Diesel: Positive ULSD outlook for Europe on the back of closed arbs despite continuing macro demand worries

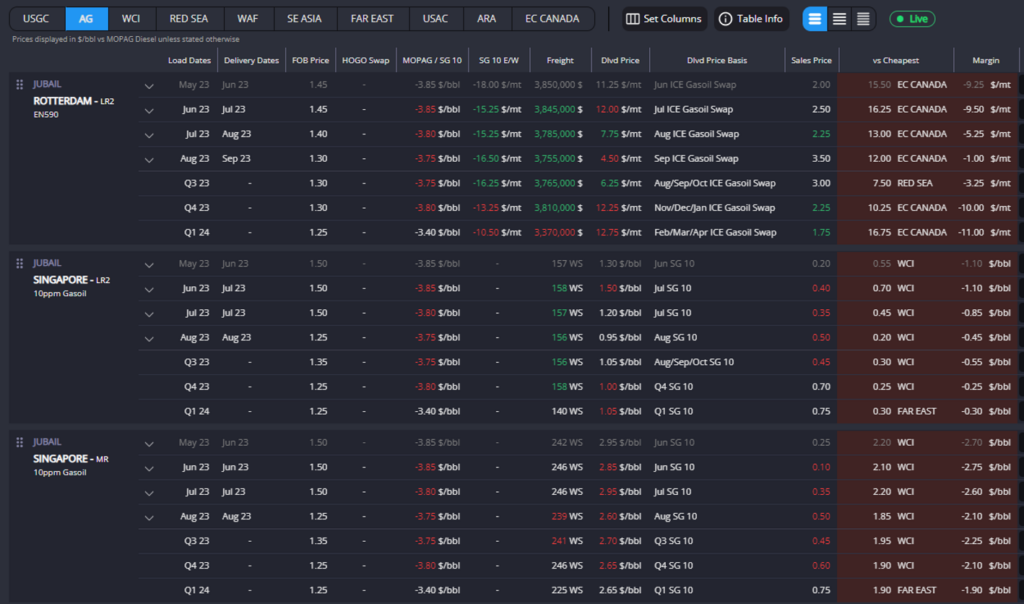

The Red Sea has maintained its position as the primary source of ULSD resupply into ARA and the MED, except for the limited supply from EC Canada.

However, barrels from AG, WCI, and the Red Sea are currently pointed at Singapore due to rising sales prices in that region on the back of disappointing Chinese gasoil exports in May, according to our in-house pricing analyst Thomas Cho.

This trend, of arbs pointing at Singapore, is expected to persist as Asian regional refineries, including S-Oil and SK Energy, continue their maintenance periods throughout June.

Meanwhile, freight from the US Gulf (USG) is at close to three-month highs, resulting in the closure of the ULSD arb to Europe. Despite European ULSD demand hitting a low point in Q1 2023, cracks in the distillates market have appeared to stabilize and, with the TA arb having been closed for over 3 weeks and the EoS arb closed for a week, it suggests that the positive trend in European distillates will continue.

This is expected to be reflected in ICE GO spreads and cracks, signalling a favourable outlook for the European distillates market.

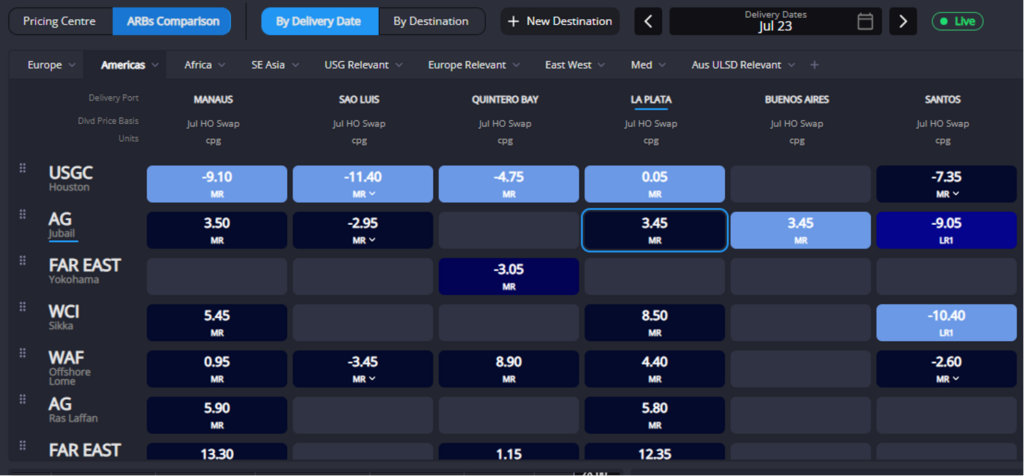

The US Gulf (USGC) region remains the most cost-effective source of non-Russian sanctioned barrels into the ECSAM (Argentina and Brazil). However, two important points must be noted.

Firstly, there is competition from the West Coast of India (WCI) due to the continued falling of FOB prices in that region.

Secondly, shiptracking data reveals that Brazil received a sizeable portion, two-thirds to be precise, of its imported diesel from Russia in May.

As mentioned previously, the USGC arbitrage to Europe is closed due to high MR freights, leaving the USGC with limited outlets for its ULSD. Meanwhile, the current strength in the Far East, driven by ongoing turnarounds in the region, has led to positive regional cash ULSD differentials for the first time this year.

Consequently, USGC ULSD has regained its primary position as a supplier to WCSAM (represented here by Quintero Bay, Chile).

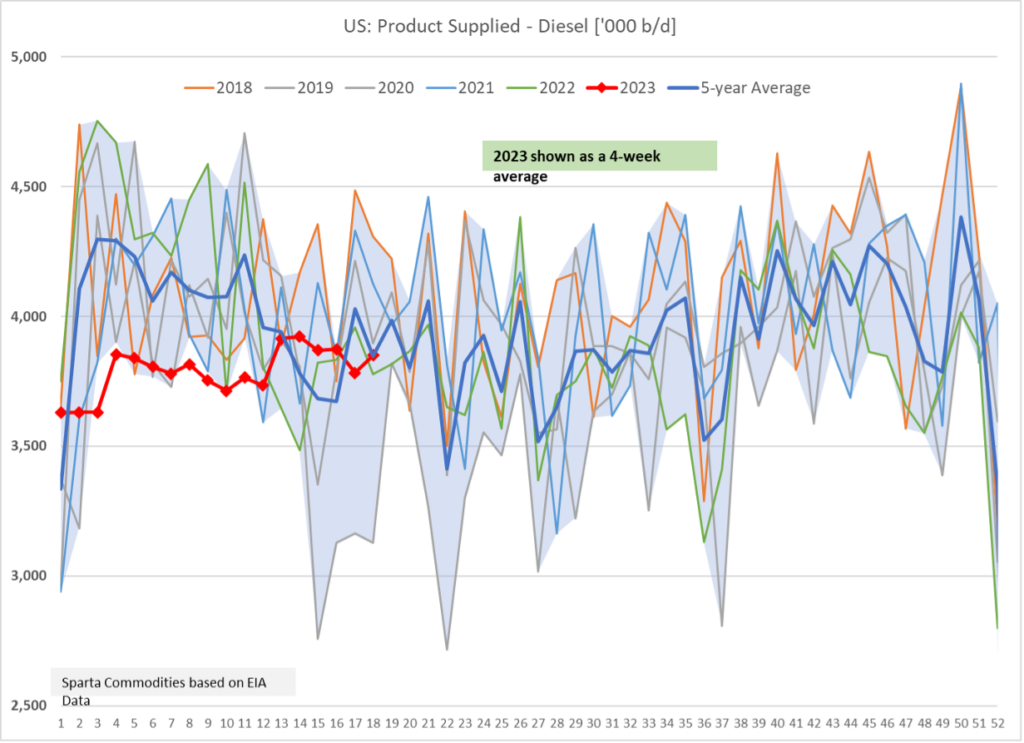

However, the US Energy Information Administration (EIA) reports that US diesel demand remains significantly below its seasonal pre-pandemic levels, experiencing a decline of almost 5%. This presents a challenging scenario for US ULSD.

As a result, we can expect US ULSD cracks and spreads to continue their downward trend from the previous week with the resulting effect of a narrowing HOGO. Additionally, USGC ULSD is likely to maintain a negative differential to gasoline, indicating that further yield switching is probable.

Due to regional turnarounds, the cheapest point of ULSD re-supply in Singapore has shifted from Far East refineries to WCI and AG barrels.

Throughout May, the arbs for AG and WCI have been pointing at Singapore, resulting in an increase in Singapore’s MD stocks to their highest levels in four weeks.

Chinese gasoil exports in May have been more reserved compared to earlier in the year due to weaker export margins for Chinese refiners and reduced export quotas.

Meanwhile, industry news this week highlighted that Saudi Arabia imported record levels of Russian ULSD in May. This move allows Saudi Arabia to free up its own production for export, particularly to the East of Suez (EoS) region.

Despite this development, initial indications suggest that EoS demand will surpass European demand.

This coupled with ongoing regional turnarounds in EoS, we can expect AG and WCI barrels to continue pointing towards Singapore. To attract these barrels, the E/W (East-to-West) will need to maintain the narrowing trend observed in recent weeks.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com