E/W narrows; bullish Singapore & Global Demand outlook poor; bearish cracks

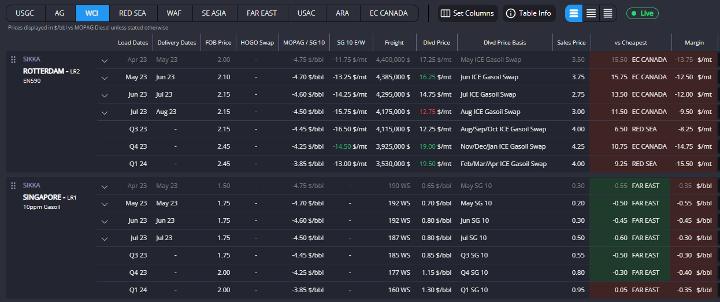

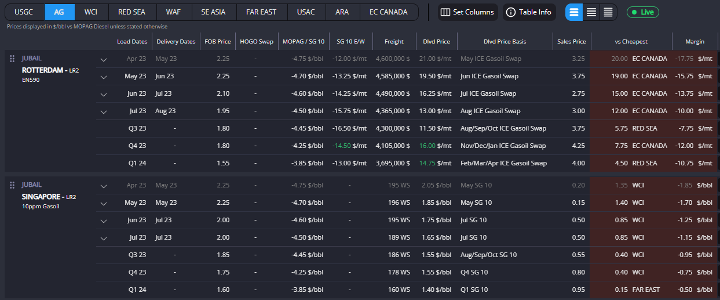

Current open arbitrage opportunities into ARA are limited to EC Canada and the US Gulf, which is only open at the very front.

The US Gulf freight to ARA has fallen to its lowest level since March, while the April HOGO has narrowed to below 17cpg for the first time since mid-to-late March. However, despite these developments, there have not been significant numbers of fixtures on this route due to the intermittent nature of the arb being open at the front.

As well as suggesting that, as discussed further below, that the USGC may be finding better homes currently in Latam. Only a few LR1s with TA options and the highly unusual LR2 SKS Darent have been noted within the last week.

Although there has been a raft of Red Sea diesel fixtures flowing into Europe, this having become its typical home since before the Russian sanctions, the arb remains currently the most closed it has been since mid-March, $10.75/t out of the money currently.

This is due to a combination of factors, including rising Red Sea FOB prices (at their highest since mid-February), European sales prices at their lowest since mid-February, and the May E/W narrowing to its highest level since it has had liquidity.

Despite ARA stocks reducing for the past couple of months, cracks and spreads under pressure indicate that the market feels it is adequately supplied. So much so, in fact, that Argentina shorts are currently being partially filled from ARA, and the May ULSD barge diff has fallen to its lowest level since it has had adequate liquidity, indicating further pressure on the market.

European cracks and spreads are expected to face continuing pressure in the short term, as the numerous EoS fixtures that have been fixed to Europe in recent weeks take effect, combined with ongoing demand concerns in the market due to the current economic outlook.

In the medium term, however, there could be the initial green shoots of a recovery for European cracks and spreads, with currently all arbs, apart from EC Canada, closed to Europe.

The currently narrow E/W having pulled a considerable number of Red Sea, WCI and AG fixtures away recently, these having been Europe’s typical point of re-supply since the Russian sanctions.

The US Gulf diesel market has been defending its natural home in Latam against increasing competition from AG and Russian barrels in the east coast and far eastern barrels in the west coast over the past few weeks. However, the market has put up a notable defence through reducing USG cash diffs and narrowing HOGOs, on top of MR freight reductions, helping to turn the tide.

As a result, we are likely to see a rising number of fixtures from the USGC to EC Latam, Petrobras already having been observed to have fixed an LR1 to Brazil this week, and matching fixtures to WC Latam over the coming period.

Nonetheless, the continued pressure from discounted Russian barrels, and the sure to-shut-again TA arb, means that US diffs will have to continue to price down to keep these arbs open.

While a relatively appreciating Singapore market may allow USGC barrels back into WCSAM, offering some relief to the USGC diesel complex, it may not be enough given the respective size of these shorts.

The market will be closely watching MR freight rates and the ongoing economic outlook for further direction.

Our in-house Freight Commodity Owner, David Thwaite, is of the view that USGC MR TA freight rates may have a way to fall still given; (i) the lack of current demand, (ii) freight brokers stating currently that the market has moved down from WS115 to 95 over the last few days, and (iii) TC14 having been as low as WS70 as recently as late January.

This would help to open the TA arb, applying additional supply to a European market already under pressure.

The latest developments in the diesel market have seen a shift in perspective from the Atlantic Basin to Asia.

As previously mentioned, the May E/W has narrowed to its highest observed level, which has resulted in AG and WCI ULSD pointing at Singapore. Moreover, it is observed that WCI diesel is now competing better into Singapore than Japanese and South Korean barrels all down the curve.

This is partially due to the current maintenance period in East Asia and cheap Indian exports resulting from the export duty removal.

These factors have led to several AG and WCI fixtures with Singapore options being observed over the past week.

The pricing up of the E/W is likely to continue until the potential arrivals start to have an impact. It is crucial to keep an eye on the Singapore onshore middle distillate stock levels as well as any floating storage over the next few weeks, which should both be significant indicators.

Current demand outlooks being what they are, as these arrivals arrive, we should start to see Singapore diesel stocks move up, with a resulting widening of the E/W in the medium term, with the AG/WCI fixtures once again pointing West as a result. In the short term, we would expect this relative Singapore strength to manifest in Sing 10 cracks finding some kind of floor over the coming weeks.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com