Barrels being pushed into Rotterdam in the prompt as Russian displacement begins

The expected turnaround in the arbs into Rotterdam has, at least at the very prompt, come sooner than expected.

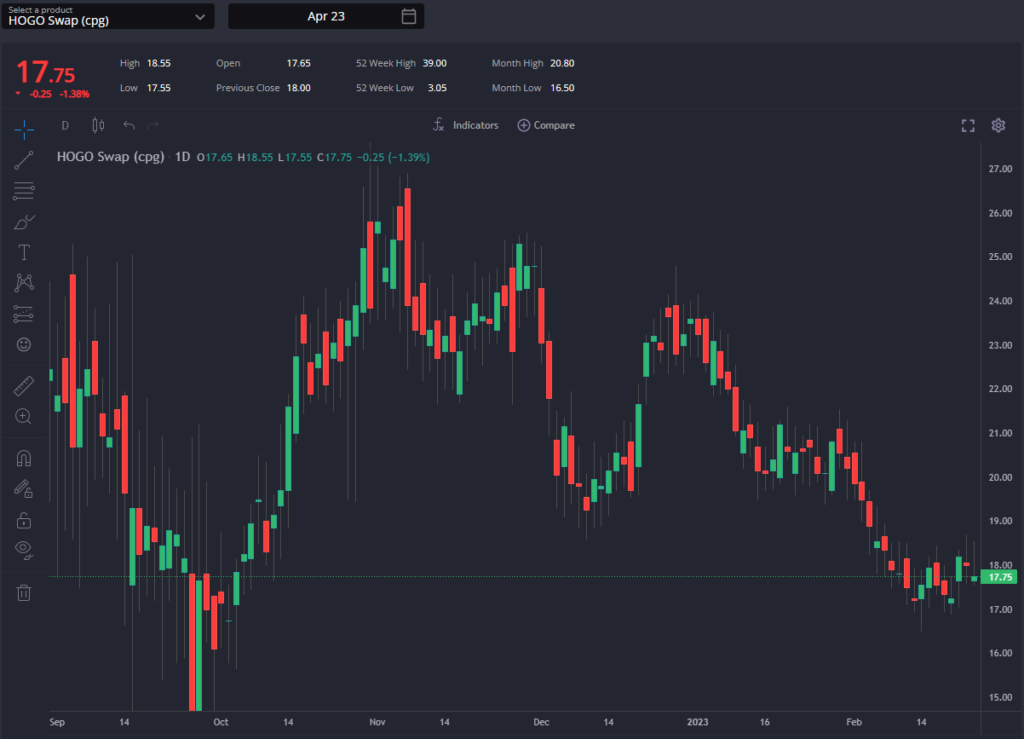

Whilst ICE GO spreads continue to soften and have likely bottomed out now, and the arb spreads remain largely unchanged (both E/W and HOGO are relatively unchanged w-o-w), prompt freight quotes and cash diffs in both the USGC and AG have weakened to the extent that these arbs have re-opened at the front.

Again, whilst these push-factors were largely foreseen, the speed with which incremental pressure on their baseload export destinations has forced a pricing reaction to reopen the prompt into Europe points to an underlying softness in a currently well-supplied diesel market.

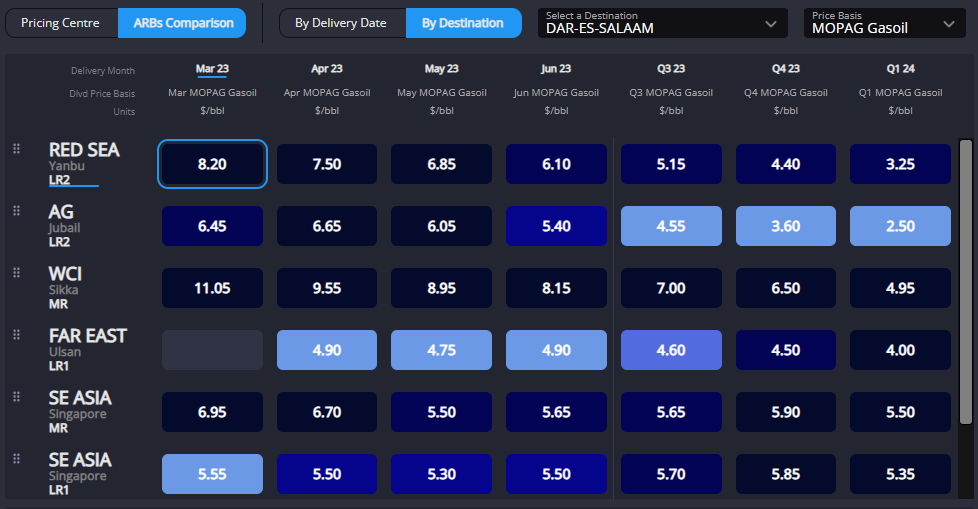

Indeed, prompt weakness is also spreading to Singapore which, combined with softening freight, has begun to open up new options out of Singapore again. Indeed, Singapore is currently pricing as the cheapest source of volumes into each of our South and West African destinations, whilst NE Asia is currently outpricing AG barrels into East Africa.

With pressure mounting on AG outlets, we wouldn’t be surprised to see additional pressure on physical prices in the region, although the upcoming maintenance period may be looming at just the right time to curb some of the building regional surplus if outlets remain shut-off.

To that end, the E/W spread (which has been stable-to-narrowing in recent weeks) should have reached a ceiling for now – remaining far wider than pre-Ukraine war levels, but having narrowed significantly still vs 2022 levels.

Going forward, and as the high inventories built up in Europe gradually dwindle, the need to maintain this incentive at an elevated level should remain – with factors on both sides of the Suez Canal working to ensure these routes remain workable.

The European side of that equation – an assumption that the European market will need to strengthen – will likely be tempered by a greater need for USGC barrels to find their way into the European market.

We are already seeing forward HOGO values narrowing, now solidly below RVO values in the case of April, and the USGC 10 Diff is allowing for prompt flows to emerge transatlantic – including into Barcelona, which as a route had been closed for multiple months.

We would expect this to spill into the following months as inventories in the US have begun building rapidly. However, as with arbs out of the AG in the coming weeks and months, much will likely hinge on the actual intensity and duration of the upcoming maintenance period to make a dent in currently swelling supply overhangs.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com