First signs of market tightness already reappearing in Europe

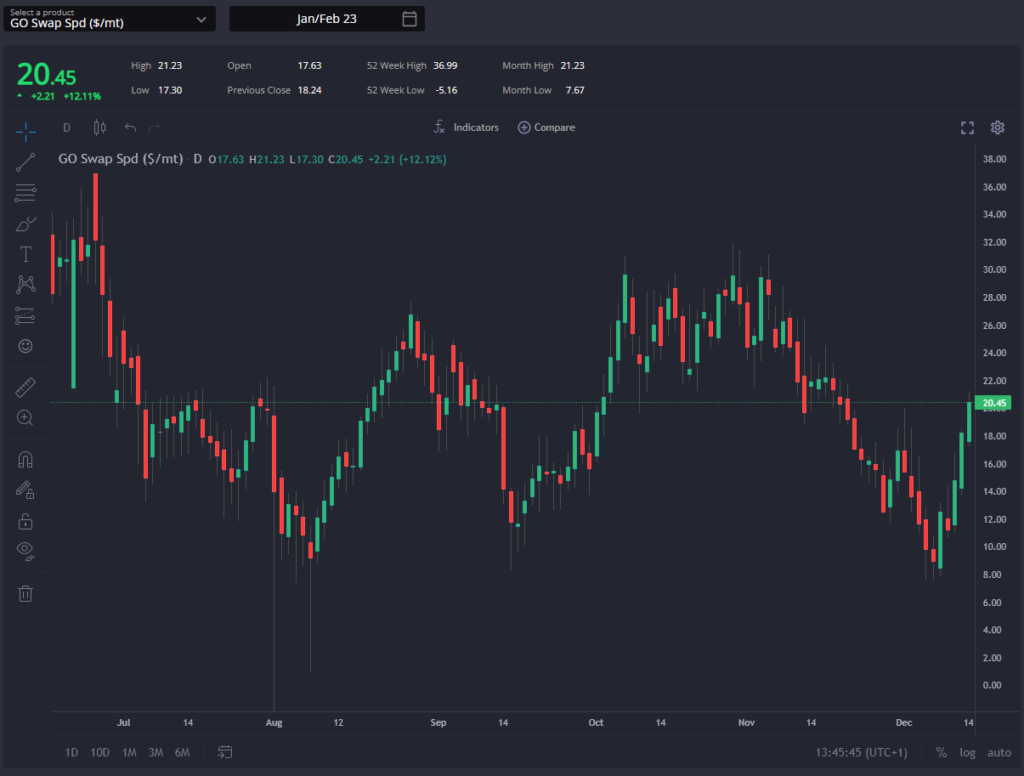

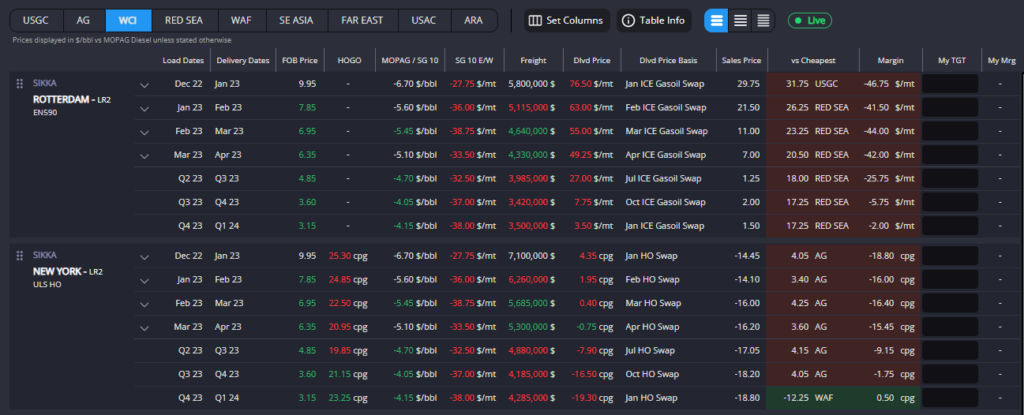

The Arbs into Rotterdam remain closed from all of our origins through the foreseeable future, with a narrowing E/W spread and a stabilised HOGO running up against a weaker cash market in Europe. We have seen, however, the first reactions in European pricing, with both structure and cracks getting stronger once more in recent days as the market begins to look ahead.

With a cold snap across much of Europe currently sending power and gas prices higher once more, threatening the profitability of European refineries, the attractiveness of external barrels is likely to begin increasing and we are likely to see the ICE GO swap needing to strengthen once more vs HO and SG 10 going forward to compensate for any shortfalls if colder temperatures persist across Europe.

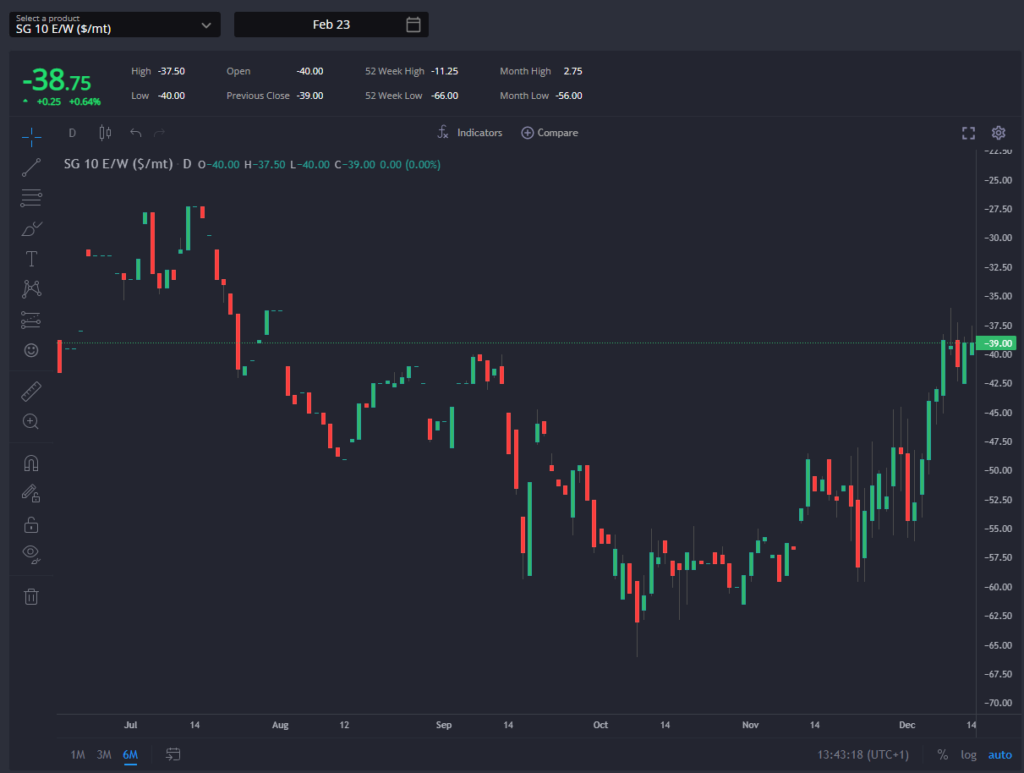

Indeed, despite repeated news pieces concerning high Chinese diesel exports in recent weeks, the E/W spread has continued to narrow, with Europe likely under-priced currently and the potential continued relaxing of Chinese Covid restrictions generating some expectations for a renewed tightness in the Asian balance.

This has also begun to be reflected in the Singapore structure, with Jan/Feb spread returning above $3/bbl backwardation for the first time since mid-November. Although many markets appear to be lacking some liquidity towards the year-end, pricing signals appear to be reacting to improving fundamentals both in Asia and Europe.

In the US, the easing of fundamental support for the HO swap towards the end of November as PADD-1 inventories began to stabilise saw the HOGO Swap slip but stabilise in recent weeks. There has been some renewed upside in the US market over the last few days, however, with the Feb/Mar HO spread now back above 9cpg for the first time since late-November.

With the USGC 10 diff also having narrowed significantly since the middle of last week, this has somewhat taken the wind out of the sails of what had promised to be a spate of USGC cargoes headed transatlantic, although some interest is likely to remain with the USGC still the origin-of-choice for volumes in NWE and the Med in January.

Looking further ahead, however, sees the AG and India becoming more attractive sources of supply once more from February onwards, with the Feb USGC 10 diff a solid 5cpg narrower than January.

With fundamentals beginning to improve once more as the market begins to look beyond the turn of the year, we would expect the Arbs into Rotterdam and Barcelona to begin opening up once more.

With supply pressure out of the AG remaining in place but balances potentially tightening in Asia and Europe, we should see the call on Indian barrels strengthening as the competition for these barrels also from the East picks up.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com