Europe: Bullish signals of an explosive March

Last week’s European gasoline spreads bounced back from the monthly lows to hit new highs as we approach March/April pricing. We are noticing a decoupling of the European prompt strength when compared to Asian and NY spreads.

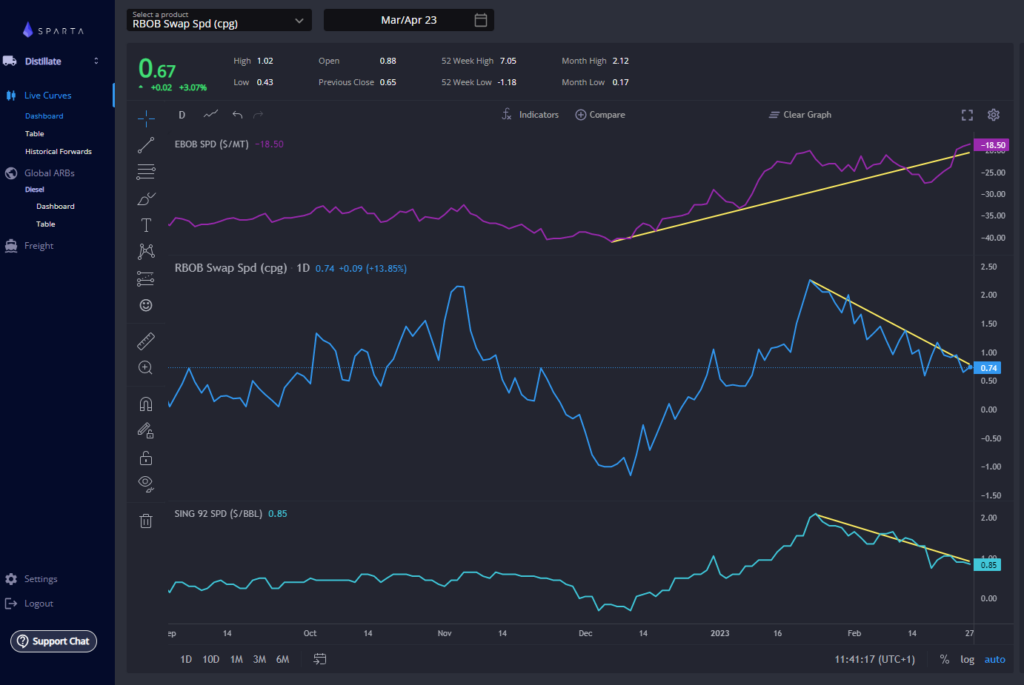

Indeed while E5 March/April spreads rebounded from -27 USD/T to now trading at -18.5 USD/T, both Sing and RBOB spreads continued to slide and remain within the bearish trajectory that started end Jan. Is this late month rally justified?

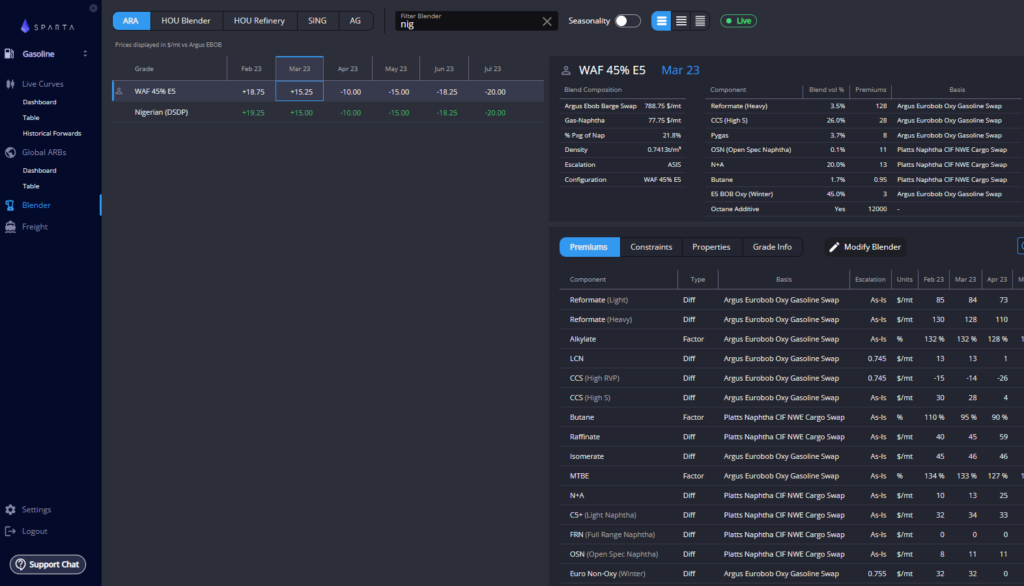

As mentioned last week, one key driver could be WAF. We argued that WAF demand could be supplied by both AG or NWE at similar levels. But if the final origin was NWE and more particularly ARA, we anticipated that this could very bullish for front spreads, as WAF blends are favouring the use of E5.

Currently the most economic WAF blends could take up to 45% of E5 barrels. This week we saw several MRs, LR1s and LR2s being fixed to WAF from ARA and NWE for early March loading. This clearly indicates that E5 is too cheap relative to other components and we could see some fireworks in ARA in March if more fixtures are confirmed.

Another sign that E5 is too cheap is the negative E5 blending economics. Currently blending E5 has a $14/MT negative blending margin. E5 and E10 remain relative cheap as high ron component prices remain stubbornly high despite a much lower Gas Nap.

As forecasted last week, we finally saw reformate prices coming off in both Houston and ARA (light reformate traded $10/MT lower in ARA at +$85/MT), whereas isomerate prices recovered and are now trading at +$45/MT (up $20/MT since early feb).

This $10/MT drop still does not compensate the $40/MT drop on gas nap since the beginning of the month and as a consequence it is pricing itself out of most blends right now. In theory this should lead to a replenishment of reformate and high octane stocks ahead of summer driving season. A much needed trend. But perhaps this is too little and too late?

On top of the WAF E5 bullishness, we also notice that ARA remains the cheapest source of supply into most LATAM and Atlantic destinations as we move into April.

Despite the recent European bounce back, it remains the cheapest source of supply into destinations like Colombia, Brazil, Canada, Ecuador and of course WAF. European spreads are trading at historical highs, but the fundamentals seem to justify the move, at least relative to both AG and Houston.

The market clearly seems to be anticipating an explosive pricing environment in Europe during the month of March. But traders should be mindful of the potential upside from here and the potential threats as Europe continues to decouple itself from other trading hubs.

As you can see on Sparta’s Live Blender, the current blending spread between winter and summer is $-29/MT ($-25.5/MT if we take into account the last 4 march trading days as summer). With March/April trading at $-18.5/MT, traders are anticipating a tighter winter/summer spread than the cash diffs indicate.

NY arbs remain shut for European blenders in a clear indication that US does not require European barrels. Should the decoupling between Europe and US continue, Houston should take over most of the LATAM shorts as we move into April, and AG should become the cheapest source of supply into WAF.

Coupled with the lower reformate blending intake, any March spike could provoke a bearish environment for April.

In terms of freight, as diesel arbs start to open again into Europe (last week prompt arbs were open on MRs from Houston to Rotterdam by up to $10/MT), whereas gasoline arbs from Europe to US remain shut, there is a case for TC14 to outpace TC2 in March. Particularly if the current gasoline decoupling persists and Houston regains its competitive edge into LATAM destinations.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com