Not All Open Arbs Mean Volumes Will Flow

20 September 2022

Time to read: minutes

RECENT OPEN ARBS OUT OF ARA TO THE AMERICAS MAY NOT HAVE YIELDED ACTUAL FLOWS

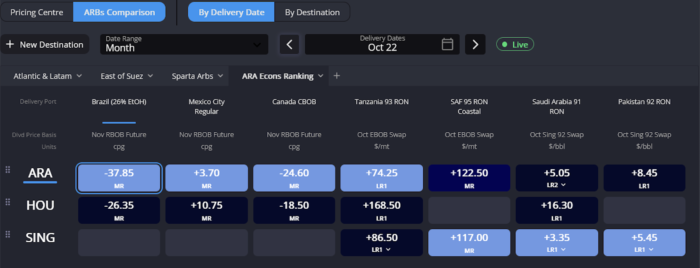

- As we have explored recently, Arbs out of ARA have appeared broadly attractive into most Atlantic Basin destinations in recent weeks for both October and November delivery.

- For example, mid-month October Brazil deliveries are currently over $4.79/bbl cheaper out of ARA than out of USGC. For deliveries into Mexico city, the spread is $2.50/bbl, up from a <$1/bbl advantage less than two weeks ago.

- Especially into Mexico or Canada, however, whilst the ARA barrels have been more attractive than USGC-sourced volumes, until recently there was simply more money to be made shipping those cargoes East rather than West.

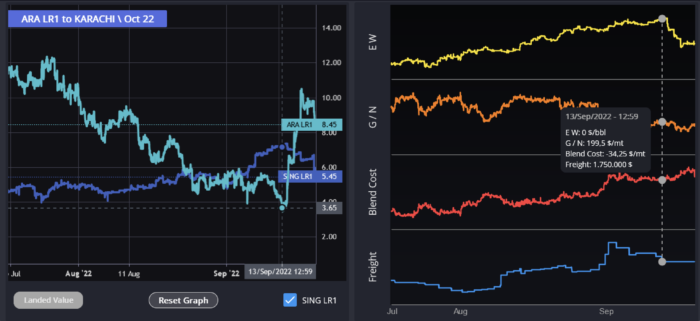

- As we can see from the charts below, however, last week’s collapse in the E/W spread has effectively shut those opportunities into the East of Suez for now, reversing a $4/bbl advantage over Singapore-origin barrels into a $3/bbl deficit in the last week as moves in the Blend Cost and Freight rates also contributed.

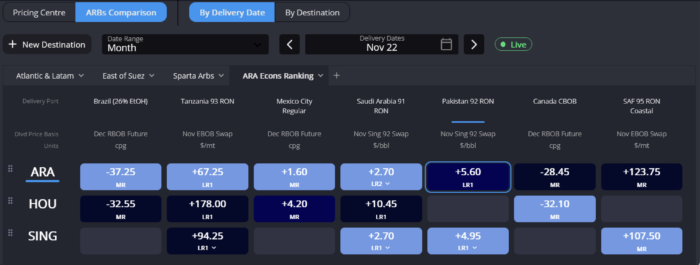

- This is likely to renew competition for USGC-origin barrels into destinations in the Atlantic Basin for both October and November deliveries, even if the economics also on moving these barrels appears slightly healthier in their own right come November.

- Ultimately, is it a reminder for us and our users that there are multiple ways to digest the information our Arbs comparisons show.

- A competitive advantage for one supply source over another may not see swing importers able to capitalise if those barrels are more profitable elsewhere, reinforcing the need to keep an eye on the global situation and not only those routes one knows and follows closely.

REFINERY MARGINS EXPLAIN RECENT OUTRIGHT PRICE JITTERS

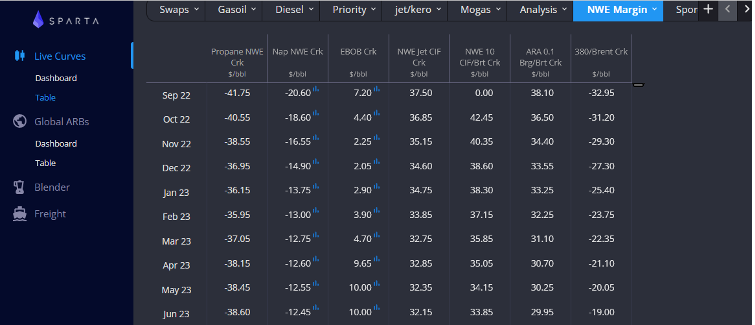

- Finally, with gross refining margins for relatively complex players in Europe and Asia dipping into low double-digit territory on diesel’s recent softening, it is understandable that some uncertainty is beginning to creep into oil demand forecasts for the coming quarter.

- With mogas export hubs apparently pressuring each other lower in recent weeks, it appears unlikely there will be support from the mogas complex in the short term.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a pricing and information platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com