Market likely at a bottom as new dynamics being established

The cold light of day in a European market deprived of Russian product barrels has exposed a market struggling with tepid demand, sky-high inventories, and a regional refinery system likely still running at high utilisation thanks to cracks which have only very recently fallen to “workable” rather than very strong levels.

With market structure recovering, it would appear that the backwardation in the market is finally being allowed to tab into regional inventories, with cash diffs in ARA dipping into single digit ($/mt) territory for the first time since Feb-22.

The irony that this happens almost exactly a year after the invasion of Ukraine and on the back of the imposition of a ban on the import of Russian clean products is apparently lost on the market.

As we have been saying for weeks now, however, Arb economics can turn around very quickly on any signs that European demand is recovering or inventories are being chewed through more quickly than anticipated.

Forward pricing currently appears to suggest that the market is not pricing in a return to regular Arb inflows before Q3-23 – a poor indictment for expected European demand through this period.

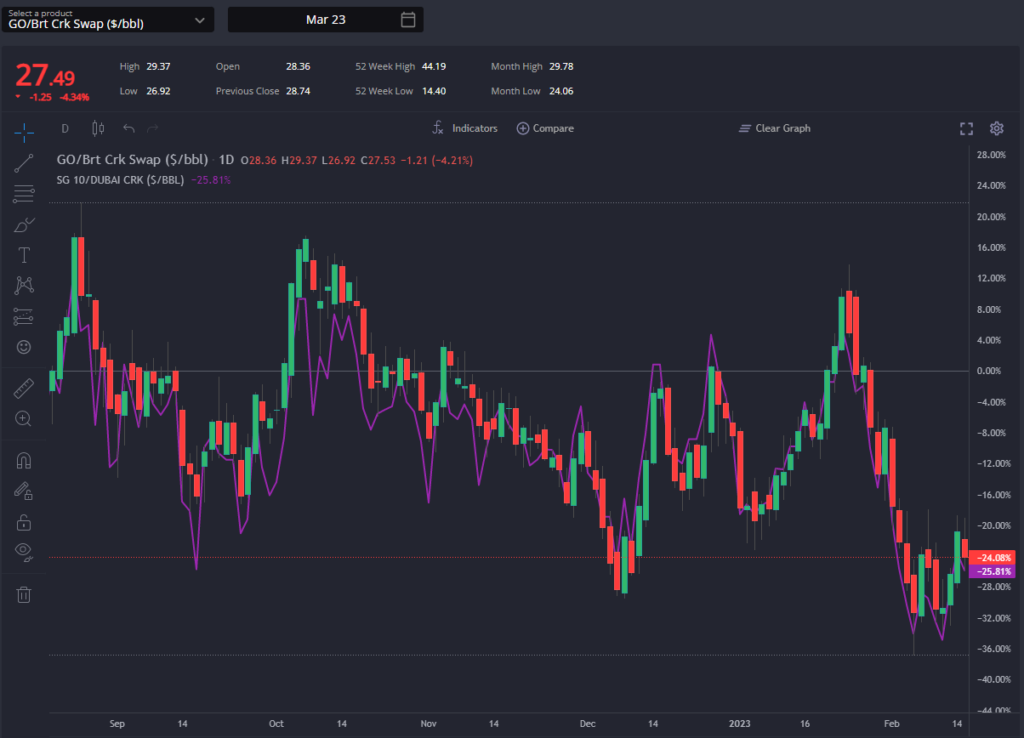

Whilst the European market has fallen in the last week or two, it has not been alone. Cracks in Singapore have tracked developments in Europe almost one-to-one in ratio terms, although the Mar-23 E/W has narrowed to $30/mt now vs a peak of $60/mt as recently as Nov-22.

The Asian diesel market has otherwise held up, with cash diffs in Singapore and the Far East falling only slightly in recent weeks. A significant uptick in Russian diesel arrivals into the East of Suez may be about to upset this, however, with Chinese exports remaining elevated and some initial signs that end-user demand in China may take longer than anticipated to move higher once more.

Although we have already begun to see some softening of the physical market in the AG and WCI, we would expect these markets to come under increasing pressure as we move into Q2.

The prompt diesel E/W spread remains historically wide, but with freight rates picking up again and a greater availability of barrels out of storage in ARA currently, we remain some way off seeing a sizeable exodus of barrels from the EoS into Europe – with the latest market reports rather seeing cargoes currently fixed to East and South Africa, with a couple of speculative attempts to move volumes into the Atlantic Basin without a pre-defined home just yet.

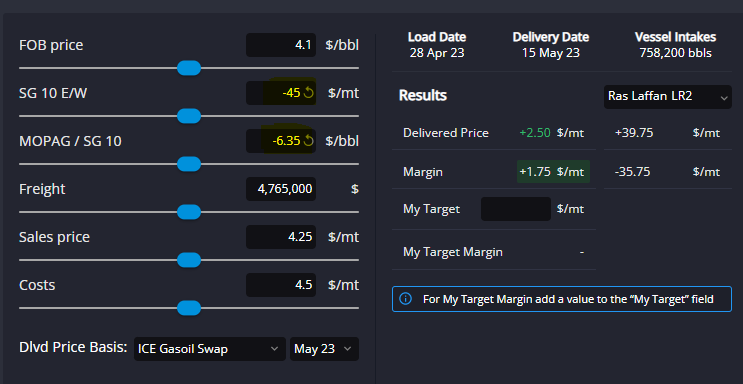

Finally, let’s take a quick look at what how much a swing we would need to see in different instruments to reopen the Red Sea into Rotterdam Arb in the month of May – an Arb which is currently closed by around $20/mt and a month which is likely to see a renewed need to pull barrels into Europe as inventories presumably now gradually dwindle and refinery maintenance season rears its head once more. Given it is $20/mt closed, let’s aim for a $30/mt swing to reopen it.

Current forward freight lumpsum assumptions put the cost from Yanbu to Rotterdam at $4.75m, despite having been just $3.6m two weeks ago. However, freight rates seem unlikely to fall going forward with longer average distances and a growing shadow fleet to accommodate Russian volumes. A May-arrival Arb into Rotterdam is subject to the April E/W, currently sat at -$32/mt.

Opening this back up to -$60/mt would be required to reopen the arb, but this puts us back at the peak of European buying interest levels from May and October-22, which feels unlikely.

However, the E/W will need to play a part – weakening Asian markets and gradually improving European cracks – and a target of around -$ 45/mt for the April or May E/W may be necessary.

The rest will then likely need to come from a combination of a widening MOPAG / SG 10 spread (April currently at -$5.35/bbl). Here just a $1/bbl swing (on top of the E/W widening assumed above) would be enough to open up AG barrels back into ARA in May – a move which the influx of Russian volumes heading that way may well facilitate.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com