Market Commentary: Ebob Market Supported For Now

CRACK AND OUTRIGHT

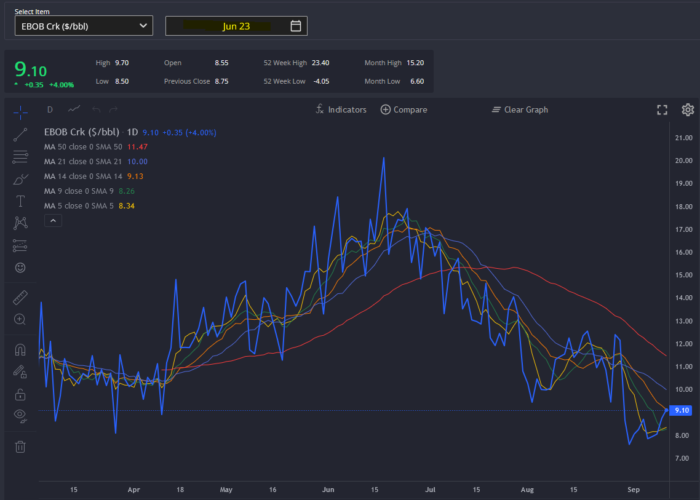

The expected rebound in EBOB cracks materialised, breaking through the 14-day moving average ($2.20/bbl). The next resistance would be the 21-day moving average at $4.75/bbl, and although export markets should prove supportive, these may well prove short-lived.

Meanwhile cash diffs and timespreads came in slightly with the wider gasoline market continuing to look well pressured into winter.

ARB DEVELOPMENTS

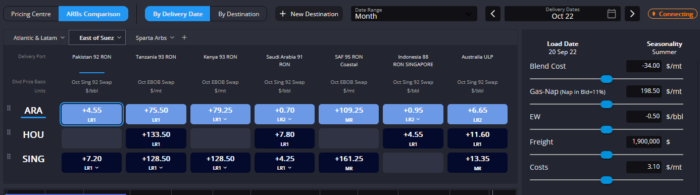

Autumn swing barrel destinations with high EBOB-blend potential such as Mexico (65% in September), Saudi Arabia (51%), and Pakistan (74%) are all pointing to Europe as their cheapest source of supply for September and October-loading cargoes.

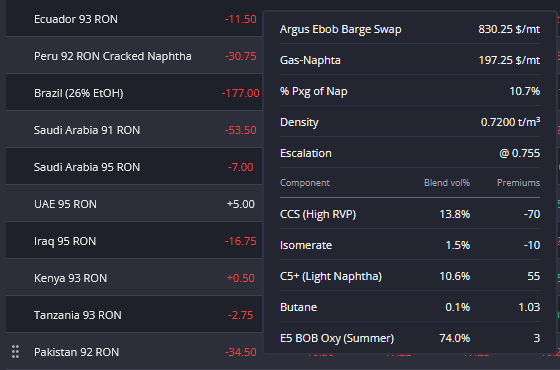

E5-Oxy barrels are expected to prove abundant given a wide-open blend margin into the ARA window currently from October onwards. ARA-sourced barrels are currently $2.65/bbl cheaper on an October-landed basis into Pakistan than volumes sourced from Singapore, with that gap widening out to $3.40/bbl for cargoes landing in November.

As such, we would expect savvy traders to be snapping up positive EBOB blending margins in ARA and open arbs to these Oxy-market destinations to help move surplus oxygenate out of Europe in the coming weeks.

LOOKING FORWARD

EBOB support may well prove temporary. With winter specs around the corner E5 blending will become less attractive. Additionally, volumetric pressure remaining in the region as diesel-focused refiners continue running flat-out means ARA needs to continue to price itself as the cheapest source of resupply for swing arb destinations through winter.

To this end, winter E/W mogas spreads have gathered further support recently, with Dec-Mar contracts now consistently positive (avg: +$0.70/bbl) after having spent much of this summer trading in negative territory.

LOOKING (FURTHER) FORWARD

Finally, with forward mogas-diesel spreads having consistently shifted into diesel’s favour over recent months, and the spread in Europe now averaging $41.70/bbl through Oct-Mar, we are increasingly risking a volatile Q2-2023 for gasoline markets.

With June 23 EBOB cracks currently trading under $10/bbl ($9.05/bbl), having more than halved since June 22 when they peaked at $20.13/bbl, a return to the 50-day moving average of $11.47/bbl appears prudent lest the market begin pricing in a significant gap in supplies next spring.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a pricing and information platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com