Damp squib sanctions bring sell-off, continued status quo – for now

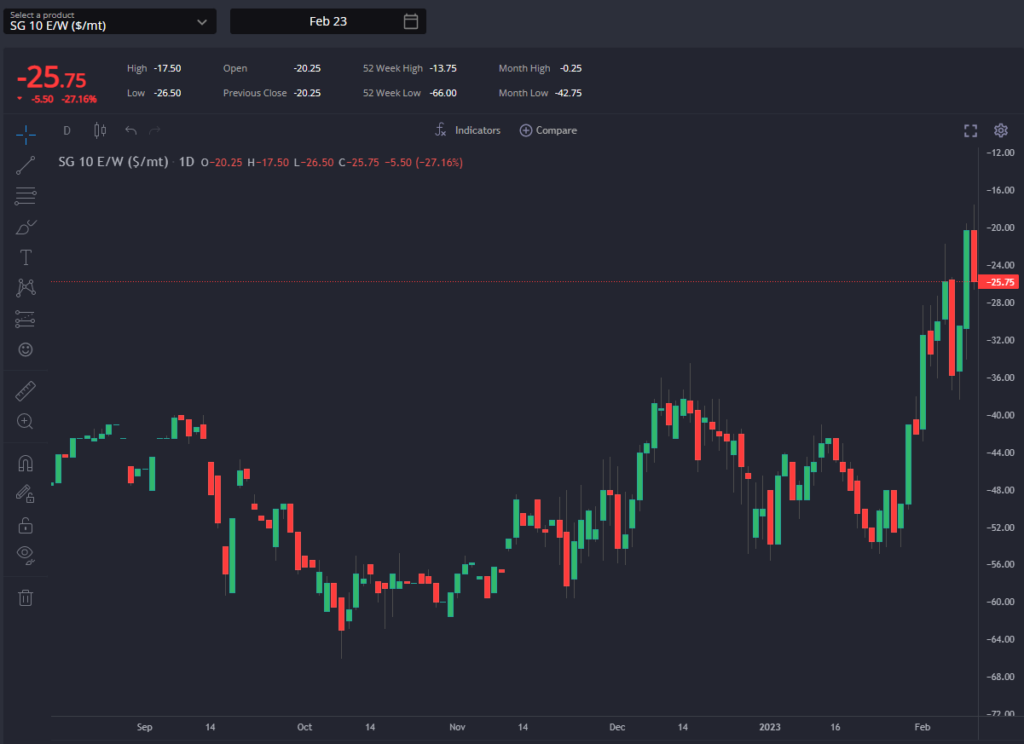

With selling pressure high in Europe as long positions got wound up in the face of a much less dire global supply situation that had been perhaps anticipated, the prompt E/W spreads have been narrowing rapidly and are currently sat at their narrowest level since November.

Poor demand in Europe is likely to have also played a significant role in recent weeks, with a milder-than-usual winter coupling with buying ahead far beyond what would usually be required to leave storage tanks brimming across ARA in particular.

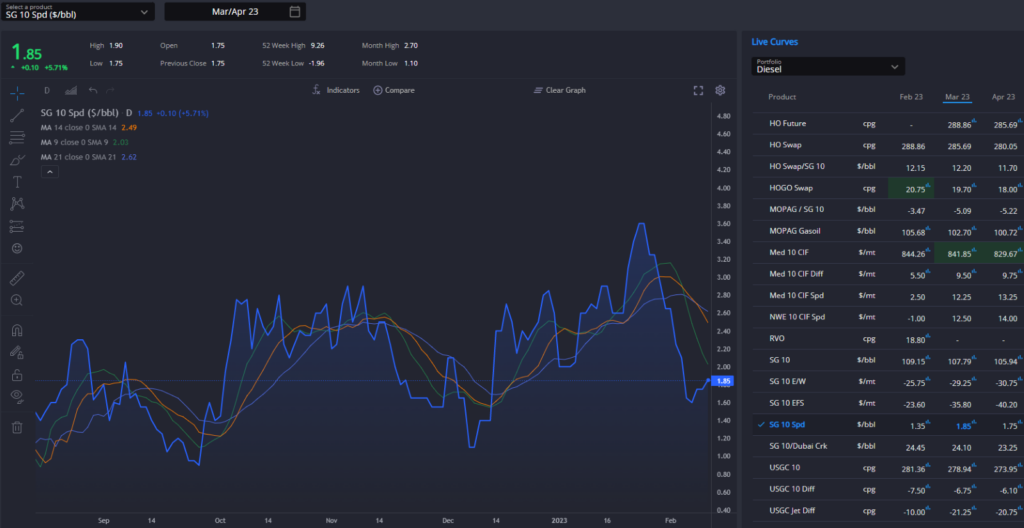

The need to shut the arb from the East in the short-term therefore remains a logical conclusion – but with European diesel cracks remaining well supported and spreads still at levels considered very high pre-Ukraine invasion, the market is clearly not yet ready to take its eye completely off the problem.

Compared to the last few weeks, the latest moves to weaken the European market have now extended further into the future as well, with the June window from the Red Sea and the AG slamming shut after having previously been open since mid-January.

Softening expectations for the ARA physical market based on lower spreads has played a role, but it is also important to keep an eye now on Increasing expectations for forward freight costs creeping into the market.

With the ‘shadow fleet’ of clean tankers able and willing to take Russian barrels relatively smaller than the dirty tanker equivalent, there may be increasing pressure on the clean tanker fleet, helping support those freight rates again come Q2 and beyond.

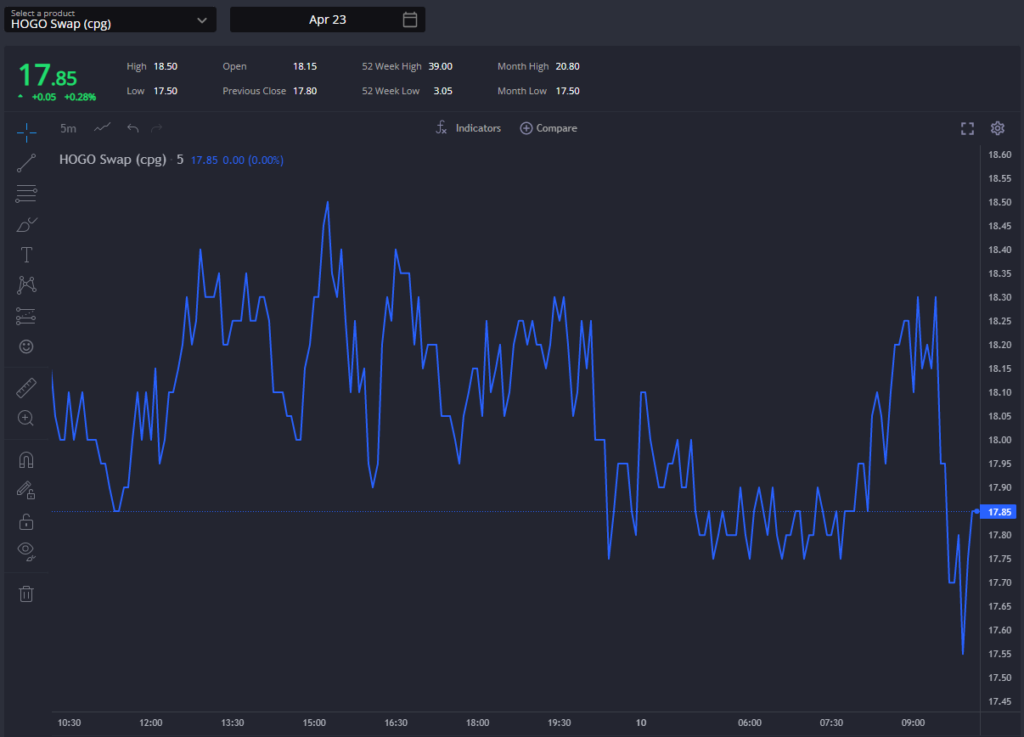

The expectation that there may be an increased need for barrels out of the US come Q2 is beginning to be seen in the HOGO Swap, however.

The April HOGO Swap is now trading below 18cpg, doing its part to move the arb towards being more workable, but moves in the opposite direction in physical pricing (higher in the USGC, lower in ARA), as well as the aforementioned higher forward freight expectations are keeping the USGC->ARA route well shut for now.

This is a route which we would expect to see opening up in due course, however, and it may require a softening of the USGC Diff vs HO as well as a further downside to the HOGO Swap as we move towards Q2 to allow these barrels to move transatlantic once more.

Finally, the pressure that has been applied to European pricing has not left the Asian diesel complex untouched, with spreads here also coming off strongly in recent days.

This appears to have bottomed out for now, but without a sustained pull from the West currently, Singapore pricing is likely to remain comparatively under pressure as returning barrels out of China keep supply tightness at bay.

That being said, with distillate stocks in Singapore falling to a 7-week low, pricing will likely need to match or exceed the attractiveness of Europe for Indian barrels in the next few weeks, keeping pricing off of a potential bottom.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com