Market coming off hard, but European Mogas comparatively well-supported

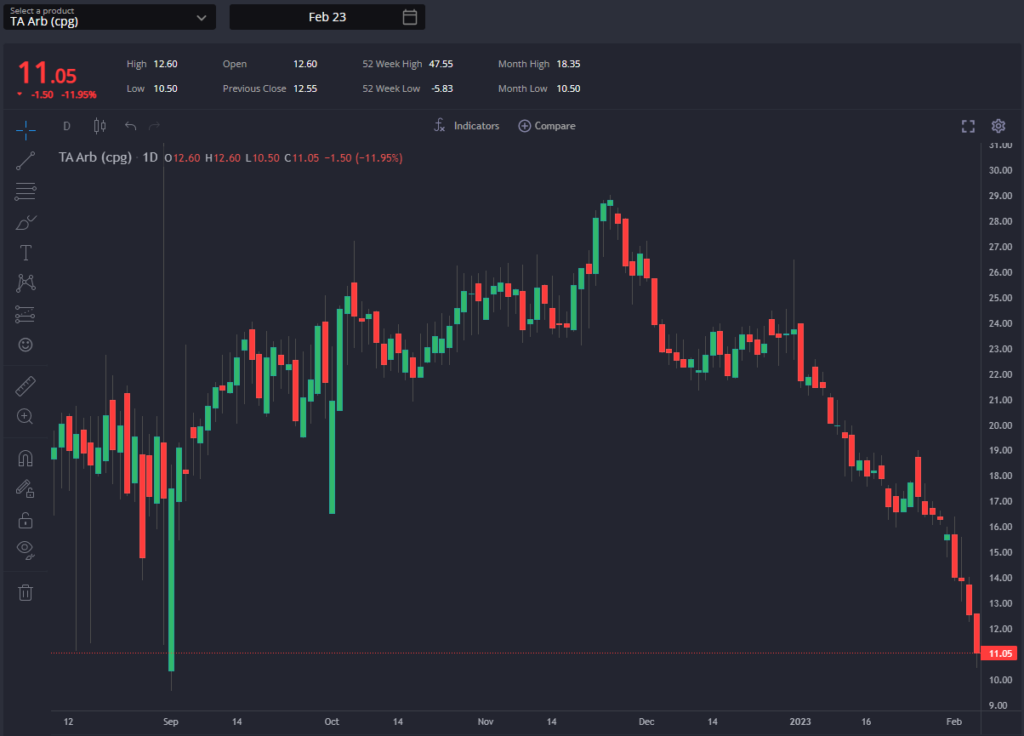

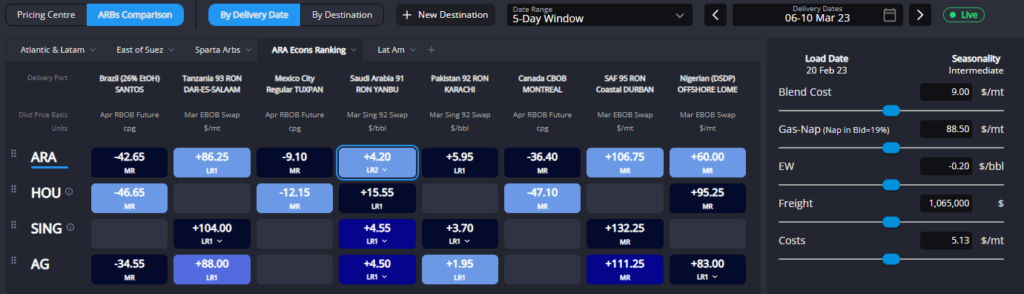

The prompt TA arb has slammed shut in recent days, with increasing blend costs and a narrowing gas-nap spread more than outweighing lower freight costs. Indeed, an RBOB cargo landing 1-5 March is now some 9cpg in the red, despite having been just about workable for an ARA blender as recently as 30th January.

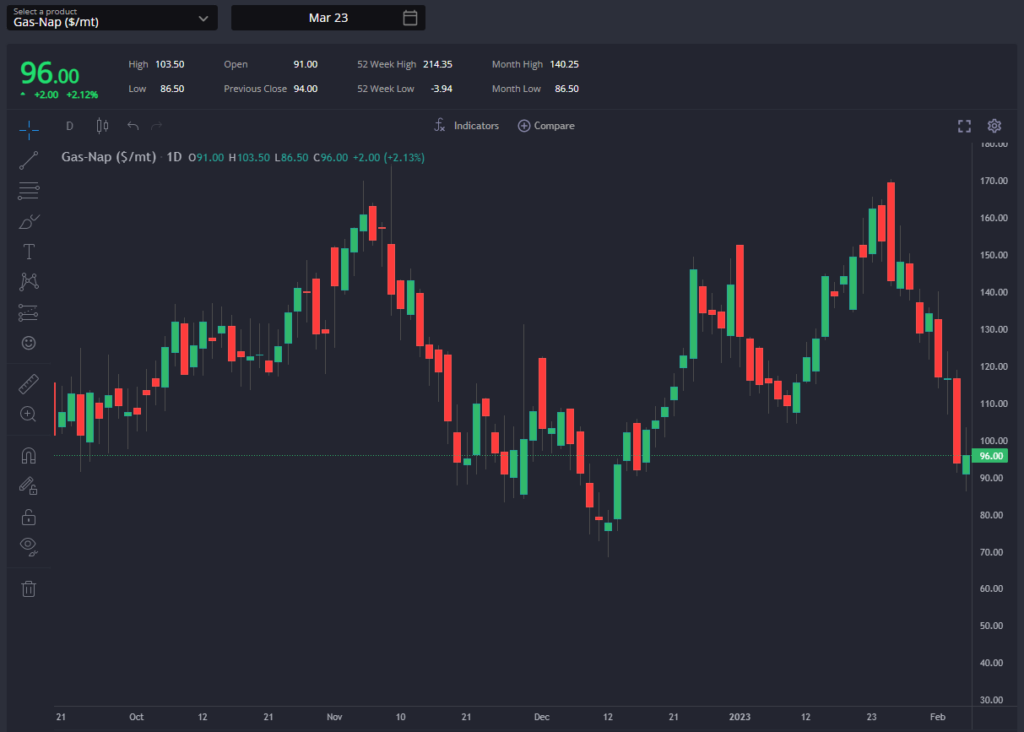

As we can see from the charts in the bottom right of the graphic, this move has been the result of a combination of sharp movements in all of the components that make up the Arb (with the exception of the aforementioned lower freight rates).

Whilst the moves in European gasoline pricing are in line with the rest of the oil barrel, with outright price falls in crude and weakening cracks and spreads across finished clean products, the weakness in the TA arb is simply a continuation (and acceleration) of a trend we’ve been seeing since December.

With Europe looking to hold onto molecules and PADD-1 potentially past the worst of its importing needs for now, the prompt has been allowed to collapse. The picture remains somewhat more supportive throughout Q2, however, with TA arb values still around 24cpg, allowing at least some movements at current levels.

Indeed, whilst the European market remains comparatively well supported vs the USAC, the EoS remains an attractive destination for European export barrels, providing a floor for the European market and calling the current strength in the East of Suez market into some relief.

With Europe pricing into East Africa and Saudi Arabia even for early-March arrival, EoS pricing appears unsustainably strong at the moment, and we wouldn’t be surprised to see the recent narrowing of the E/W spread reopening on the back of a reaction in the East going forward.

Naphtha has held onto its strength better than crude and gasoline, with improving cracks and narrowing gas-nap spreads, hurting blending economics. With the crack improving steadily since the turn of the year, we could end up with positive $/bbl cracks soon, with the petchem complex holding outright values higher thanks to components further down the value chain.

Despite weakness in both Europe and MOPJ, E/W has broken its downward trend, finding a floor and the forward curve has returned to positive values except for the prompt. Despite this trend change, the differential remains at very low values so Asia can attract European cargoes in the short term.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com