with little indication that higher crude intake in the country is doing anything other than supply more diesel and jet for both domestic and export consumption, gasoline exports out of China should remain around recent average levels through the remainder of Q2 at least.

Gasoline yields in the country have been noticeably lower y-o-y so far in 2023, and although incentives also in Asia have improved for gasoline supply over diesel, this is unlikely to translate into higher gasoline yields in China in the short-term, alleviating at least this potential avenue of pressure.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com