Arbs into Europe close fully as E/W narrows

The February-landing Arbs into Rotterdam remain underwhelming to say the least in recent days, with only cargoes out of Yanbu hovering around the workable level.

The market continues to lack direction in this respect, with the implementation of the next round of Russian product restrictions coming into force in February, but as-yet we continue to see little in the way of movement that would suggest any particular desire to pull in additional barrels into the Atlantic Basin.

Indeed, the USGC is pricing itself out of its swing export destinations currently, with cheaper alternatives available for anyone wanting to place volumes in Europe, WAF, or WCSAM.

This is likely a response to a broader lack of supply in the US in recent weeks thanks to weather-related disruptions, and a strengthening Colonial pipeline market has priced PADD-3 out of the aforementioned waterborne markets.

The East of Suez market has remained largely under pressure from a weak West of Suez pull and ample supply into Singapore in recent weeks. With refining margins across Asia remaining quite supportive and with nominal supply potential higher this year than in recent times with new capacity in the market, it will be interesting to play close attention to whether the East of Suez market will need to fall further in order to alleviate some of the building supply pressure through the rest of this quarter.

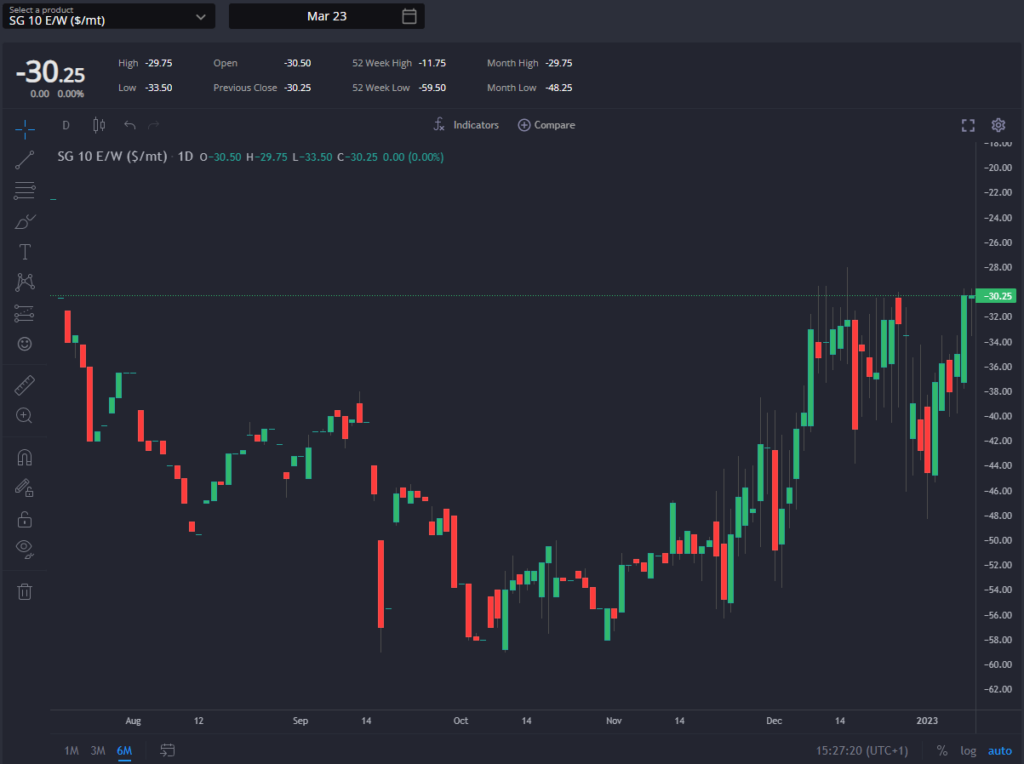

For example, the March E/W spread has narrowed recently to around the -$30/mt mark, half the level it was trading at in late-November, essentially closing off any potential movements from East to West through the second half of this quarter and into the beginning of Q2.

This is unlikely to be sustainable on a fundamentals basis, with oversupply pressure likely to build in the East before any renewed tightness in European markets emerges, with the Singapore leg of the E/W seemingly more likely to move to accommodate a renewed uptick in flows.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com