Mixed feelings from Europe

Following a very strong end of the year in Europe, prices seem to have cooled off, but remain in backwardation despite NY moving into contango.

On the one side RBOB Arbs to NY are now completely shut for both refiners and traders and Arbs to AG also remain shut despite the $2/bbl spike on EW and lower freight (Vessels on subs last week have since failed).

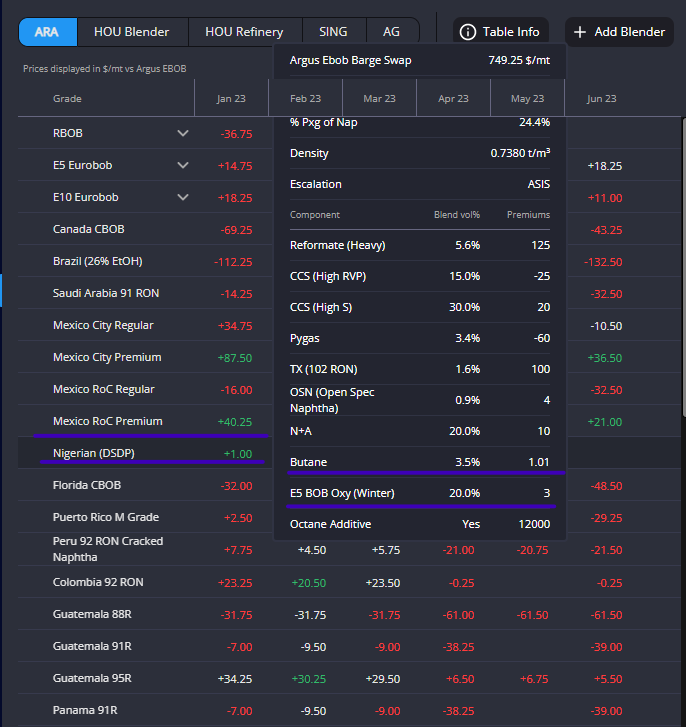

On the other hand component prices in Europe are still too strong to generate any blending margin and the blender generally favours finished grades such as E5 or E10. This incentives E5 buyers to make their purchases in the window rather than blending it themselves.

On top of that we notice that Nigerian blends also favour up to 20% of E5 in the blends. If this is materialised it could incentivise even further window buying. Something to keep an eye on.

But even if ARA components are too expensive to generate blend margins, European High Octane remains the cheapest worldwide. Last week, we witnessed a spike in Alky values in the GC moving from M +9 to +35 cpg. MTBE prices also jumped from RBOB +27 to +55 cpg. As a consequence ARA is now the cheapest source into high octane/non oxy destinations such as Colombia and Ecuador.

Last week USGC blending margins for A and M were positive by 4cpg and now they are negative again by 8cpg for A grade and 10 cpg for M grade . This comes mainly on the back of the alky rally and on a 10 cpg drop on gas/nap. Could this be a leading indicator on spreads?

Despite the move GC remains the cheapest source of supply into its main exports markets like Mexico and Canada. It is nevertheless worth mentioning that Brazil Arbs show a close tie between ARA, GC but also AG as cheapest source of supply (all landing mid Feb at March RBOB -34cpg).

Again something to keep an eye on. AG to Brazil arbs could be a new trend going forward, specially as AG naphtha values continue to be under pressure.

Meanwhile freight keeps coming off globally. Now that Sparta also covers distillates, we notice that following the massive diesel movements into Europe in December (mainly from USGC), now all arbs seem to be closed into ARA, except for Red Sea.

This coupled with lack of arbs on the gasoline side has a direct negative impact on the freight outlook. This is particularly hurting the MR market. So despite the freight price drops, the oil markets have adjusted in kind (E/W, TA, cash diffs and spreads) and these new freight prices are not yet incentivising any intercontinental movements.

On clean vessels the TCE remains very constructive for owners with MRs around $24 – $26k/day globally and LR1s $62k/day with LR2s at $67k/day. All very positive and far from negative earnings.

However dirty is more of a mixed bag with VLCCs on TD3 down around Opex at $30k/day but Afras are more in line with clean at $70k/day. Nothing to concern freight too much right now although perhaps some disappointment after a great year.

Structure reflects current sentiment with a mild contango in TC2 and TC14 in Q1 but backwardation in the stronger AG markets of TC5 (AG-Japan LR1) and TC17 (AG-EAFR MR).

No support to the weaker markets from reduced vessel supply. Freight continues to drift lower in NWE after seasonal de stocking prior to end of year and the unusual arb movements meaning that stocks may be lower and demand muted. However Europe mains the best location for owners and vessels from WAF and ECSAM will ballast back to Europe with earning still more attractive than elsewhere.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com