East Of Suez Remains Pressured As Atlantic Basin Moves Beyond Covid

EUROPE’S FUNDAMENTALS HOLDING UP STRONGLY VS PREVIOUS YEARS

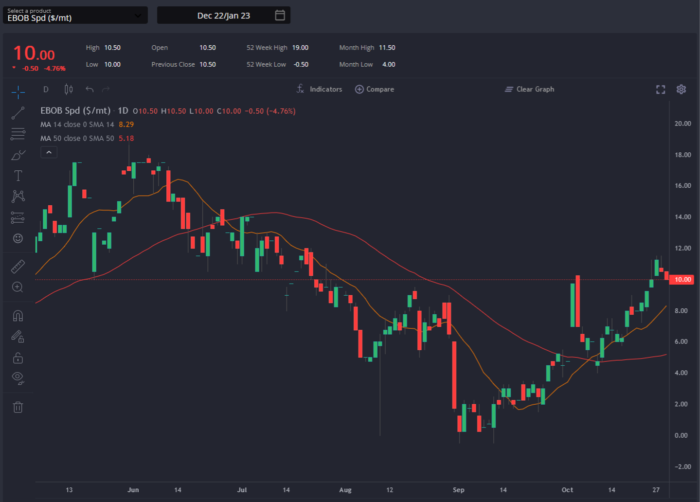

With barges in Europe currently trading at extreme premiums (+$70/mt for E5 and upwards of $90/mt for E10), it is clear that the NWE mogas market continues to cling on to its own barrels, with backwardation also pushing the Nov/Dec spread past the $50/mt mark in recent days.

Although this spread looks set to end the day until the $50/mt mark for the first time since last Tuesday, the November EBOB crack remains at its strongest levels since July.

We have written in recent weeks about the fundamental support coming from French refinery outages, but it would be remiss to omit the fact also that European demand is likely holding up much better right now than it has done in the last few years.

Despite Covid cases rising once more across the continent, there is no political appetite to impose the kind of mobility restrictions seen in the last two winters, and the particularly mild start to the period combined with retail prices which have fallen since the summer are helping demand fall less seasonally. This is being backed up by recent mobility data readings.

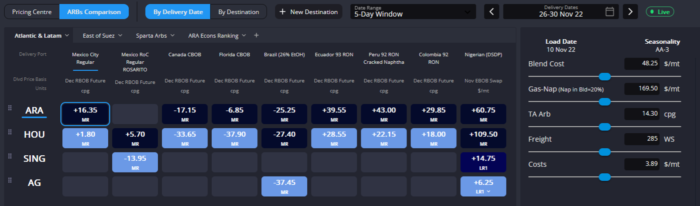

These stronger demand readings are being observed elsewhere as well, with much of Latin America and East of Suez markets also seeing continued higher mobility. The Atlantic Basin markets would appear to be drawing heavily from the USGC as their cheapest source of supply in the next few weeks (with the same caveat as in our last note regarding barrels out of the AG where applicable).

Indeed, with North American mobility indicators lagging behind those of the rest of the world somewhat, and the seasonal dip in demand in the US, this is likely a scenario which can be maintained for the time being, although there is room to the upside for the USGC mogas market now as flows begin to shift and the call on USGC volumes increases.

EAST OF SUEZ OVERSUPPLY SHOWS LITTLE SIGN OF ABATING

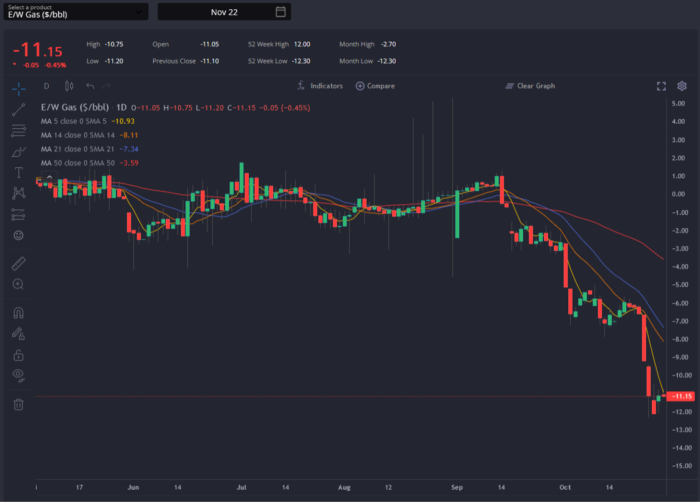

Finally, the East of Suez is showing both robust demand (ex-China) and overwhelming supply. With Al-Zour tendering their first naphtha cargo last week, the net-length in the EoS continues to pressure the prompt E/W spread, now hitting double-digit negative territory for the November contract.

With the renewed lockdowns in China once again hampering the demand recovery there, this situation is likely to continue well into December and January. Although the E/W spread has already widened for these months, their new levels are set to be sustainable in the weeks ahead, with negative Sing 92 cracks the order of business through until the new year at least.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a pricing and information platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com