Gasoline market at the crossroads

Over the past few weeks market sentiment has changed from very bullish to somewhat cautious: both cracks and spreads hit multi year highs end Jan and have started correcting since then.

But is this a pause in what remains a very strong market, or does this correction have legs? Lets look at the facts:

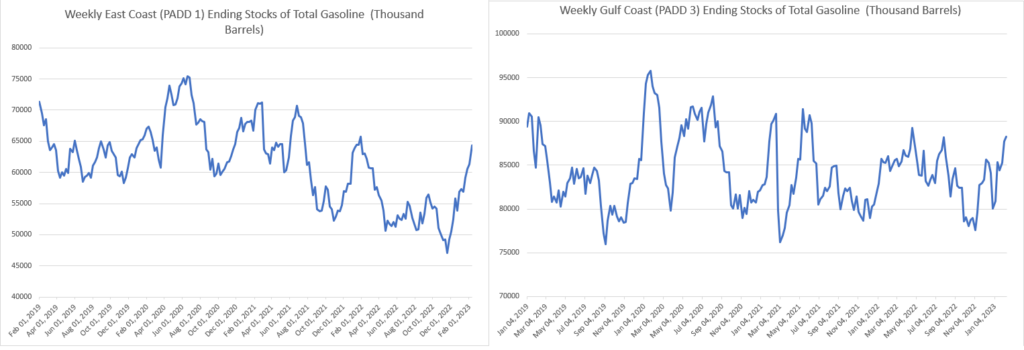

Gasoline stock levels in PADD 1 have risen from multi-year lows at 47M bbls on November 18 to 64.4M bbls on February 10, just shy of the 65.5M bbl PADD 1, 5-year February median. Similarly PADD 3 gasoline stocks have risen to 88M bbls, once again just shy of the 5-year February median of 88.5M bbls.

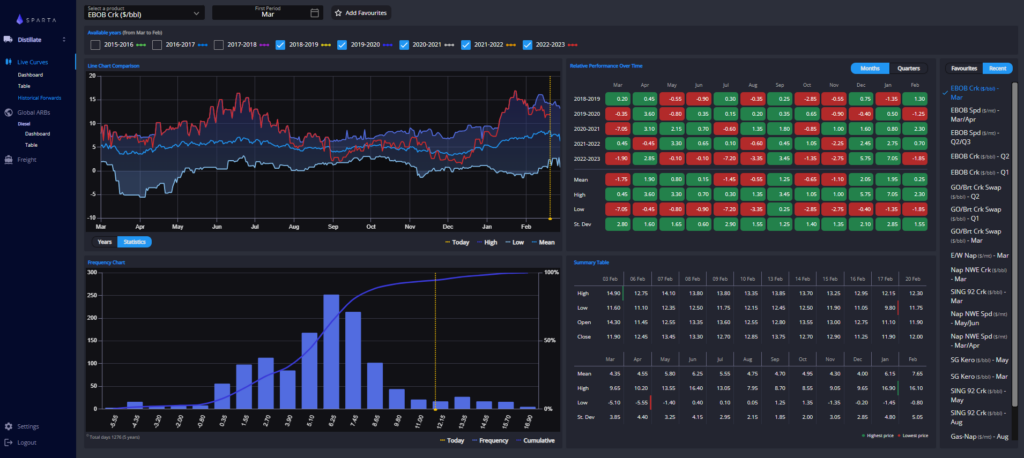

Looking at these stock levels one could argue if the recent multi-year highs on both cracks and spreads are warranted. Spreads have done the job, and the March/April EBOB spread has now come off from the highs and is currently flirting with the 5 year lows at $-27/MT. On the other hand, the March cracks remain well above the 5 year mean ($11.9/bbl vs $8.45/bbl).

Spreads are a very good indicator of prompt bullishness whereas cracks are an indicator of Month M+2 market sentiment. Market is essentially saying that there isn’t any front-month tightness, but remains cautious about Q2 product availability.

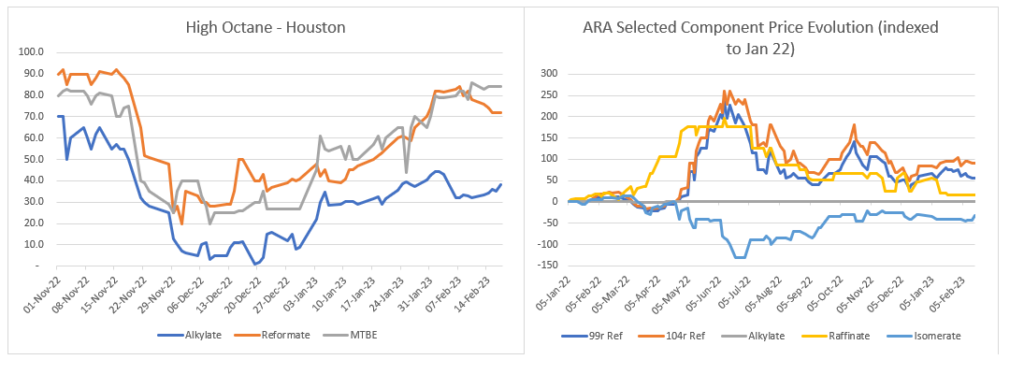

We looked at the cash diffs in both ARA and Houston to see if there was any sign of weakness, particularly on the high octane components, which were driving the recent bullishness.

As you can see, high octane components remain at very healthy premiums and we have not seen any recent price decline that could be considered a leading indicator to a continued bearishness in the market.

That being said, one element we have noticed is that Gas Nap prices are now reverting to the mean. Following the naphtha rally in recent weeks, naphtha components have started to price themselves out of the blend pools.

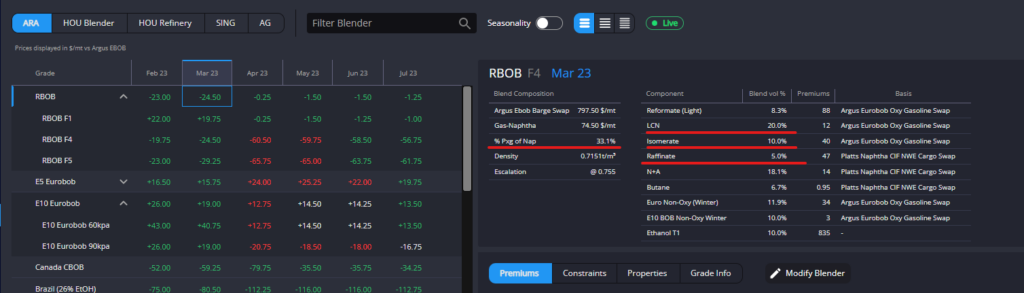

Although ARBs to NY are now closed, the theoretical RBOB blend in ARA only takes up to 33% of naphtha components, instead of the typical 45-52% at this time of the year.

Consequently blends use a lower proportion of high octane components such as reformate and alkylate in favour of other components such as isomerate or raffinate that were less in demand until now.

Will we see a normalisation of component usage and therefore prices over the coming weeks?

In terms of demand, if we focus on the main gasoline arbs, we notice that ARBs to NY remain shut for finished grade RBOB, as they have been since early Jan. This is actually quite common for winter months, but, surprisingly, we see that Q2 ARBs are also shut for traders and refiners.

Clearly the US market is not asking for additional barrels or is not sending any distress signals to European traders.

On a more global perspective, ARA and Houston have similar competing economics to supply LATAM destinations. Given the shorter voyages, end users will most probably favour USGC supplies, but these tight arb economics should act as a warning call to GC suppliers, as April landed prices favour an ARA resupply.

Finally, the other big ARB story is WAF. On the one hand we keep seeing AG competing with ARA for a share of the WAF cake.

What used to be an open ARB once or twice a year is now becoming a recurrent theme, and traders should continuously keep an eye on ARB economics from AG to WAF vs ARA, particularly as the Netherlands will start banning high sulphur and high benzene blends. Although most WAF blends will then be displaced to Antwerp and Terneuzen, this could have a significant impact on ARB economics from ARA in favour of AG.

In the meantime, as mentioned above, as component prices remain elevated (particularly vs a lower Gas/Nap), WAF blends keep maximising E5 as blend stocks (37.7% of E5 in WAF blends for March). This could obviously incentivise window buying as the best way to collect cheap components.

As a consequence, ARA could either see a strong demand for E5 going into WAF blends, or on the other side see an overall decrease in demand as WAF traders favour alternative supplies such as AG.

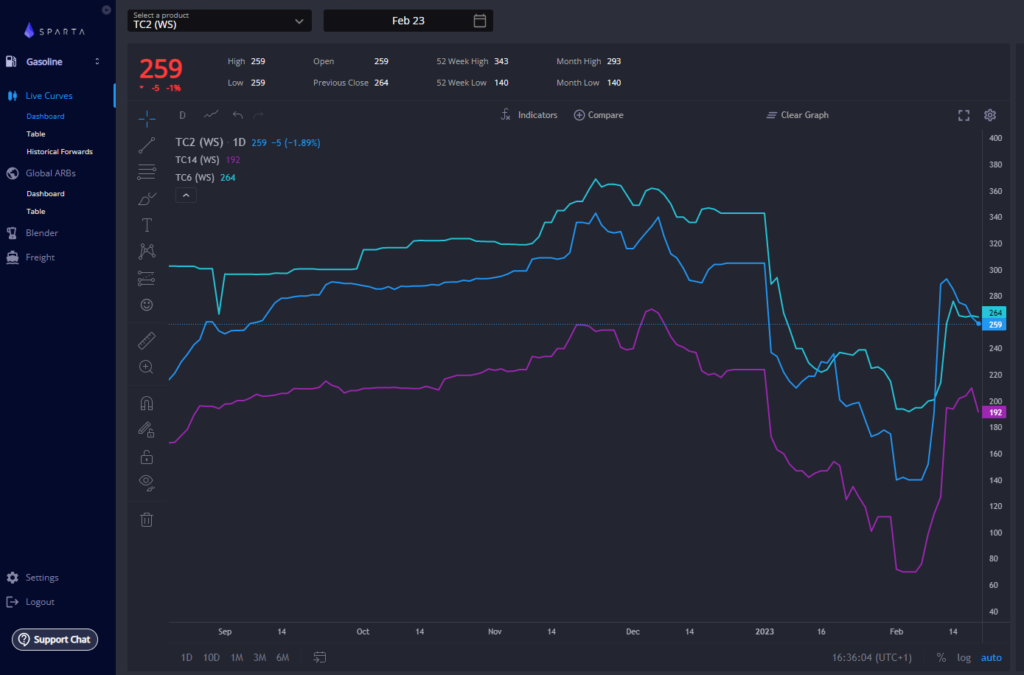

On the freight side, ARBs have also been impacted by roofing freight rates over the last few weeks. The price increase followed the enactment of the Russian sanctions and owners are now pricing a potential lack of vessel availability to resupply Europe on diesel.

But, as we see on our distillate ARB tool, all ARBs into ARA remain closed from both EOS as well as USGC.

Overall, demand remains poor. As a consequence we start seeing a correction on freight rates, that should normally continue unless we do see those longer voyage arbs materialise.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com